Ethereum (ETH) Preparing to Surge to $5,000, Is it Time to Buy?

Jakarta, Pintu News – Ethereum (ETH) has shown a positive trend since September 28, with its price rising from around $3,800 to reach the mid $4,000 range recently. Based on recent data from Binance, Ethereum (ETH) experienced a “reset” during late September and early October, and now appears to be eyeing the $5,000 price level.

Ethereum Reset Completed, Is a New Milestone Imminent?

According to a CryptoQuant Quicktake post by contributor Arab Chain, Ethereum (ETH) has experienced a healthy reset the past few weeks. Although the digital asset briefly dropped to the $3,800 – $3,900 range, it is currently trading at the mid-$4,000 level.

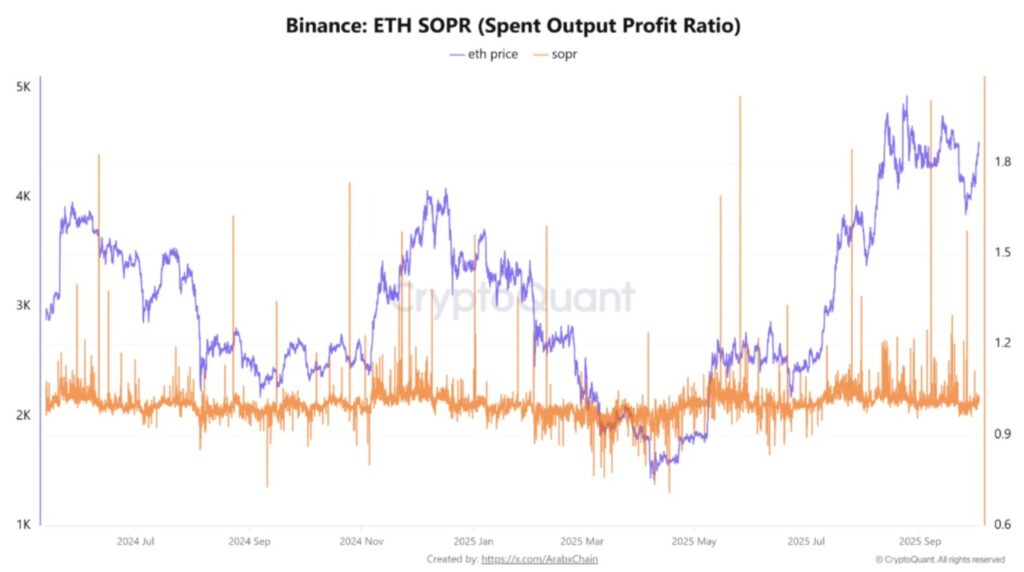

During this period, Ethereum’s (ETH) Spent Output Profit Ratio (SOPR) remained volatile around 1.0, with a few spikes above one and one outlier seen in the chart below. This suggests that short-term inflows are sufficient to meet supply.

Also Read: 10 Crypto Nearly Hit All-Time High Prices – October 2025 Update

Technical Analysis and Bullish Signal from RSI

From a technical standpoint, Ethereum’s (ETH) Relative Strength Index (RSI) has recently given a rare bullish signal, indicating potential price appreciation up to $8,000. Currently, Ethereum (ETH) is trading at $4,471, up 2.6% in the last 24 hours.

Any rapid price decline is reversed as long as the Ethereum (ETH) SOPR remains above 1.0. The chart shows a local bottom forming in late September near $3,800 – $3,900, which was then followed by a gradual rebound to $4,500.

Ethereum Availability on Exchanges Continues to Decline

Despite Ethereum’s (ETH) bullish momentum that may push it to $5,000, the digital asset’s reserves on crypto exchanges continue to decline. A recent analysis found that more and more new Ethereum (ETH) investors are withdrawing ETH for self-storage or staking. S

uring this period, SOPR hovered between 0.98 and 1.03, a neutral range that suggests position rotation rather than massive selling in the market. Despite some quick peaks surging above 1.0, this burst of profit-taking was quickly absorbed by strong demand for Ethereum (ETH).

Conclusion

With SOPR stabilizing above 1.0 and the support level at $4,000 undisturbed, Ethereum (ETH) could benefit from a sustained upside scenario. A sustained break above $4,500 would consolidate demand momentum and pave the way for a gradual higher target.

Also Read: Shocking Bitcoin Cash (BCH) Price Predictions for 2025 to 2030!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Ethereum Breakout Suggests Sopr Trend Could Spark $5,000 Upside. Accessed on October 6, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.