3 Made in USA Cryptos Gaining Attention After Trump’s China Tariff Announcement

Jakarta, Pintu News – The crypto market is reeling from Trump’s new 100% tariff on China, causing many altcoins to struggle to get back on their feet.

However, not all assets were affected in the same way. Some American-made coins showed surprising resilience – some capitalized on the decline to form new rally patterns, while others remained stable or even experienced gains.

With the United States back in the center of market attention, these altcoins have the potential to register significant movements before Trump’s new tariffs come into effect on November 1, citing the BeInCrypto report.

Solana (SOL)

Solana (SOL) has been one of the American-made coins that performed quite well after the recent crypto market crash.

Read also: The Market Turns Green: These 3 Altcoins Are Top Picks for Whales and Smart Money Accumulation

Despite a drop of 1.8% in 24 hours and more than 23% during the week, the token was still able to hold above the $168 level, forming a bullish ascending channel pattern.

This structure indicates that Solana’s price could be poised for a technical recovery. The Chaikin Money Flow (CMF) indicator has also started to show positive signals, signaling possible accumulation from large holders – a sign that buying on the downside is taking place, rather than a massive sell-off.

If Solana (SOL) continues to build momentum, a break above the $200 level could pave the way towards the $220 to $234 price target. However, if the price drops below $168, a potential retest of the $147 level is still open.

For now, SOL’s ability to hold above important support levels while attracting major investor interest makes it one of the US-made coins worth keeping an eye on in these post-crisis market conditions.

Dash (DASH)

Dash, one of the oldest blockchain projects developed in the US and known for its focus on fast transactions and low fees, has been surprisingly in the positive spotlight as the crypto market has taken a recent tumble.

Instead of plummeting like the overall market, the price of DASH broke out of a bull flag pattern right as the crash occurred, indicating strong technical conviction on the part of buyers.

This rise started from around the $33 level and since then the DASH price has soared – up 36% in the last 24 hours (12/10) and over 62% during the week.

More importantly, the Chaikin Money Flow (CMF) indicator has risen above zero to a level of 0.07, confirming that large fund flows are starting to come into this asset – a healthy sign that this rally has institutional support, rather than just being driven by retail investors.

Based on the pole height of the bull flag pattern, DASH’s next price target is around $66, while the token is currently trading at around $58. In the event of a correction, the nearest support levels are at $49 and $43, with stronger support at $33.

A drop below $29 would invalidate this bullish scenario, but as long as large fund flows continue, DASH could potentially test the $66 level in the near future.

Read also: 3 Reasons Why Analysts Say Now is the Smartest Time to Look at Altcoins

SKALE (SKL)

SKALE (SKL) – an Ethereum-based scaling network designed to make blockchain faster and cheaper – has been one of the few US-made coins to bounce back strongly after the recent crypto market crash. As of October 12, the token was up 18.5%, showing renewed strength from both large and retail investors.

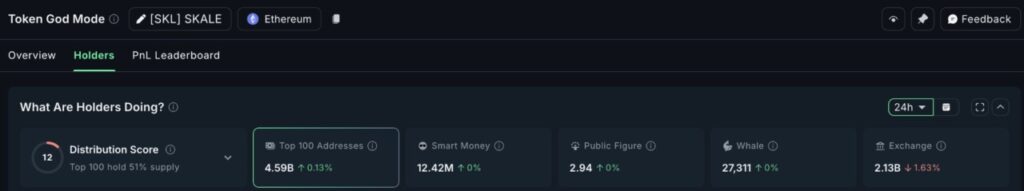

On-chain data from Nansen reveals that the top 100 SKALE addresses add 0.13% ownership, equivalent to around 6 million SKL tokens.

With SKL’s current price around $0.021, this means that these large holders bought around $126,000 worth of SKALE in the past day – a small amount but an important signal of silent accumulation.

At the same time, the token balance on the exchange fell by 1.63%, from approximately 2.17 billion SKL to 2.13 billion SKL. This means that around 40 million SKL (about $840,000) were withdrawn from the exchange and most likely moved to long-term wallets.

As the top 100 addresses only added 6 million SKLs, the remaining 34 million SKLs likely came from retail investors, which reinforces the signal that accumulation was widespread in the market.

Technically, SKALE has managed to reclaim the $0.021 level, with the next resistance at $0.026. If price is able to close daily trading above this level, a path towards $0.032 and $0.037 will open up – and breaking $0.05 will confirm the bullish structure in full.

However, if the price drops below $0.020, the potential for a drop back to $0.015 still exists. With accumulation from large holders and falling balances on exchanges, SKALE’s price rally looks quite solid – supported by both institutional and retail investors.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Made in USA Coins to Watch After Trump China Tariffs. Accessed on October 17, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.