7 Effective Ways to Use Google Gemini for Potential Crypto Research

Jakarta, Pintu News – Research before investing in cryptocurrencies is now an absolute necessity amidst the flood of information from thousands of blockchain projects, tokens, and complex white papers. Unfortunately, many investors struggle to distinguish important data from mere hype.

Now comes Google Gemini, an AI assistant that helps filter, summarize, and analyze information efficiently. It’s not a price prediction tool, but a smart research assistant that can make data-driven investment decisions easier. Here are 7 effective ways to use Google Gemini for in-depth and efficient crypto research according to Cointelegraph!

1. Make Gemini an analytical assistant, not a fortune teller

Gemini is designed to help analyze and structure data, not guess the direction of Bitcoin (BTC) or Ethereum (ETH) prices. Use this AI to understand the factors that drive price movements, such as market trends, community narratives, or fundamental aspects of projects.

That way, you’ll focus on the reasoning and logic behind the data, rather than speculation. This analysis-based approach helps to create a more informed and less emotional investment strategy.

2. Use Specific and Targeted Prompts

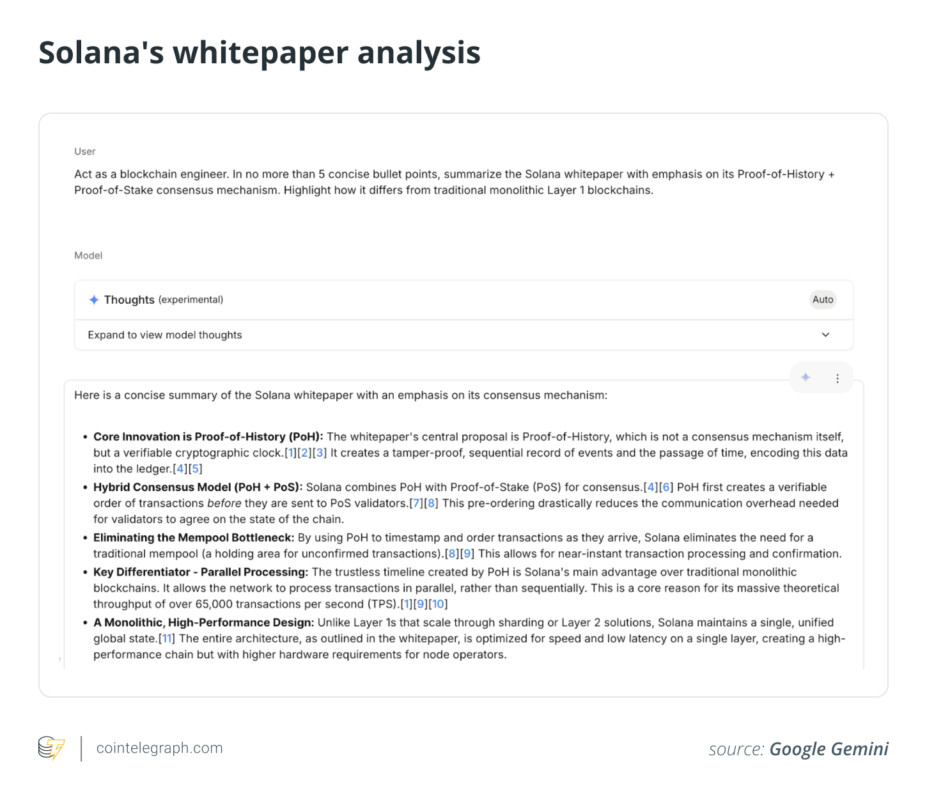

The key to using Gemini is the precision of the instructions. Avoid general questions like “Is Solana good?” and turn them into more technical directions, for example:

“Act as a blockchain analyst. Explain Solana’s Proof-of-History consensus system and how it differs from Ethereum.”

Contextual prompts like this make Gemini “think” like a professional analyst. The more detailed and targeted your questions are, the more relevant the results will be.

3. Request Results in a Structured Format

To make the analysis results easier to understand, ask Gemini to display the data in a table, bullet, or SWOT analysis format. For example:

“Create a comparison table of Solana (SOL), Avalanche (AVAX), and Ethereum (ETH) based on transaction speed, fees, and number of active developers.”

With a clean view of the data, you can instantly compare projects and assess which ones have the strongest growth potential.

Also read: 5 Best Stocks According to Chat GPT For Long Term

4. Explore Project Fundamentals and Tokenomics

Before buying crypto, understand the basics of the project: the technology, the token economic model(tokenomics), and the credibility of the team. You can use prompts like:

“Act as a tokenomics analyst. Explain Solana (SOL) token allocation, vesting schedule, and transaction fee burning mechanism.”

