Could Ripple’s (XRP) Rally Be Set to Explode Again This October?

Jakarta, Pintu News – As reported by Cointelegraph, the price of XRP (XRP) opened monthly at around $2.77 after correcting 14% in the last two weeks. The holding of prices at this level raises hopes of a recovery towards October.

XRP Price should Stay Above $2.75

According to the analyst, XRP is now facing an important test in the area around $2.75 (September 1 opening). This level coincides with the lower boundary of the symmetrical triangle pattern on the daily chart.

Read also: Ripple Partners Ondo Finance to Tokenize US Bonds on the XRPL Network!

If the price is able to stay above this trend line, the chances of breaking the downtrend line around $2.86 (100-day simple moving average/SMA) will increase. This scenario could pave the way towards the bullish triangle target of $3.62.

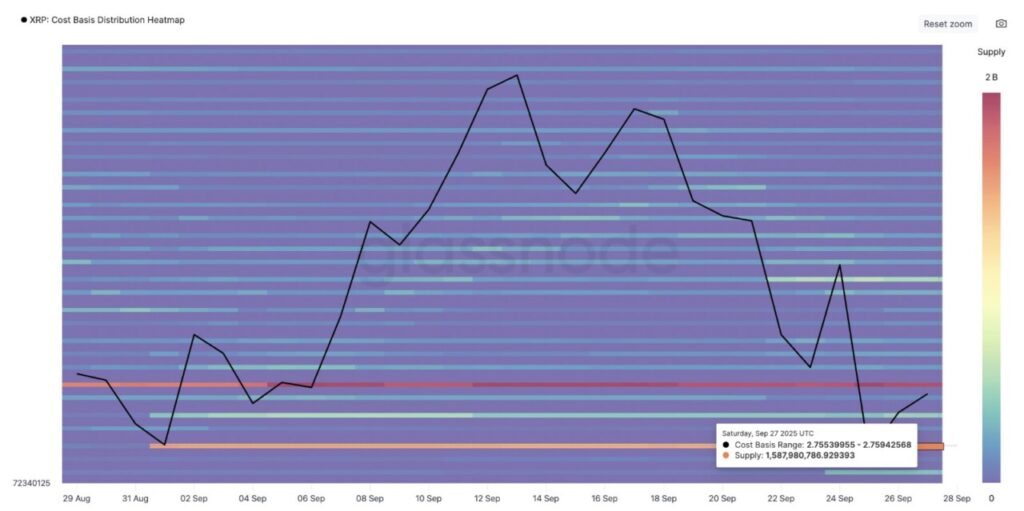

Glassnode’s distribution map shows a large demand cluster around $2.75, where nearly 1.58 billion XRP was acquired. This confirms the importance of that level. However, there is also a supply wall around $2.81 (coinciding with the 100-day SMA) that could potentially hamper recovery efforts in the short-term.

Conversely, if the price falls below $2.75, the selling pressure could intensify and drag XRP towards $2.00, the bearish target of the symmetrical triangle pattern.

“$XRP is still in a solid bullish consolidation phase,” Hardy analysts said in a post on X on Sunday, adding that as long as the price stays in the $2.72-$2.75 range, upside opportunities remain open.

Another analyst, XForceGlobal, added that the longer XRP consolidates around $2.75, the stronger the potential for a breakout, even saying that the $20-$30 target is still possible.

As reported by the Cointelegraph website, XRP also has the potential to drop first to $2.50 before eventually bouncing back, based on Fibonacci extension analysis.

