Dogecoin Poised for November Surge as Murad’s Memecoin Portfolio Plummets 59%

Jakarta, Pintu News – Dogecoin (DOGE) traders are watching the month of November closely after a community chartist highlighted the coin’s frequent recurring rally pattern in the month.

The trader, known as YazanXBT, mentioned that historically, November is one of the strongest periods for Dogecoin.

Dogecoin Pattern Shows Potential for Altseason Rally in November

An analyst stated that Dogecoin’s price movements are generally in line with major rises in the altcoin market. He referred to previous cycles in 2015, 2017, 2020, and 2024, where DOGE experienced significant price spikes every November – which were then followed by long periods of price increases for other altcoins.

Read also: Altcoin Season Hasn’t Ended, Analysts Say Bitcoin’s Dominance Is Still Below 62%

A chart from ChandlerCharts on TradingView also displays a similar trend, showing that there is a recurring spike in the price of DOGE every November, which is then followed by broader gains in the crypto market. This pattern suggests a psychological link or even a seasonal cycle that could potentially repeat itself this year.

As of November 3, the Dogecoin price was trading around $0.183 according to data from TradingView. The meme token has dropped about 2.2% in 24 hours, extending its weekly decline to nearly 7%. However, recent massive accumulation by whales suggests that large holders may be preparing themselves ahead of a potential price rebound.

Dogecoin is also often considered an early indicator of the coming altseason – a phase where altcoins experience simultaneous price spikes – and sparks enthusiasm among retail traders. DOGE’s performance is often considered an early signal that altcoin season is about to begin.

Historically, Dogecoin rallies are usually followed by capital flows to tokens with smaller market capitalizations. DOGE is therefore an important indicator in analyzing market sentiment, especially during periods of high speculation.

If this pattern repeats itself, traders can expect renewed activity that will push up the price of memecoin and other community-based tokens.

Murad’s Memecoin Portfolio Value Drops Drastically

However, on-chain data shows a different story in the recent market downturn. According to data from Arkham, the value of Murad’s memecoin portfolio has dropped by 59%, from a peak of $67 million to around $27.5 million currently. Most of his investments consist of tokens such as POPCAT, MOG, and RETARDIO – all of which have seen sharp declines.

This decline was caused by a decline in speculative interest in memecoins, after previously experiencing a sharp surge in the middle of the year, precisely between June and August. During that period, the total market capitalization of memecoins briefly surpassed $70 billion before starting to weaken since early September.

Read also: Bitcoin Price Drops to $106,000 Today: BTC Miners Start Selling

Altcoin Index Shows Bitcoin’s Dominance

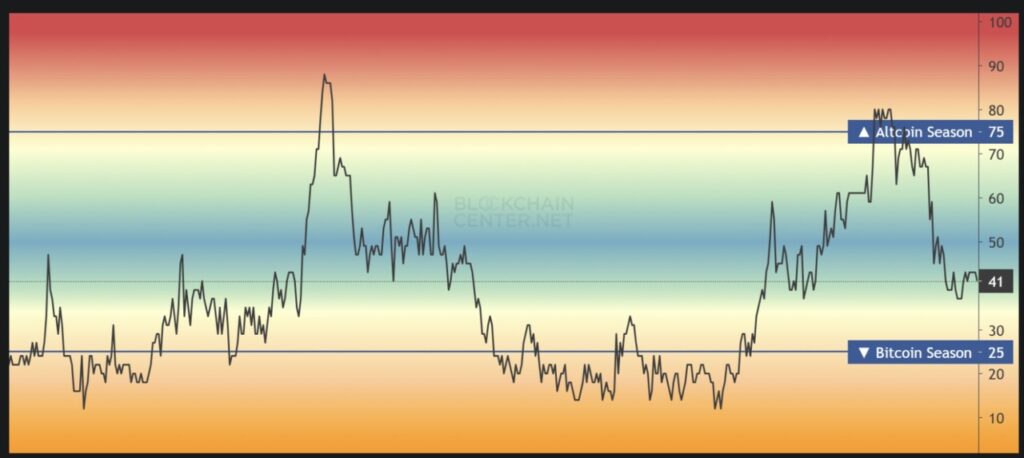

Adding to the cautious sentiment in the market, data from BlockchainCenter’s Altcoin Season Index showed a figure of 41 – down significantly from the 84 levels recorded earlier.

This indicates that it is not yetaltcoin season, and that traders may be prematurely anticipating a surge in altcoin prices, including a potential Dogecoin rally.

Bitcoin’s (BTC) current dominance suggests a shift of capital from high-risk assets such as meme coins and altcoins to the main cryptocurrency. However, if Bitcoin’s performance starts to slow down by the end of this month, there will likely be a rotation of capital back to Dogecoin and other altcoins.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Trader Predicts Dogecoin Breakout as Murad’s Portfolio Drops. Accessed on November 4, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.