Ripple (XRP) DEX Volume Surges as Price Plummets: Here’s the Potential Recovery!

Jakarta, Pintu News – At the current tipping point, Ripple (XRP) is struggling to maintain support below the $2.5 mark after experiencing intense selling pressure for several weeks. Although the overall market sentiment is still weak, some analysts argue that this exhaustion phase could signal a local bottom which is often followed by a strong Ripple (XRP) price recovery.

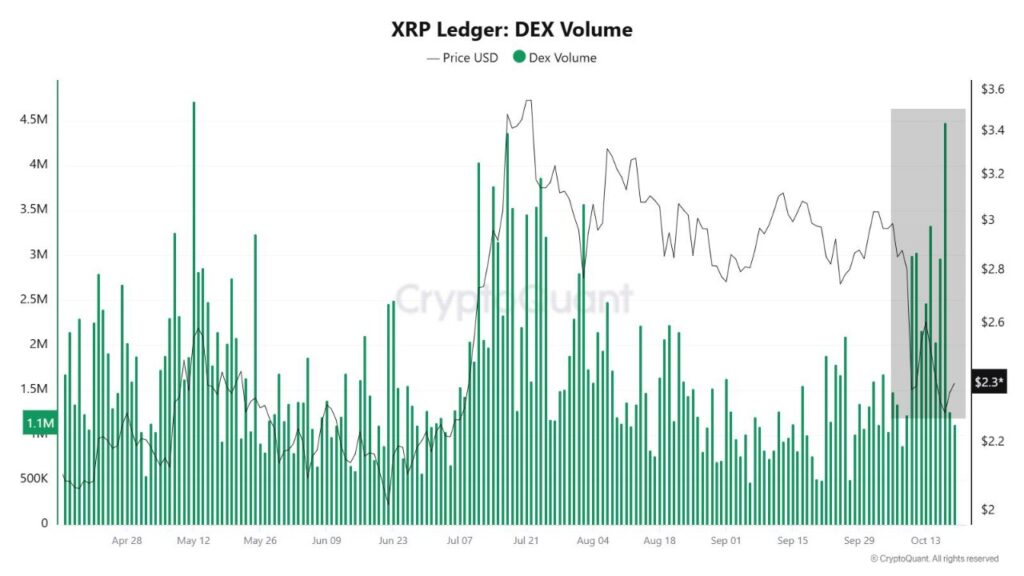

Price-Volume Divergence Signals Market Turning Point

Analysis from CryptoQuant, CryptoOnchain, shows that the divergence between Ripple (XRP) price and trading volume on the DEX can be interpreted in two opposite but important ways. The first scenario is Capitulation and Selling Pressure, where a spike in trading volume during a price drop reflects panic selling. This suggests that short-term holders and traders who are not willing to bear further losses are rushing to get out.

Historically, this confirms strong bearish momentum. On the other hand, the second possibility is Accumulation by Smart Money. The surge in volume may not indicate panic, but strategic positioning by large investors or whales capitalizing on discounted prices. While retail participants sell out of fear, long-term players may be soaking up supply, preparing for a potential recovery. This dynamic of Ripple (XRP) transferring from “weak hands” to “strong hands” often precedes major reversals.

Also Read: The Potential Price of Shiba Inu If Half the Supply is Burned: SHIB Likely to Surge?

Ripple (XRP) Seeks to Stabilize After Massive Sales

Ripple (XRP) is showing early signs of stabilization after one of the biggest corrections of the year. The chart shows that the token bounced off a low near $2.3, a level closely aligned with the 100-day moving average that now acts as short-term support.

Although it has recovered to around $2.47, the structure is still fragile, with the 50-day moving average showing a downward trend and the price still below the key resistance zone of $2.6-$2.7. This zone previously served as strong support before it was broken during the last sell-off, suggesting that it may now act as a barrier to bullish continuation.

The broader trend also highlights increased volatility reflecting uncertainty among traders. The lower long tail on the latest candle suggests that buyers are defending the $2.3 level, but without a clear volume expansion, a sustained reversal is still uncertain.

Potential Recovery and Its Impact on the Market

If Ripple (XRP) holds above $2.3, a short-term consolidation phase may follow, potentially leading to a retest of $2.6. However, if selling pressure returns and the price drops below $2.3, a deeper pullback towards the 200-day moving average near $1.8 cannot be excluded. For now, the outlook for Ripple (XRP) depends on whether the bulls can turn this temporary bounce into a confirmed recovery.

Conclusion

Taking into account the current dynamics, investors and traders should pay attention to volume indicators and price movements to catch further accumulation or selling signals. The depth and sustainability of this trend will determine the medium to long-term direction of Ripple (XRP) in the market.

Also Read: Can XRP Reach $10 Before 2025 Ends? Investors Should Know This Analyst’s Assessment!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. XRP DEX Volumes Surge as Price Plunges, Smart Money Accumulating. Accessed on October 21, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.