Pi Network Surges 13% Today — How Much Higher Can Pi Coin Climb?

Jakarta, Pintu News – Pi Network (PI) experienced a sharp price surge of 32% in 24 hours on Monday, sparking hopes of a sustained rally. However, the optimism was short-lived, as investors seemed to take advantage of the brief spike to offload (sell) their assets.

As of October 28, the altcoin’s momentum is starting to take a hit, and a number of technical indicators point to further downside potential if the sell-off continues. Then, how is Pi Network’s current price movement?

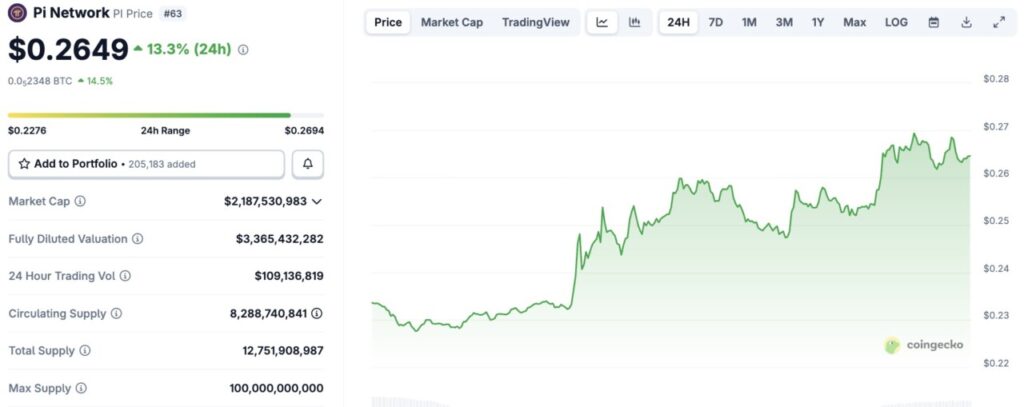

Pi Network Price Rises 13.3% in 24 Hours

On October 29, 2025, the price of Pi Network was recorded at $0.2649, an increase of 13.3% in 24 hours. If converted to the current rupiah ($1 = IDR 16,629), then 1 Pi Network is IDR 4,405.

Read also: Zcash (ZEC) Whales Sell Assets on 9th Anniversary

The price of PI has moved within a range of $0.2276 to $0.2694 in the last 24 hours. The price chart shows a consistent uptrend, despite some minor corrections.

This increase comes amidst a surge in trading volume of over $109 million, indicating high market interest in the asset. Pi Network’s market capitalization now stands at $2.18 billion, with a fully diluted valuation (FDV) of $3.36 billion.

Pi Coin Outflows Rise Sharply, Market Sentiment Begins to Deteriorate

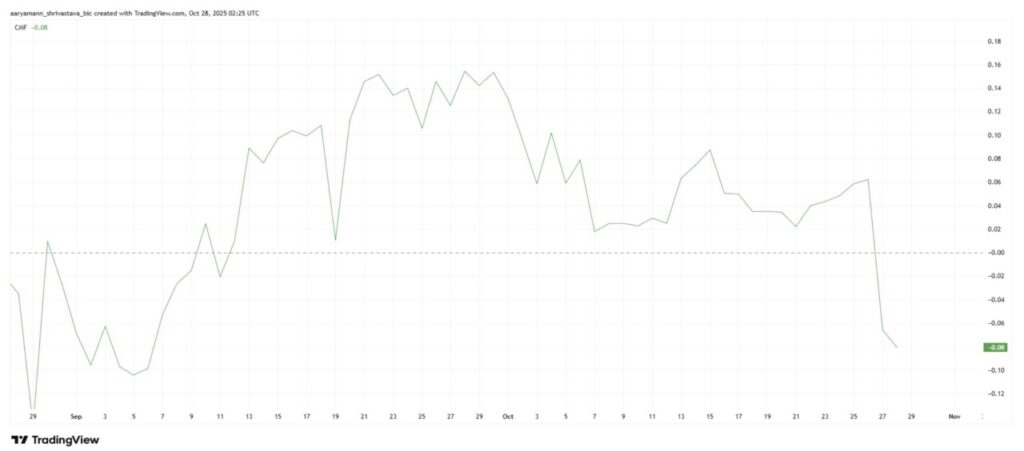

The Chaikin Money Flow (CMF) indicator is showing warning signals for Pi Coin. In the last 24 hours (10/28), the CMF experienced a drastic decline and reached its lowest level in almost two months.

This sharp decline reflected massive capital outflows, indicating that many traders opted to take profits quickly rather than hold their positions for further upside potential.

Significant CMF drops like this are often an indication of increasing bearish sentiment. Pi Coin holders seem to have started abandoning their positions when the price briefly rose 32% in a day, triggering a large outflow of funds. This sudden change in sentiment could limit the potential for a short-term recovery, especially if investor confidence continues to decline.

However, on the other hand, the Relative Strength Index (RSI) indicator showed a different signal. Within 24 hours (28/10), the RSI jumped sharply – from the bearish area below 50.0 to the positive zone. This spike usually indicates renewed bullish momentum and a potential continuation of the upside in the short term.

However, ongoing fund outflows could hamper this rally. If selling pressure continues, this could potentially offset the positive technical signals, and keep Pi Coin prices moving in a range-bound manner.

Read also: x402 Update Triggers Optimism, Cardano Price Ready to Soar 80%?

PI price is in danger of not strengthening

As of October 28, the Pi Coin (PI) price was sitting at $0.229, just above the crucial support level at the same figure. This area could potentially be a bounce point if buyers re-enter the market with conviction.

If Pi Coin is able to hold and bounce off the $0.229 level, then the price has the opportunity to rise towards $0.256, or even higher. This movement would indicate recovering market strength as well as a potential partial recovery from previous selling pressure.

But conversely, if the $0.229 support level fails to hold, then the price could drop to around $0.209, possibly even repeating the test of support at $0.198. This scenario would invalidate the bullish view and confirm the continuation of the short-term bearish trend for Pi Coin.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Did Pi Coin’s Price Just Lose Its Shot At Recovery As 32% Jump Fails? Accessed on October 29, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.