Bitcoin (BTC) price crashes 5.47%, will it continue to fall below $100,000?

Jakarta, Pintu News – Bitcoin (BTC) is again at the center of market volatility by facing a critical technical formation – the head and shoulders pattern. This bearish formation, historically known as a trend reversal marker, indicates a potential short-term decline. The combination of technical weakness and outflow dominance is raising concerns among traders.

Losing Investor Confidence

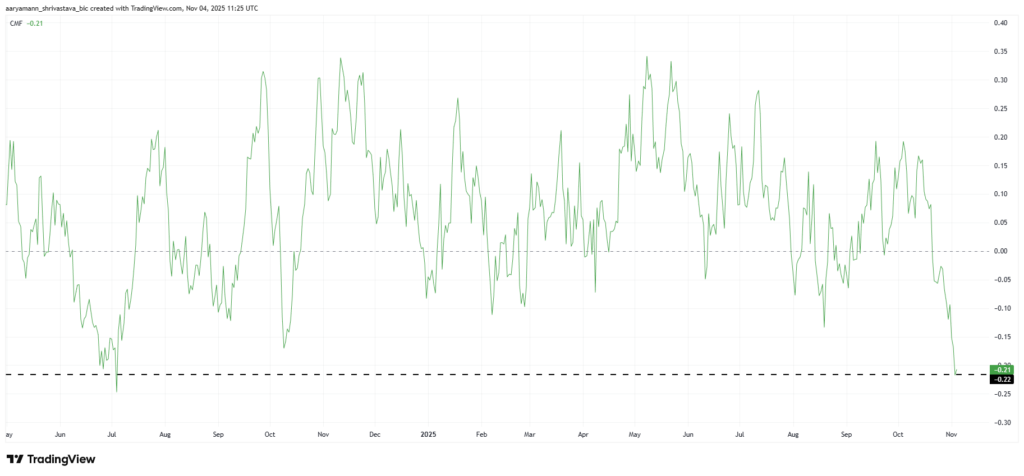

The Chaikin Money Flow (CMF) indicator shows that outflows are currently dominating Bitcoin (BTC). In recent days, the CMF has fallen sharply to its lowest level in 16 months. The indicator tracks capital flows in and out of an asset, and its latest reading highlights the intensity of selling pressure on major exchanges.

Sustained outflows indicate that investors would rather withdraw funds than accumulate positions, which is often a precursor to a deeper correction.

This situation marks one of the most significant bearish divergences in over a year. Unless inflows recover quickly, Bitcoin (BTC) could continue to lose momentum as traders reduce risk ahead of further market turbulence.

Also read: 3 Token Unlock in Early November 2025

Potential Price Drop Below $100,000

Currently, the price of Bitcoin (BTC) is at $104,268, after slipping below the $105,000 support level. However, the cryptocurrency has held above $100,000 since May this year. Nonetheless, Bitcoin (BTC) continues to follow a head and shoulders pattern, which historically precedes a bearish decline.

If this pattern is confirmed, it could result in a 13.6% drop from its neckline, pushing Bitcoin (BTC) towards $89,948. Coupled with weakening inflows and a potential EMA crossover, the risk of a correction below $100,000 seems high in the short term. However, a quick recovery could still prevent this outcome.

If Bitcoin (BTC) finds investor support and reclaims $105,000 as a stable floor, the currency could rebound towards $110,000. Surpassing this resistance would thwart the bearish outlook and restore short-term market confidence.

Also read: These 2 Metrics Show Why Pi Network (PI) Price Recovery Isn’t Over!

Prospects for Price Recovery

The possibility of a Bitcoin (BTC) price recovery is still open if the market support factors play out well. Monitoring market indicators such as CMF and EMA will provide further insight into the direction of the price action. Investors and traders are advised to stay alert to any changes that may occur in the market.

A deep understanding of technical patterns and market dynamics can help in making informed investment decisions. With the volatile situation, caution remains key in navigating the cryptocurrency market.

Conclusion

With the market situation full of uncertainty, constant monitoring of economic and technical indicators is crucial. Investors and analysts should combine technical analysis with an in-depth understanding of external factors that can affect the market. Timely and data-driven decisions can help in managing risks and capitalizing on emerging opportunities.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Is Bitcoin Price About to Crash? Accessed on November 5, 2025

- Featured Image: Generated by Ai

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.