Gold Price Chart Today November 4, 2025: Up or Down?

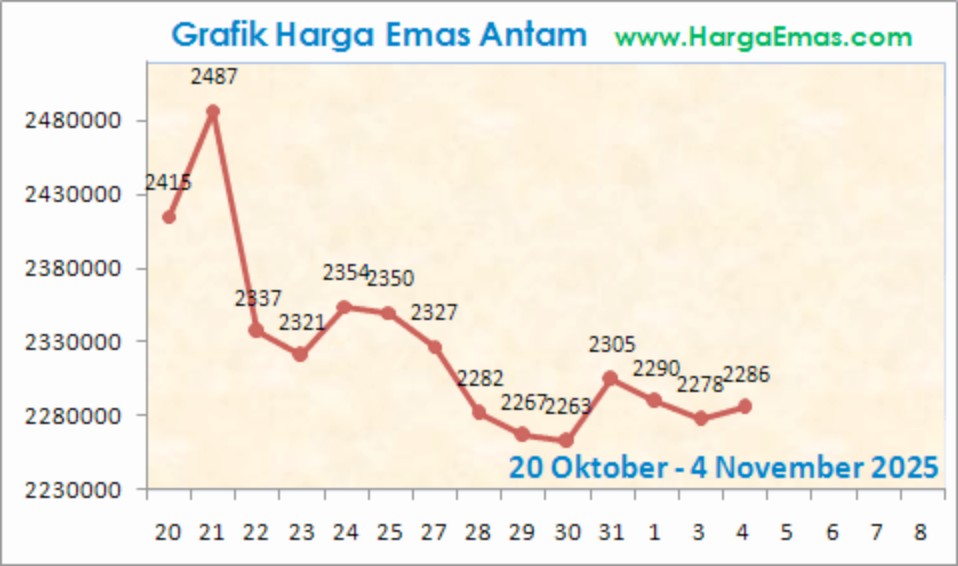

Jakarta, Pintu News – Antam and global spot gold prices on Monday, November 4, 2025, showed limited movement with a weakening trend. Based on data from HargaEmas.com, the price of Antam gold bars fell slightly after experiencing sharp fluctuations over the past two weeks.

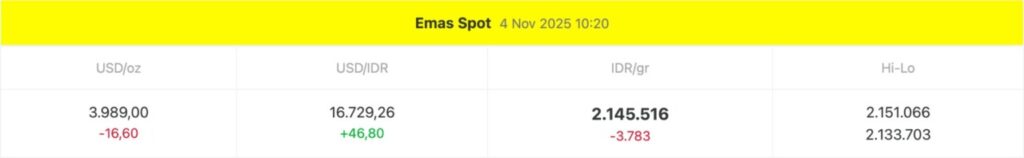

Meanwhile, the world gold price in rupiah denomination was also observed to be stable at around Rp2.14 million per gram, despite weakening at the beginning of the Asian trading session.

1. Antam Gold Price Drops 8.3% Since End of October

According to the Antam price chart from HargaEmas.com, the price of gold bars has been declining since October 21, 2025 when it touched a peak of IDR 2,487,000 per gram. After that, the correction trend continued to the lowest level of around Rp2,263,000 per gram on October 29.

The data showed a decline of around 8.3% in a two-week period, triggered by the strengthening of the US dollar exchange rate and global price adjustments. However, from October 31 to November 4, prices began to stabilize in the range of IDR2,278,000-Rp2,286,000 per gram, indicating the potential for short-term price consolidation.

According to HargaEmas.com team analysis, this trend is natural as gold investors tend to take a cautious position ahead of the release of US economic data that has the potential to affect sentiment towards the dollar and hedge assets such as gold.

Also Read: 5 Shocking Ethereum (ETH) Predictions from Robert Kiyosaki that Made Crypto Hunted by Whales

2. World Spot Gold at IDR 2.145 Million: Stable Despite Increased Dollar Pressure

Based on data on world gold spot prices from HargaEmas.com, on November 4, 2025 at 10:20 WIB, the price of gold was recorded at IDR 2,145,516 per gram, down slightly by IDR 3,783 compared to the previous day. In international units, the spot price of gold is at US$3,989 per troy ounce, or around IDR66,338,502 if converted using an exchange rate of IDR16,618 per US dollar.

Despite the decline, gold prices are still in a relatively stable range compared to the volatility of risky assets such as cryptocurrencies. The rise in the US dollar index briefly suppressed demand for gold, but weakness in US bond yields provided support for investors seeking safe-haven assets.

Analysts from Bloomberg Commodity Index noted that although crypto markets such as Bitcoin (BTC) and Ethereum (ETH) stole investors’ attention in the past two weeks, gold remains a key hedge asset amid geopolitical uncertainty and a potential global economic slowdown.

3. Global Gold and Cryptocurrency Price Comparison

Interestingly, despite gold’s slight weakening, a number of crypto assets are performing strongly. According to the CoinMarketCap report, the price of Bitcoin (BTC) has risen 2.4% in the past 24 hours, while Ethereum (ETH) has risen 1.9%. If converted to rupiah at the current exchange rate, Bitcoin is trading at around IDR 1.45 billion, while Ethereum is around IDR 49 million per coin.

The correlation between gold and cryptocurrencies is still a matter of debate. Some analysts argue that investors are starting to see crypto as an alternative to modern hedge assets, especially when gold prices are stagnating. However, crypto’s high volatility keeps gold as the ultimate conservative instrument for long-term investors.

According to on-chain data from Glassnode, while interest in altcoins is increasing, Bitcoin accumulation by whales tends to slow down. This suggests that most market participants are still waiting for clearer macroeconomic signals before adding exposure to riskier assets, including crypto.

4. Gold Price Prediction and Further Market Direction

According to analysis from HargaEmas.com, gold price movements in the short term are likely to remain in the range of Rp2.13-Rp2.15 million per gram for the spot market, with an upper limit of around Rp2.16 million per gram. Meanwhile, Antam prices are expected to move in the range of Rp2.27-Rp2.30 million per gram until the end of the week.

The main factors to watch include the release of US inflation data and the direction of the Federal Reserve’s monetary policy. If inflation data is higher than expected, pressure on gold prices could continue due to the strengthening of the US dollar. However, if inflation slows down, the potential for a rebound in gold prices is considerable as investors may return to hunting for safe-haven assets.

In addition, developments in the crypto market could also affect the general sentiment towards digital assets and precious metals. If altcoins such as Ripple (XRP) and Solana (SOL) make significant gains again, some short-term investor liquidity could shift from gold to crypto, although in the long run the two could potentially continue to go hand-in-hand as non-fiat investment alternatives.

Conclusion

Overall, gold price movements in early November 2025 showed a consolidation phase after a significant decline at the end of October. With world spot gold prices at IDR2.145 million per gram and Antam gold at IDR2.286 million per gram, the market seems to be waiting for new catalysts from global economic data.

While crypto is stealing the spotlight again with altcoin rallies and increased trading volumes, gold is still the go-to instrument for investors who prioritize stability in value. For Indonesian investors, portfolio diversification between physical gold, digital gold, and cryptocurrencies could be the most rational strategy to deal with market volatility towards the end of the year.

Also Read: Can You Live Only on Crypto? Here are 3 Sources of Income & Challenges You Need to Know About

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- HargaEmas.com. Antam Gold Price Chart October 20 – November 4, 2025. Accessed on November 4, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.