These 4 Altcoins Could See Major Gains in Early November 2025

Jakarta, Pintu News – The crypto market is full of surprises, and November could be an important turning point. Traders and whales are quietly starting to accumulate certain altcoins, while most of the market still looks caught off guard and distracted.

In this article, we’ll look at four altcoins that are on the rise but haven’t gotten much attention. Although still under the radar, these altcoins are showing signs of a big surge, according to AltcoinBuzz.

Solana (SOL)

Solana (SOL) has all the ingredients to experience a price surge in November. The main thing to watch out for is the relationship between Solana and ETFs. This is where the big potential lies. The world’s first Solana spot ETF will start trading in Hong Kong tomorrow. This is an important milestone for SOL. But it’s not the only big news.

Read also: 3 Altcoins to Watch Ahead of the FOMC Meeting at the End of October 2025!

The $SOL spot ETF from 21Shares has also completed Form 8-A with the SEC, which is usually considered a green light for launch. Interestingly, this ETF also offers a staking yield of 6-7% for its holders.

In addition, there is one more Solana spot ETF submission from Franklin Templeton under review, with a decision scheduled to come out by November 14, 2025.

If approved, this could be a huge boost to the price of $SOL. In fact, the current news alone has made the price of $SOL rise 5.6% in a day.

Not just on the financial side, Solana is also preparing to launch the biggest technical change in its history. A new consensus protocol called Alpenglow will replace the old system. This is a fundamental change in how validators work and how consensus is achieved in the network.

Ethereum (ETH)

Ethereum (ETH) is the next altcoin to potentially experience a price spike in November. In recent times, Tom Lee has played a significant role as he and his company, Bitmine, have contributed greatly to the current price development of ETH.

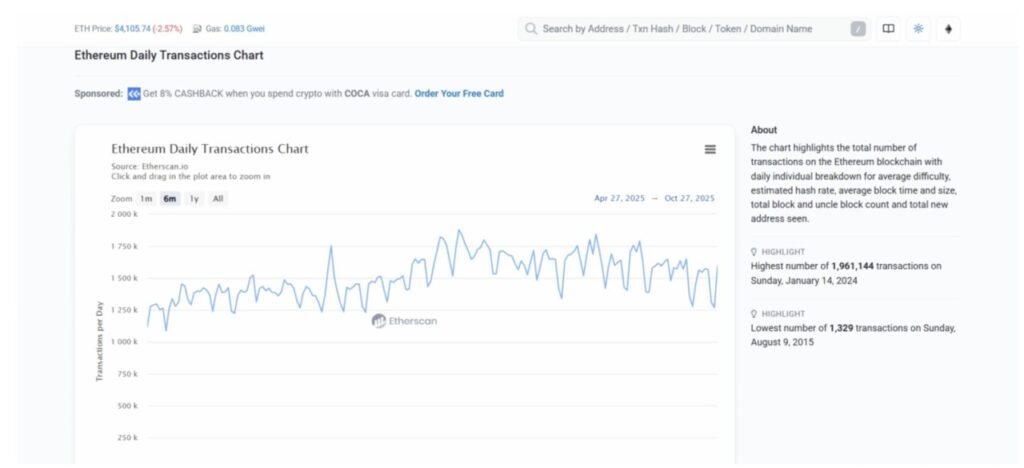

According to Tom Lee, ETH is in a supercycle phase, where the fundamental strength of Ethereum is now the main driver of the price. He highlights the high demand for stablecoins and the number of Ethereum transactions reaching an all-time high.

Not only that, the rise in Ethereum price was also driven by the accumulation of Treasuries of large companies. After Tom Lee’s Bitmine, public company SharpLink Gaming became the next big player to add to its Ethereum holdings. They just bought 19,271 $ETH, worth about $81 million. This shows that the whales are still continuing to accumulate ETH.

Read also: Ethereum Price Prediction: ETH Could Hit $5,000 Record in November 2025?

On the technology front, Ethereum is gearing up for its next major upgrade, Fusaka, which is scheduled to launch in early November. This upgrade is aimed at improving the scalability, efficiency, data availability, and fee structure of the network.

Fusaka builds on previous major upgrades, such as Dencun and Pectra, and is prepared to support the next wave of roll-up and Layer-2 scaling solutions. This will improve the overall Ethereum user experience.

In addition, institutional interest in Ethereum is also on the rise. For example, in the third quarter (Q3), fund inflows into Ethereum (ETH) ETFs surpassed Bitcoin (BTC) for the first time.

Chainlink (LINK)

Chainlink (LINK) is one altcoin that is currently on an exciting momentum. Chainlink will be attending the SmartCon conference in early November. Chainlink’s presence at SmartCon is not big news alone, but the list of other participants is what makes this event special.

SWIFT, Mastercard, and JPMorgan are set to attend, along with a growing number of actors from the Web3, finance, and governance worlds. So, announcements and strategic partnerships during SmartCon-which will be held on November 4-5 in New York City-have the potential to trigger a surge in interest in Chainlink.

Chainlink also continues to expand its role in the Real World Assets (RWA) market, a market that is expected to grow to $16 trillion by 2030.

One of the key technologies driving Chainlink’s position in the sector is CCIP (Cross-Chain Interoperability Protocol), a cross-chain protocol that enables the transfer of data and value between more than 60 blockchains. CCIP plays an important role in the process of tokenizing assets, including stablecoins and other real-world assets.

Read also: 3 Major Token Unlocks Worth Keeping an Eye on in Late October 2025

On the other hand, the Chainlink Reserve also continues to grow. On October 23, a total of 63,481.88 $LINK was added to this reserve, bringing the total to 586,640.66 $LINK. These tokens are being held to support the long-term growth and sustainability of the Chainlink network, as well as reduce the supply in circulation, ultimately increasing the scarcity of $LINK tokens in the market.

Chainlink is also actively adding new integrations. As of October 28, they announced 17 new integrations covering 6 services and 11 different blockchains, including Arbitrum (ARB), Avalanche (AVAX), Base, BNB Chain, Ethereum, MegaETH, and others.

Bittensor (TAO)

Bittensor (TAO) brings us to the Artificial Intelligence sector of crypto-a sector that is currently one of the most exciting, along with Real World Assets (RWA). In addition, Bittensor is also a key pillar in the DePIN (Decentralized Physical Infrastructure Networks) ecosystem.

Like several other altcoins on this list, institutional interest in Bittensor is on the rise. For example, Tao Synergies (Nasdaq: TAOX) is now the largest public holder of the $TAO token. They have expanded their $TAO reserves to 54,000 TAO, both through direct purchases and staking. At current prices, that equates to about $22.4 million.

Read also: WisdomTree Launches Stellar ETP, XLM Aims to Rise to $0.36!

Another large institution, Grayscale, has also started looking into the decentralized AI sector. They have launched a Decentralized AI Fund consisting of 6 components, and $TAO is the second largest component, with a weight of 22.15%. Grayscale has even filed a Form 10 to form the Grayscale Bittensor Trust.

In terms of tokenomics, Bittensor follows a similar model to Bitcoin. The total supply of $TAO will be limited to 21 million tokens. In addition, Bittensor also has halving events, just like Bitcoin.

The first halving will occur in early December, which will significantly reduce the number of new tokens issued. This creates a supply-side tailwind that could push prices up ahead of the halving.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Altcoin Buzz. 4 Altcoins That Will Pump FIRST in November 2025. Accessed on October 29, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.