October is Usually a Bad Month for XRP

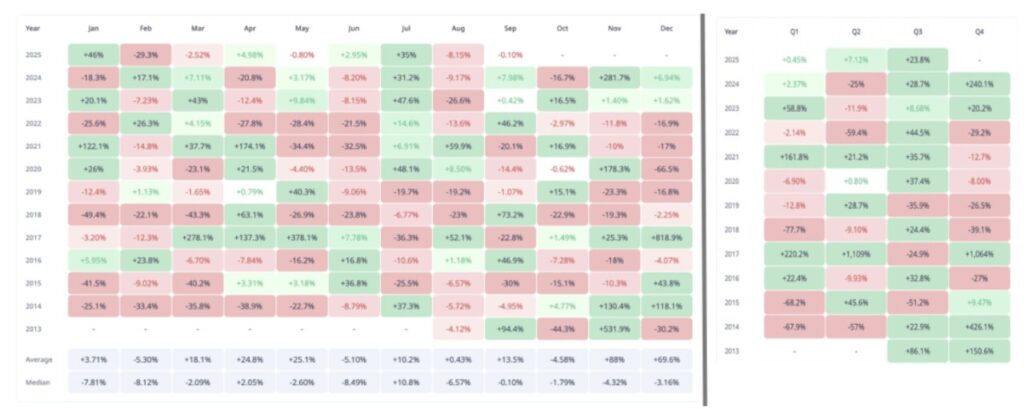

Unfortunately for the bullish side, October is often a difficult period for XRP. Since 2013, the XRP price has closed lower in 7 of the last 12 Octobers, with an average decline of around -4.58%.

However, November was the best period, making October-December the most positive quarter for the XRP price rally. Data from Cryptorank shows that this was the only three-month period with an average gain of 51%.

In recent years, XRP had rallied around 240% in Q4 2024 and 20% in Q4 2023. A much larger rally occurred in 2017, with a 1,064% jump in just the period October 1 to December 1.

Read also: Where Is Nvidia’s Stock Headed in 2026?

Even when the market is bearish, such as the -39.1% drop in 2018 and -29.2% drop in 2022, it is still considered an aberration. Regardless, the last quarter of each year consistently brings significant movement for XRP.

If history repeats itself, XRP’s price action could potentially reverse completely in Q4 2025, with a recovery that could start in mid-October.

XRP ETF could trigger “Uptober”

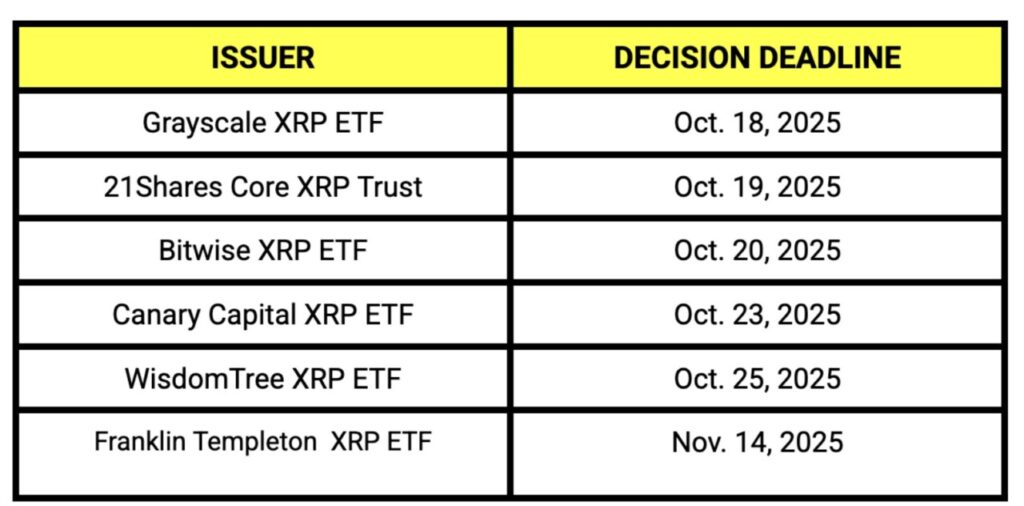

The spotlight on ETFs in October could potentially give an additional boost to the XRP rally, especially with the SEC decision deadline falling in the middle of the month.

The decision for Franklin Templeton’s XRP ETF has been delayed until November 14, while REX/Osprey’s XRPR product was officially launched on September 18 with first-day trading volume reaching nearly $38 million.

Meanwhile, the Grayscale decision is expected to come out on October 18, followed by another important deadline between October 19-25 for several other ETF applications.

According to analysts, the SEC’s more concise standards and Ripple’s post-lawsuit clarity increase the chances of approval to 100% before December 31, which could unlock a potential $4-$8 billion in new fund flows in the first year.

However, some market participants caution that it is likely that these catalysts are already partially reflected in current prices, so there is a risk that ETF approval could trigger a “sell the news” phenomenon.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Will the XRP price rally restart in October? Accessed on September 29, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.