6 Facts on the Surge in Crypto Adoption to 2100: Old & Rich Investors are the Drivers!

Jakarta, Pintu News – Global crypto adoption is no longer driven solely by the younger generation. A study from the Federal Reserve Bank of Kansas City confirms that the old and wealthy population will be the main driver of digital asset demand until 2100.

With regulatory support, economic growth, and blockchain innovation, the world is heading towards a new era – one where Bitcoin becomes a pillar in the digital economy across generations.

1. A New Phenomenon: Old and Wealthy Population Drives Crypto Adoption

Jakarta, Pintu News – New research from the Federal Reserve Bank of Kansas City (US) reveals that changing global demographics will be one of the main factors driving demand for digital assets such as Bitcoin (BTC) until 2100.

In a report released on August 25, 2025, the central bank projected that the aging of the world’s population and the increase in personal wealth will create a society that is older, wealthier, and has more capital to invest into assets such as crypto, stocks, and digital gold.

Also Read: Shiba Inu Price Prediction: Will October Be a Month Full of Surprises?

2. Asset Demand Projected to Rise 200% of World GDP

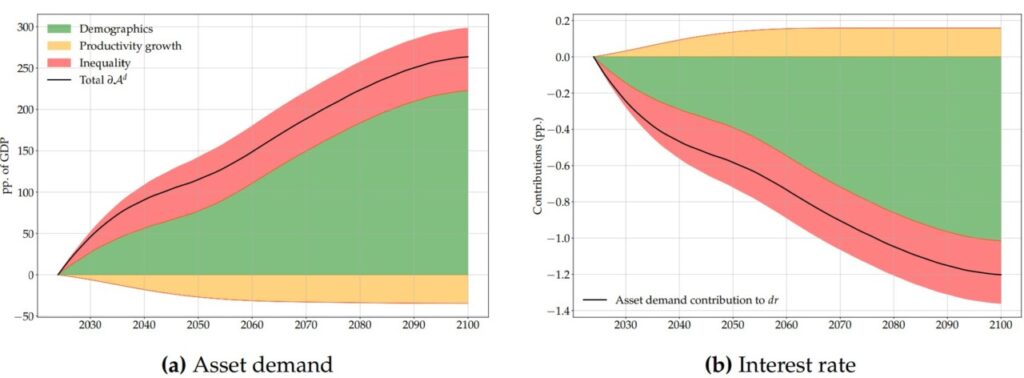

According to official data from the Kansas City Fed, global investment trends will continue to rise rapidly. The report writes that “population aging will increase asset demand to 200% of the world’s gross domestic product (GDP) between 2024 and 2100.”

This increase in demand is driven by rising productivity levels, more equitable distribution of wealth, as well as falling real interest rates that make investors seek higher-risk investment alternatives such as cryptocurrencies. This could also extend the phase of falling global interest rates until the end of the 21st century.

3. Bitcoin (BTC) Projected to be Equivalent to Gold in the Next 75 Years

According to Gracy Chen, CEO of crypto exchange Bitget, the aging generation will start valuing Bitcoin (BTC) on par with gold within the next 75 years, especially if global crypto regulations mature.

He adds that regulatory maturity and legal clarity in many countries “could be the catalyst that accelerates demand for this asset class.” Over time, Chen said, older people will see Bitcoin not as a speculative asset, but as a store of value like precious metals.

4. Crypto investors are now dominated by young people, but that’s about to change

According to a report by Triple-A (2024), about 34% of global cryptocurrency owners are currently between 24 to 35 years old. However, analysts predict that in the next two decades, the age composition of crypto investors will shift significantly as older generations become more tech-savvy and begin to move some of their portfolios to digital assets.

Chen emphasized that “with institutional products such as Bitcoin ETFs and regulated trading platforms, senior investors will be more confident to invest in crypto.” This will expand Bitcoin’s investor base and strengthen global market liquidity.

5. Rising Global Wealth Increases Risk Appetite

Analysts from Bitfinex Research added that rising personal wealth around the world will naturally increase risk appetite and portfolio diversification. They explained, “as wealth increases, investors tend to allocate funds to new assets such as crypto, due to its high growth potential.”

In addition, investors who have a long-term investment horizon are considered more open to crypto price volatility. “The younger tech-savvy generation will view altcoins and new crypto projects in a more positive light,” Bitfinex’s report added, emphasizing that resilient altcoins also have the potential to become a top choice for global investors in the future.

6. Trends Until 2100: Crypto Becomes a Pillar of the World’s Digital Economy

If the Kansas City Fed’s projections are correct, the world will enter the 22nd century with a fully digitized global economic system, where cryptos such as Bitcoin (BTC), Ethereum (ETH), and other blockchain assets become core components in people’s financial portfolios.

Declining long-term interest rates, increasing life expectancy, and cross-generational wealth accumulation will create an ideal environment for sustainable crypto asset growth. Thus, crypto will no longer be just a technological trend, but a permanent part of the global investment structure.

Also Read: Dogecoin October 2025 Breakout Potential: Analyst Ali Martinez Points to Accumulation Phase!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Older, Richer Investors Could Power Crypto Adoption Through 2100. Accessed on October 7, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.