Gemini can help spot signs of risk such as token distributions that are too large for early investors or unlock schedules that could depress prices in the future.

5. Competitor Analysis and Market Sentiment

The crypto world is highly competitive. To assess the position of a project, have Gemini perform a comparative analysis between projects. For example:

“Compare Ethereum’s (ETH) three main competitors based on network activity and developer adoption rates.”

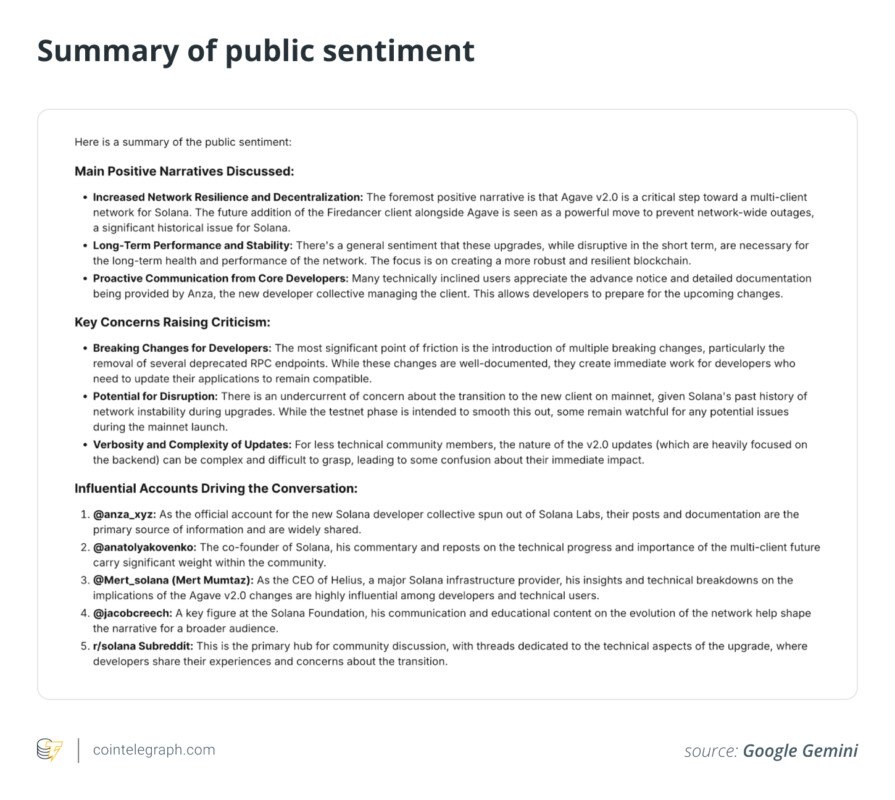

In addition to data analysis, you can also have Gemini summarize market sentiment on platforms such as X (Twitter) or Reddit. Prompts such as:

“Analyze the community’s reaction to the Solana testnet update and name the most influential accounts.”

Helps understand the dynamics of public opinion – an important factor that often triggers crypto price volatility.

6. Review Project Risks, Regulations, and Security

Security and regulatory compliance are two crucial aspects before investing. Gemini can summarize the results of security audits from companies like CertiK or Quantstamp, for example with a prompt:

“Summarize the key findings of the Solana audit report, including high-level vulnerabilities and their resolution status.”

In addition, you can assess the legal risks of crypto projects with commands:

“Analysis of potential regulatory risks for projects offering off-chain computing in the US and Europe.”

This approach helps assess the sustainability of projects in the face of changing global rules.

Read also: 5 Hottest Facts in the Crypto World This Week

7. Verify All Information Independently

Even if Gemini’s results seem accurate, still check directly with official sources such as project websites, white papers, audit reports, or blockchain explorer. AI may produce data that sounds logical but is not factual.

Think of Gemini as an early-stage research tool, not the absolute truth. The combination of artificial intelligence and human rigor will result in more objective and efficient investment decisions.

Conclusion

Google Gemini is a revolutionary tool for crypto investors who want to do research quickly and purposefully. With the right prompts, you can decipher project fundamentals, assess risks, and understand market sentiment without drowning in piles of data. AI doesn’t replace analysts, but it helps make the research process faster, more objective, and strategic.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. How to use Google’s Gemini to research coins before you invest. Accessed October 19, 2025.

- Featured Image: Coin Central

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.