Ethereum Surges 8% as Crypto Whales Scoop Up ETH at a Discount

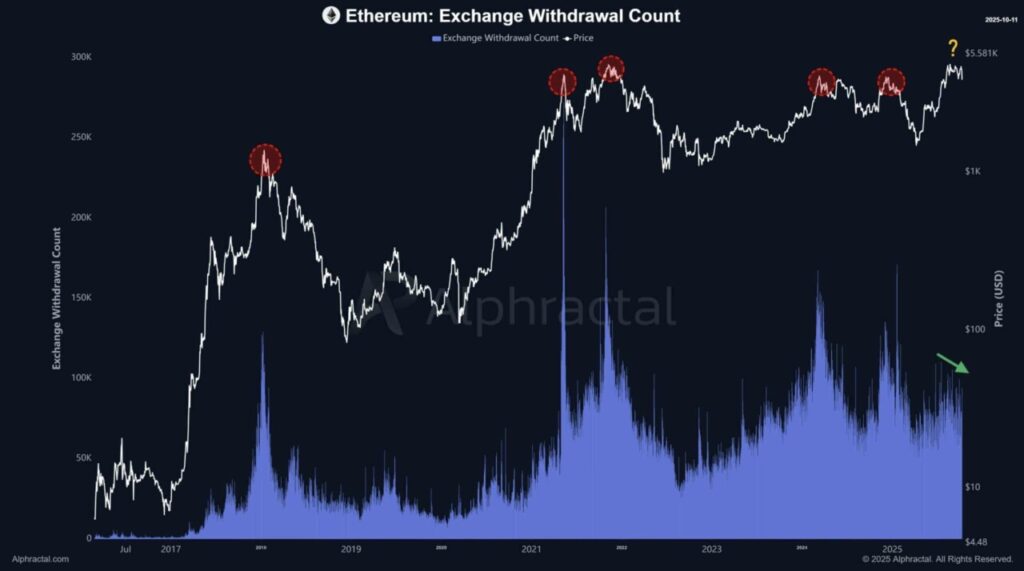

Jakarta, Pintu News – Ethereum’s (ETH) latest price recovery appears to be missing one familiar sign: withdrawals from exchanges. In previous bull cycles, ETH price spikes were usually followed by an increase in the number of tokens leaving centralized platforms.

This time, however, the number of withdrawals actually decreased. Even so, smart money investors don’t seem to be worried – perhaps even preparing for the next upswing.

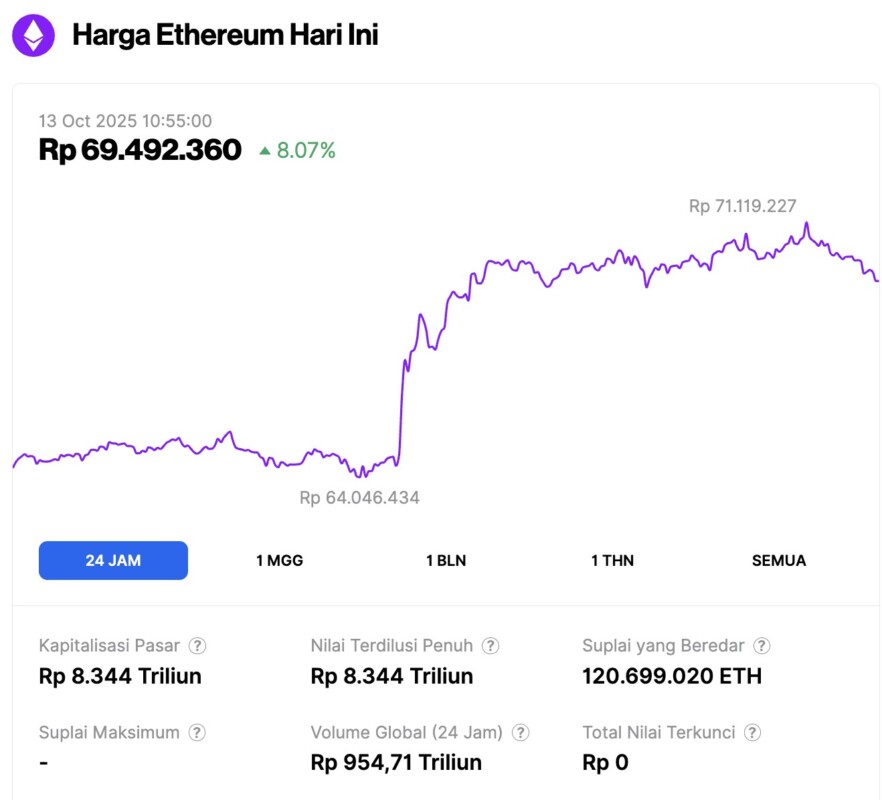

Ethereum Price Rises 8.07% in 24 Hours

As of October 13, 2025, Ethereum’s price was recorded at around $4,145, equivalent to IDR 69,492,360, marking an 8.07% increase over the past 24 hours. During this period, ETH traded as low as IDR 64,046,434 and reached a high of IDR 71,119,227.

At the time of writing, Ethereum’s market capitalization stands at approximately IDR 8,344 trillion, while its daily trading volume has climbed 10% to IDR 954.71 trillion in the past 24 hours.

Read also: Bitcoin Bounces Back to $115,000 — Is This the Start of a New Rally or Just a Temporary Rebound?

Disconnected Patterns

Historically, the cyclical peak of the Ethereum price has always coincided with a surge in withdrawals from the exchange that reached over 250,000-300,000 ETH, as happened in 2018, 2021, and early 2024. Whenever the number of withdrawals from the exchange reaches a high, it almost always coincides with a local or cyclical price peak.

However, at the moment, the chart shows that the number of withdrawals is decreasing, not increasing. The condition that usually signals overheated market sentiment is not visible this time.

This leaves two possibilities: Ethereum is either breaking out of its historical behavior pattern, or the true peak-a moment of great euphoria and mass withdrawals from exchanges-has not yet occurred.

Whale Buy When Prices Fall

Underneath it all, the whales are apparently on the move. According to a report from Lookonchain, Tom Lee’s company – Bitmine Immersion Technologies – has accumulated 128,718 ETH worth nearly $480 million into six new wallets, withdrawing the tokens from FalconX and Kraken shortly after the ETH price crashed.

Analysts also found a strong buy wall in the $3,300-$3,500 range, suggesting that whales are actively defending these price levels.

Although ETH still looks technically weak, these large inflows are evidence that confidence in the potential for another rally – perhaps even towards a new All-Time High (ATH) – is still very strong.

Read also: 4 Altcoins Targeted by Crypto Whales in Uptober 2025

Is ETH Starting to Recover?

As of October 12, the price of Ethereum was around $3,824, up 1.97% after experiencing a sharp sell-off earlier.

The RSI stood at 36.7, which is still in mild oversold territory – an area that is often followed by a relief rally. Meanwhile, MACD is still below zero, but the bearish momentum is starting to weaken as the histogram bars shrink.

In terms of DMI (Directional Movement Index), the negative directional index (33.4) still dominates, but the positive directional index (14.8) is starting to move up gradually. Selling pressure is starting to ease, and if buyers are able to defend the $3,500 level, then this accumulation has the potential to drive a short-term price bounce.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Ethereum whales load $480mln for next leg up – But, ETH history says ‘top’ Accessed on October 13, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.