Crypto Expert Expects Solana ETF Approval This Week — What Could Happen Next?

Jakarta, Pintu News – An analyst predicts that the United States Securities and Exchange Commission (US SEC) is likely to approve the pending Solana ETF (SOL) filing by the end of this week.

This prediction comes as fund inflows into Solana-based investment products (ETPs), which recently hit an all-time record high.

The surge demonstrates institutional investors’ growing interest in Solana, while reinforcing expectations that the asset will soon gain official recognition through the launch of an ETF in the US market.

Experts Rate the Chances of SOL ETF Approval as Very High

Crypto expert and founder of Wealth Mastery, Lark Davis, highlighted that the final deadline for the SEC’s decision on the Solana ETF (SOL) is just four days away. He called this week a “big week for Solana.”

Read also: Shiba Inu Gains Momentum: Will Rising New Addresses Help Recover September’s Losses?

Davis added that with increasing institutional demand and strong fund inflows into Solana-based products, the chances of ETF approval this week look very high.

Several major issuers such as Grayscale, VanEck, 21Shares, Canary, and Bitwise are among the parties that applied for permission to launch the Solana ETF. In a recent development, Bitwise, Canary, and Grayscale have also revised their S-1 documents to add a staking feature, which allows investment funds to earn returns on tokens held in custody.

Furthermore, Solana ETF issuers sent an open letter to the SEC urging for liquid staking tokens (LSTs) to be approved in ETF structures.

The proposal uses Solana as a case study, arguing that ESG integration could make the Solana ETF a prototype for future blockchain technology-based financial products.

Solana ETP Records Highest Inflow in History

Despite the United States experiencing a partial government shutdown, Solana-based investment products (ETPs) recorded an unprecedented surge in inflows.

Read also: Altcoin Season Has Arrived — Here’s Why Now Might Be the Best Time to Explore Crypto Beyond Bitcoin

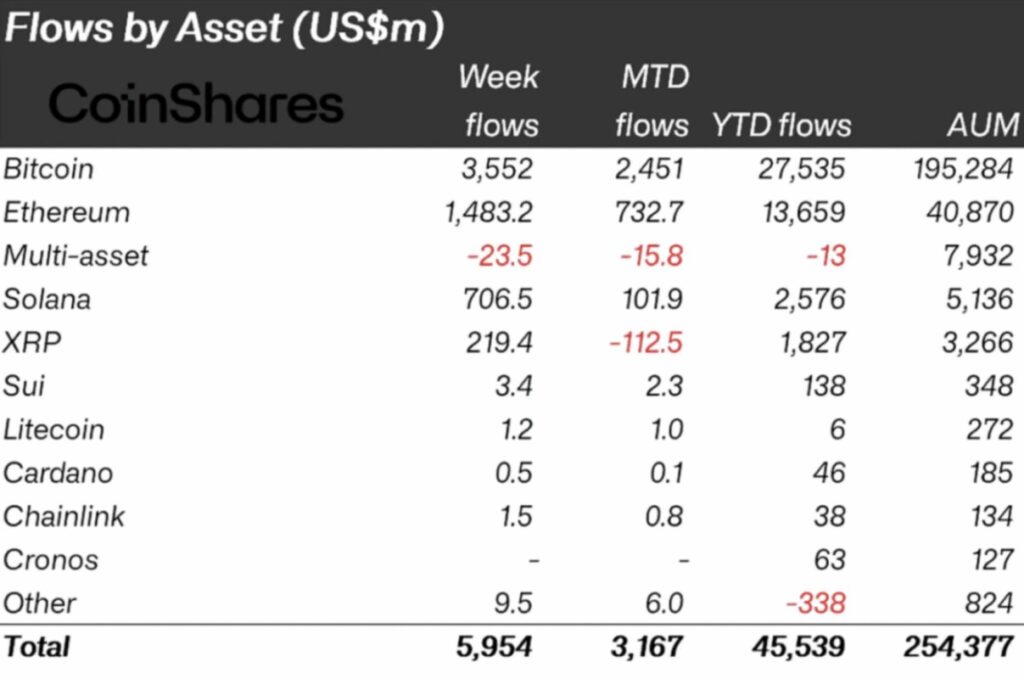

According to CoinShares, funds poured into Solana ETPs totaled $706 million during the week, pushing the total assets under management (AUM) of all Solana ETPs to $5.1 billion – more than double the previous record of $311 million recorded in July.

Solana ETP (Exchange Traded Product) products allow traditional investors to benefit from changes in the price of Solana (SOL) without having to manage its assets directly. These products typically hold native SOL tokens and can generate staking rewards through participation in the Solana network’s proof-of-stake system.

This sharp surge demonstrates institutional investors’ growing confidence in Solana. Currently, the only Solana ETF listed in the United States is the REX Shares Solana Staking ETF (SSK), which has over $406 million in assets under management – signaling Wall Street’s interest in SOL continues to grow.

Adding to the positive sentiment, 21Shares has just launched the Jupiter ETP (AJUP) on SIX Swiss Exchange. This physical asset-backed product gives institutional investors exposure to Jupiter, the main liquidity center of the Solana ecosystem.

The platform handles over 90% of transactions on the Solana network, with weekly trading volumes reaching $8 billion and an all-time total of over $1 trillion.

In addition, Solana’s futures-based ETFs have also surpassed $1 billion in inflows, emphasizing the growing global demand for crypto-linked financial products.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Expert Predicts SOL ETF Approval This Week as Solana ETPs Break All-Time Record. Accessed on October 8, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.