Despite the ETF Hype, Whale Crypto Sells 440 Million XRP in a Month!

Jakarta, door News – In today’s XRP (XRP) headlines, crypto whales appear to be betting against expectations of an XRP ETF launch and are slowly selling their holdings.

On-chain data shows that approximately 440 million XRP has been released by whales in the last 30 days, causing the price of XRP to drop back below $2.85 in the last 24 hours (9/10).

XRP Big News: Whale Sells 440 Million Ripple Coins

Whales holding between 1 million to 10 million XRP are rumored to have sold around 440 million coins in the past month, according to Santiment data shared by Ali Martinez on October 9.

Read also: 5 Reasons Why XRP is Worth More than Just the Price

Over the past few weeks, whales have liquidated holdings worth over $1.3 billion, indicating a still strong negative sentiment towards XRP.

Uncertainty has increased after the US government shutdown, while the SEC has again delayed a decision regarding XRP ETFs. It is known that six spot XRP ETF proposals are scheduled for decisions between October 18 and 25, with Grayscale being the party with the earliest deadline.

Interestingly, Crypto Funds Flow data from CoinShares shows that institutions continued to buy XRP ahead of the potential ETF launch. However, whale behavior is in the opposite direction, as previously, CryptoQuant’s XRP Whale Flow 30-DMA data indicates that whale distribution flows are still negative due to renewed selling pressure.

Why is Whale Selling Coins as ETF Launches Approach?

Amidst the fear and uncertainty(FUD) among retail investors, there are several key reasons why whales chose to sell XRP ahead of the potential ETF launch.

The two main factors were profit-taking by Ripple co-founder Chris Larsen back in July, as well as the delay in the approval of the spot XRP ETF by the SEC. Both of these have led to a lack of support from whales for the XRP price.

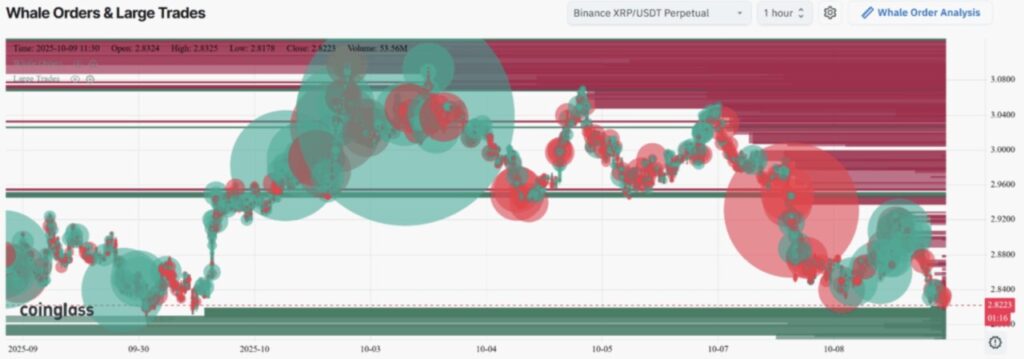

Meanwhile, the Whale Order and Large Trades data on the K-line chart shows a large wave of sell orders above the $3 level across major exchanges such as Binance, Coinbase, and OKX. In addition, whales are now known to be opening short positions in the $2.90-$2.96 price range.

Read also: Square, Jack Dorsey’s Company, Officially Presents Bitcoin Payments Without Transaction Fees!

Heavy activity was also seen around the $2.80 level, which coincides with the UTXO Realized Price Distribution, indicating that XRP holders are trying to keep the price from falling further.

XRP News: Price Moves In A Sideways Pattern

The price of XRP is currently moving flat in a falling wedge pattern on the daily chart. Some analysts predict that in case of an upward breakout, it could signal a change in the price structure that could potentially trigger a quick rally towards $4.

Crypto analyst Lark Davis said that the Ripple coin “continues to take a beating every time it tries to break the downside resistance line.”

However, if the price breaks below $2.80, then a potential sharp drop could occur, as many traders are already preparing for a further correction. Currently, the MA-50 line has cut below the MA-100, reinforcing the signal of weak XRP price momentum.

As of October 9, 2025, the price of XRP fell by more than 2% and is now trading at $2.82, with a daily range of $2.82 low and $2.92 high. Trading volume is also down 36%, signaling that traders are more inclined towards bearish sentiment.

Derivatives Market Shows Mixed Signals

According to CoinGlass data, the XRP derivatives market saw mixed sentiment. The total open interest (OI) of XRP futures fell 0.47% to $8.45 billion in the last 24 hours. However, separately, XRP OI on CME rose by more than 3%, while that on Binance fell by 1%.

Analysts think that the pending approval of the XRP ETF could be an important catalyst to trigger a price rebound after this period of selling pressure from whales.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. XRP News: Why Whales Sold Coins This Month Despite ETF Launch Buzz. Accessed on October 10, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.