Gold Price Today October 17, 2025: Up or Down?

Jakarta, Pintu News – Gold prices continue to be a hot topic of discussion in the commodities market, especially for investors looking for hedging alternatives amid crypto market volatility.

In today’s trading, Thursday, October 17, 2025, the price of Antam gold jumped sharply to Rp2,485,000 per gram-up more than Rp170,000 compared to the beginning of the month, based on data from HargaEmas.com. This surge has drawn sharp attention from physical gold investors and digital asset market players.

This increase is also inseparable from the combination of strengthening global spot prices, weakening Rupiah, and sentiment from crypto markets such as Bitcoin (BTC), Ethereum (ETH), and stablecoins that are also attracting attention. Check out 5 important facts that investors must understand today:

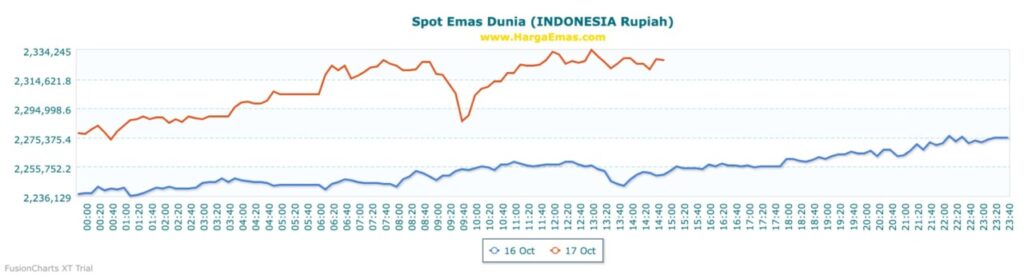

1. Global Spot Gold Price Hits $4,363.80/Oz

According to data from HargaEmas.com, the global spot gold price as of October 17, 2025 at 15:00 WIB was at the level of $4,363.80 per troy ounce. This represents a significant increase of $99.60 compared to the previous day. If converted to Rupiah with a USD/IDR exchange rate of IDR 16,590.38, then one ounce of gold is worth around IDR 72,390,690.

This increase reflects the surge in demand for safe haven assets such as gold, especially amid rising geopolitical uncertainty and tensions in the Middle East. This sharp increase in global prices is one of the main triggers for Antam’s gold price to surge domestically.

Read More: Altseason Index This Week: Traders Prepare to Take Profits

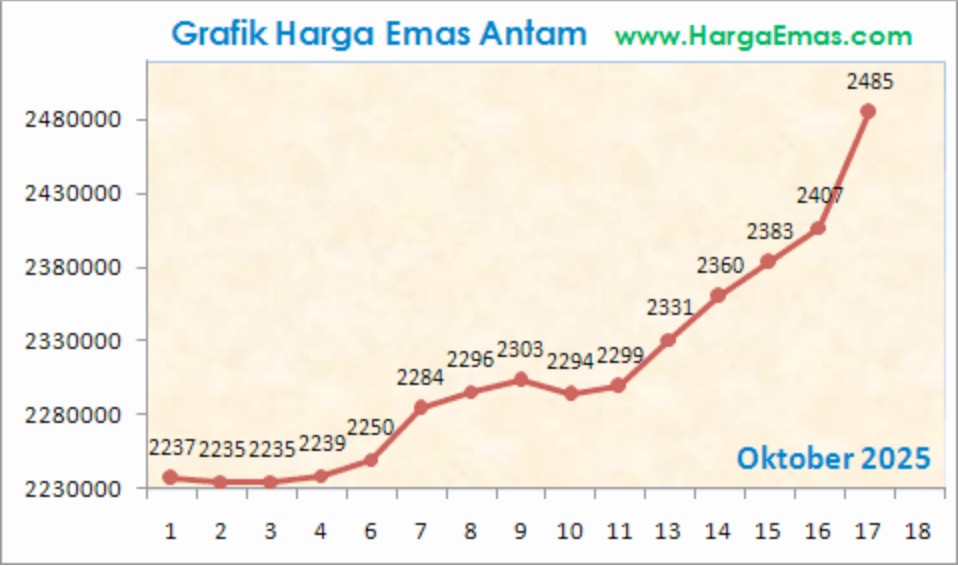

2. Antam Gold Price Soars: Highest Since Early October

Based on Antam’s price chart from HargaEmas.com, the price of 1 gram of gold jumped from IDR 2,237,000 on October 1 to IDR 2,485,000 on October 17, 2025. This means an increase of more than Rp248,000 or around 11% in just two weeks.

The chart also shows a consistent upward trend, especially after October 10. A sharp spike has been seen since October 13, driven by a combination of global factors and crypto market fluctuations. This data suggests that gold is again an instrument that investors “buy” in the face of volatility.

3. Rupiah exchange rate continues to weaken, affecting domestic prices

The Rupiah exchange rate against the US Dollar is also an important factor that strengthens domestic gold prices. As of October 17, 2025, the USD/IDR exchange rate stood at IDR16,590.38-slightly stronger than before, but still in a medium-term weakening trend.

The weakening of the Rupiah against the Dollar has increased the price of gold in Rupiah, even though the global spot price does not always move aggressively. This is an important metric for gold investors to monitor as currency fluctuations directly impact the buying and selling price of precious metals.

4. Antam Buyback Price Has Not Been Announced, But Spreads Are Getting Wider

Although official data on Antam’s buyback price has not been released today, there is usually a spread of around Rp150,000-Rp180,000 from the selling price. Referring to the previous trend, today’s buyback price could be in the range of IDR2,305,000-Rp2,330,000 per gram.

This spread reflects Antam’s operating costs and risk margin. For investors looking to resell their gold, understanding this spread is key to gauging potential short-term gains or losses.

5. Crypto attracts attention, but gold remains the favorite hedge

While the crypto market is being buzzed about due to Bitcoin’s (BTC) price spike that broke Rp1.77 billion and Ethereum’s (ETH) above Rp63 million-gold remains the “go-to” investment alternative for conservative investors.

According to today’s Pintu Market report, stablecoins like Tether (USDT) and USD Coin (USDC) are also attracting attention as temporary parking places for funds. But when crypto experiences a correction, investors are often “scrambled” back to gold as a safe haven asset. This proves that gold is still an important alternative for portfolio diversification in the highly volatile crypto world.

Also Read: Michael Saylor’s Strategy: $27.2 Million Bitcoin Purchase Before the Crypto Market Crash

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- HargaEmas.com. Spot and Antam Gold Prices Today October 17, 2025. Accessed on October 17, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.