5 Facts about BlackRock’s proposed Bitcoin Premium Income ETF: IBIT’s ‘Sequel’ Product that Offers Yields

Jakarta, Pintu News – The world’s largest asset management company, BlackRock, is again expanding its exposure in the cryptocurrency world by proposing a Bitcoin Premium Income ETF. The product is billed as a “sequel” to the iShares Bitcoin Trust (IBIT) which is already the largest spot Bitcoin ETF with tens of billions of dollars in assets under management. Here are five key facts about this new ETF plan.

1. New Products After IBIT Success

According to a Cointelegraph report (September 26, 2025), BlackRock’s IBIT has raised more than $60.7 billion or approximately Rp1,017 trillion since its launch in January 2024.

This makes it the largest spot Bitcoin ETF in the world, far surpassing its closest competitor, the Fidelity Wise Origin Bitcoin Fund (FBTC), with $12.3 billion in assets under management. The success has prompted BlackRock to launch new derivatives to expand options for investors.

Also Read: 5 Big Impacts of US Crypto Regulation: Novogratz Predicts Market Cycles Will Change Forever

2. Focus on Covered Call Strategy

Bloomberg ETF analyst Eric Balchunas explained that the product will use a covered call strategy on Bitcoin futures contracts.

This means that the ETF will sell call options on top of Bitcoin positions to collect premiums, thereby generating passive income for investors.

This strategy allows Bitcoin (BTC), which has not previously been a yield-producing asset, to provide regular returns, despite the sacrificed upside potential.

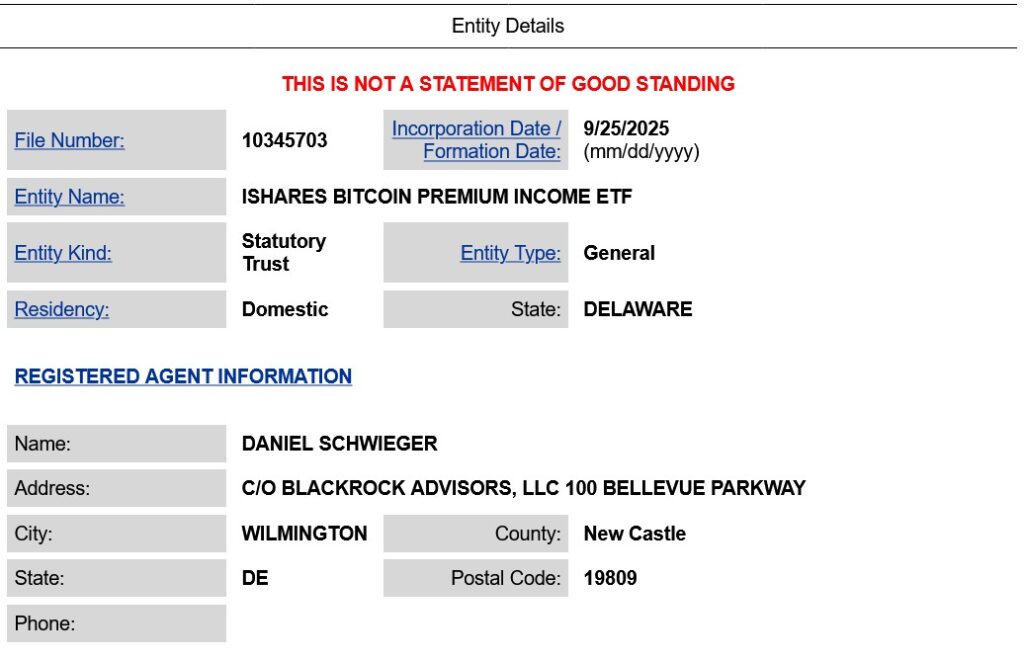

3. Delaware Registration, the First Step in the ETF Process

Cointelegraph writes that BlackRock has registered a trust company in Delaware to support the legal structure of this ETF. Typically, this registration signals that a Form S-1 or 19b-4 filing with the Securities and Exchange Commission (SEC) will soon follow. This move shows BlackRock’s seriousness in accelerating the process of launching new products amid increasingly accommodating regulations.

4. Opportunities for Bitcoin Yield-Based ETFs in the US

One of the main reasons traditional companies are reluctant to adopt Bitcoin is that the asset does not generate income naturally. However, with new products like the Bitcoin Premium Income ETF, investors can enjoy regular distributions from option premiums. If approved, this ETF will join the few other Bitcoin yield-generating products currently available in the US market.

5. BlackRock Focuses on Bitcoin and Ether

Balchunas added that BlackRock is not jumping on the “altcoin ETF bandwagon”. Instead, the company chose to build a product ecosystem around Bitcoin and Ethereum (ETH), which are considered more established. This opens up opportunities for other asset managers to compete to bring altcoins such as Litecoin (LTC), Solana (SOL), XRP, or Dogecoin (DOGE) into the ETF space in the future.

Conclusion

The launch of the Bitcoin Premium Income ETF by BlackRock is potentially an important innovation in bringing yield products to the traditional crypto market. Although the covered call strategy limits potential gains when BTC prices rise, the product could appeal to investors who prefer regular income. If it gets the green light from the SEC, this ETF will strengthen BlackRock’s position as the dominant player in Bitcoin-based investment products in the US.

Also Read: 7 Astonishing Facts: Number of Crypto Billionaires to Rise 40% by 2025, Who Benefits?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Brayden Lindrea. BlackRock chases Bitcoin yield in latest ETF as a ‘sequel’ to IBIT. Accessed September 16, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.