Ethereum Drops to $3,900 Today — Could ETH Climb to $5,000 After the FOMC Meeting?

Jakarta, Pintu News – Ethereum (ETH) price is currently trying to find a strong support level of $4,000, after experiencing a correction of almost 5% from its weekly high. On a positive note, fund inflows into spot Ethereum ETFs have picked up again, indicating that demand from institutional investors is recovering.

Leading market analysts remain optimistic about ETH and expect the price to potentially rise to break the previous record high of $5,000 and beyond. So, how is Ethereum’s current price movement?

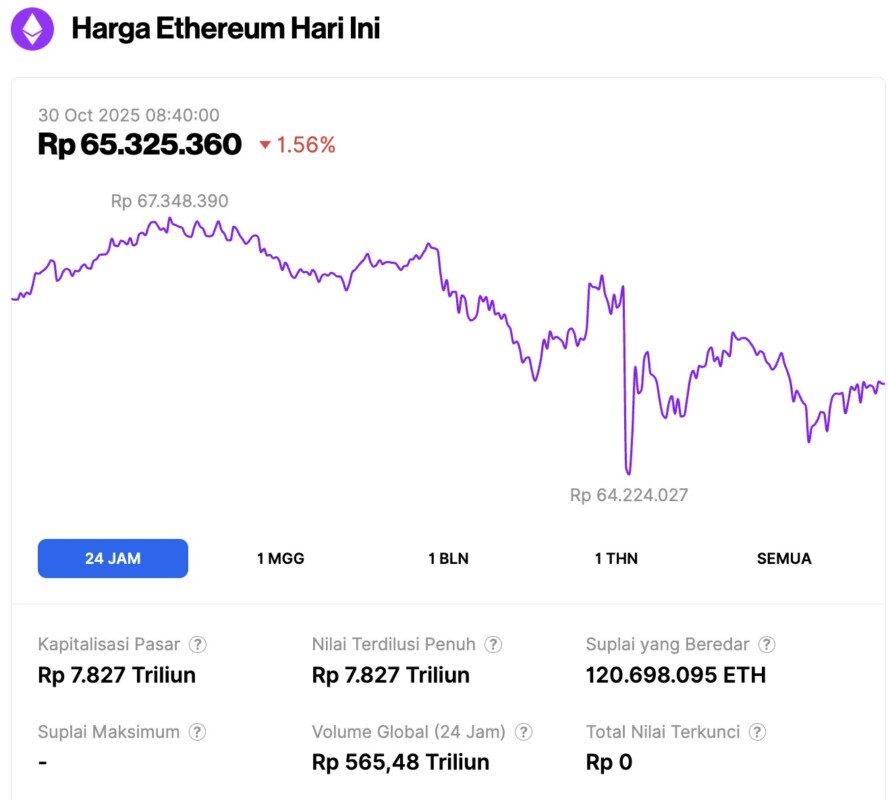

Ethereum Price Drops 1.56% in 24 Hours

On October 30, 2025, Ethereum was trading at approximately $3,924, equivalent to around IDR 65,325,360 — marking a 1.56% decline over the past 24 hours. During this period, ETH dipped to a low of IDR 64,224,027 and peaked at IDR 67,348,390.

At the time of writing, Ethereum’s market capitalization is estimated at IDR 7.83 trillion, while its 24-hour trading volume has dropped by 3% to IDR 565.48 trillion.

Read also: Bitcoin Price Plummeted $110,000 Today: Robert Kiyosaki Predicts BTC Could Double!

ETH Price Has the Potential to Rise to $5,000 Post FOMC

Ahead of the ongoing FOMC meeting, investors are optimistic that Fed Chairman Jerome Powell will announce a 25 basis point interest rate cut on October 29. Traders believe this move could be a breath of fresh air for risky assets, especially altcoins.

Renowned crypto market analyst, Michael van de Poppe, shared his views on Ethereum. He noted that ETH is currently still moving in a narrow range while building momentum.

According to van de Poppe, the next big move of ETH is likely to be heavily influenced by macroeconomic factors, especially the outcome of the FOMC meeting. If the announced policy tends to favor risky assets, ETH prices have a chance to rally again and target the $5,000 level.

Similar sentiments were shared by another popular analyst, BitBull. He highlighted Ethereum’s renewed strength after it managed to reclaim the $4,000 level earlier this week. According to him, this is a clear signal that the market sentiment towards ETH is currently bullish.

According to the analyst firm, as long as ETH prices are able to stay within the support range of $3,800 to $4,000, market sentiment will remain positive. BitBull added that the current market formation shows considerable upside potential for ETH, with a projected rally that could break the $8,000 level this cycle.

Read also: SUI 2025 Price Prediction: Could the Symmetrical Triangle Pattern Trigger Another 900% Rally?

Ethereum ETF Inflows Could Be an Additional Trigger

Inflows into spot Ethereum ETFs continued this week, signaling that institutional participation is still strong. As of Tuesday, October 28, the total inflow to all Ethereum ETF issuers in the US reached $246 million.

Based on data from Farside Investors, Fidelity Ethereum Fund (FETH) recorded the largest inflow with a total of $246 million. In second place, BlackRock through its ETHA product received inflows of $76.4 million, followed by Grayscale ETH in third place with $73 million.

On the other hand, the Ethereum Foundation team is also preparing for the mainnet launch of the Fusaka upgrade scheduled for December. This update is focused on improving network security, scalability, and node efficiency within the Ethereum ecosystem.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinspeaker. Will ETH Price Recover to $5,000 as Spot Ethereum ETF Inflows Pick Up? Accessed on October 30, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.