Bitcoin Price Hits $124K Today — Entering the Heated Zone: Is a Pullback Coming?

Jakarta, Pintu News – Bitcoin (BTC) set a new record high on Monday, October 6, by breaking through the price of $126,000. Earlier this week, the price had a mild correction to around $122,800 and around $123,974.

On the 4-hour chart (6 Oct), the $124,500 level appeared to be an important local peak area in recent weeks. The price surge that day was short-lived, and the area was not successfully defended as a support level.

However, this movement shows that the selling pressure (supply) in the area is starting to weaken, opening up opportunities for a potential continuation of the uptrend if demand increases again.

Then, how is the current Bitcoin price movement?

Bitcoin Price Up 0.46% in 24 Hours

As of October 7, 2025, Bitcoin was trading at $124,396, equivalent to IDR 2,055,748,183, marking a 0.46% increase over the past 24 hours. During this period, BTC reached a daily low of IDR 2,036,979,010 and a high of IDR 2,086,670,374.

At the time of writing, Bitcoin’s market capitalization stands at approximately IDR 41,098 trillion, while its 24-hour trading volume has declined by 7% to around IDR 1,098 trillion.

Read also: Ethereum Surges to $4,600 as BitMine Makes Massive $820 Million Investment

BTC Price Analysis from Analysts

In a post on the X platform, crypto analyst Ali Martinez highlighted that the $117,000 level is an importantdemand zone. This claim is backed up by data from the UTXO Realized Price Distribution, which shows a significant concentration of buying activity in the area.

Meanwhile, another popular analyst, CrypNuevo, forecasts a potential price correction towards the 50-period simple moving average (50SMA) on the 4-hour chart. At the time of writing, the H4 50SMA indicator is at around $119,000.

In terms of the Money Flow Index (MFI) indicator on the H4 chart, there are no extremeoverbought conditions. After surpassing the 80 level on Sunday, the MFI has now dropped to a healthier zone.

Now the question arises: will Bitcoin continue its rally this week, or will it experience a temporary price drop before rising again?

“Heated” Zones Could Delay or Halt Bitcoin’s Rally

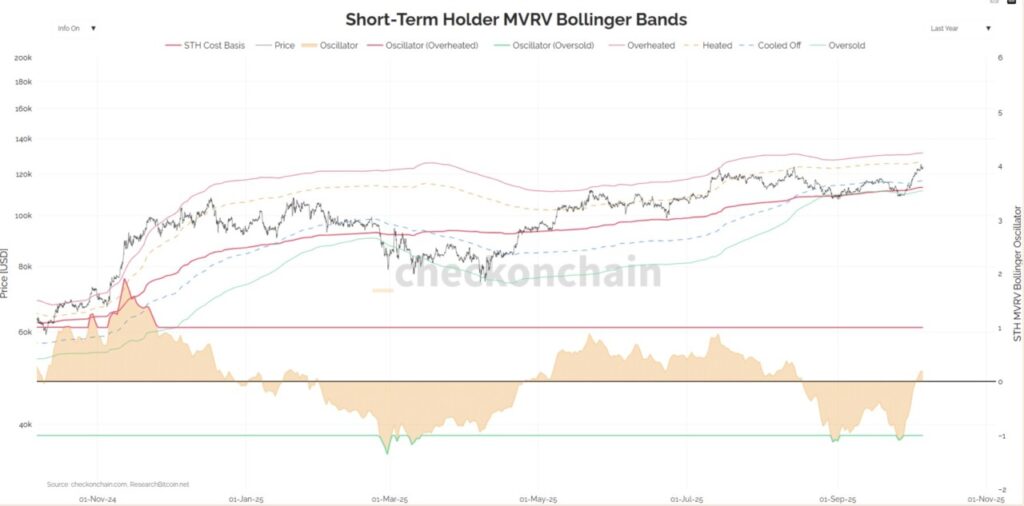

Based on the Short-Term Holder MVRV Bollinger Bands indicator, it can be concluded that recent Bitcoin buyers are not yet at statistically extreme profit levels – a condition that usually signals a potential market correction.

Read also: Aster Token Sinks 10% Ahead of Phase 2 Airdrop as Integrity Concerns Mount

The current “heated” level is around $126,600, which has historically acted as a psychological limit for Bitcoin’s price. For example, in mid-August, this zone became a temporary holding area that halted BTC’s advance.

Meanwhile, the Mean Coin Age (MCA) metric – which shows the average age of all coins on the network – has shown an upward trend since August. This increase signals steady accumulation by investors, while a decrease usually indicates increased coin movement and selling pressure.

Interestingly, despite Bitcoin hitting a new all-time high, most holders are in no hurry to sell their assets. This indicates strong holder conviction among investors.

According to the AMBCrypto report, there is still potential for an increase of around 7% above the $125,000 level, with a price target of $133,600. Based on Fibonacci extension projections, Bitcoin even has a chance to reach $139,000 in the next few weeks.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Bitcoin approaches ‘heated’ zone: Will BTC retrace below $120k? Accessed on October 7, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.