HBAR Crypto Still Standing: A Glimmer of Optimism Amid Widespread Market Pessimism

Jakarta, Pintu News – After falling over the past week, the price of the Hedera token (HBAR) is still hovering around $0.16, but is showing little energy to go higher. Market sentiment is weakening, and traders’ confidence continues to decline.

For now, there’s only one potential signal standing between HBAR and a deeper drop – it’s this signal that’s keeping a glimmer of hope amidst the increasingly bearish market conditions.

Bearish Indicators Increase: Retail Flows Weaken and Hype Begins to Fade

The biggest warning signal for HBAR is evident on the daily chart – the potential death cross between the 100-day and 200-day Exponential Moving Average (EMA).

Read also: Bitcoin Price Rises to $110,000 Today: BTC Potentially Facing a Decline?

The EMA helps smooth out price movements to indicate the direction of the long-term trend, and a death cross occurs when the short-term EMA drops below the long-term EMA. This is often a sign that selling pressure could increase if the pattern actually forms.

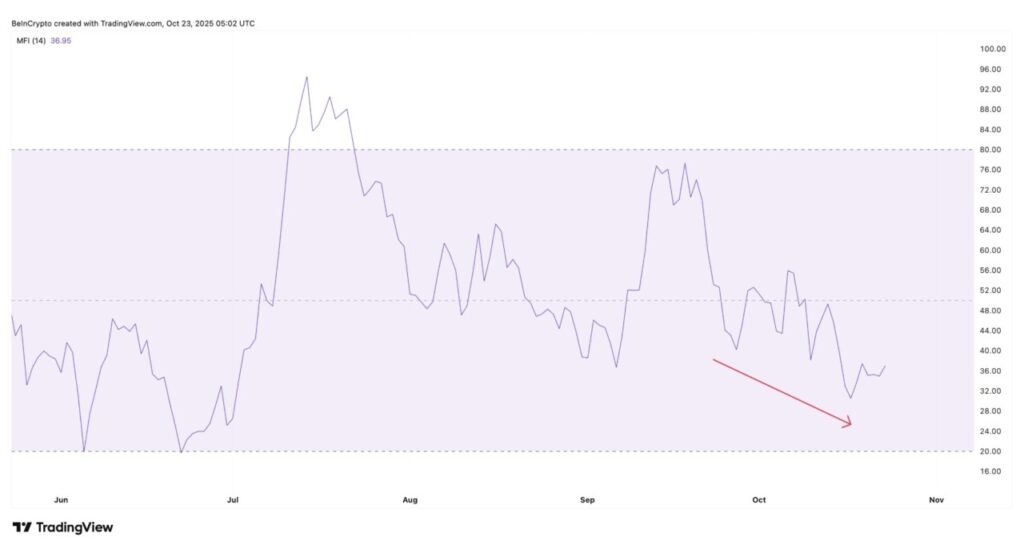

The Money Flow Index (MFI) indicator, which measures money flows in and out of an asset based on price and volume, also supports the picture of market weakness. Since mid-July, the MFI has been steadily declining – from around 55 in early October to 36 currently – signaling that retail traders are no longer buyingthe dip with the intensity they once did.

Social data also reinforced the slowdown signals. HBAR’s social dominance – i.e. the share of HBAR discussions in the overall conversation around crypto – briefly reached a weekly peak of 1.49% on October 22, driven by a surge in interest in ETF filings mentioning HBAR.

However, that enthusiasm quickly faded, and social dominance dropped dramatically to 0.51%, confirming that the euphoria was temporary.

These metrics combined form a wave of bearish signals – weakening participation, declining public attention, and a technical structure that indicates the potential for further losses if buyers don’t take over soon.

One Hope for Hedera Price Rebound: RSI Divergence Could Hold at $0.16 Level

Despite the seemingly weak market situation, there was still one indicator that gave some hope. Between June 22 and October 10, the HBAR price printed lower lows, while the Relative Strength Index (RSI) indicator formed higher lows.

Read also: Ethereum Price Held at $3,800 Today: Crypto Analysts Forecast ETH to Soar

This kind of bullish divergence often appears when selling pressure starts to weaken – and can signal a potential reversal.

If this signal proves to be correct, the price of Hedera (HBAR) could potentially rise by around 10% to test the $0.18 level again – this would be the first hurdle traders would need to break through. After that, if the price manages to close above $0.19, the path to $0.22 could open up.

However, at the moment the risks still outweigh the potential gains. The $0.16 level remains the key support to defend. If this level is broken, HBAR risks dropping to $0.15 or even $0.12. And if such a scenario occurs, the formation of a death cross will further deepen the bearish sentiment in the market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Hedera Price Rebound Hope Meets Bearish Risks. Accessed on October 24, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.