Pi Network Price Continues to Slide — Is the Pi Coin Token Unlock Behind the Drop?

Jakarta, Pintu News – The price of Pi Network continues to come under pressure after falling by 4.7% today to $0.2197. This decline reflects increased caution among investors ahead of the token’s 2.4% unlocking event in November.

A combination of weak technical factors and an impending increase in supply is driving expectations of a deeper price correction before the market stabilizes again. Ahead of the token’s opening date, market sentiment remains cautious, with the Pi coin price still struggling to hold above its short-term support zone.

Pi Network Price Drops 4.7% in 24 Hours

On November 5, 2025, the price of Pi Network was recorded at $0.2197, a decrease of 4.7% in 24 hours. If converted to the current rupiah ($1 = IDR 16,719), then 1 Pi Network is IDR 3,673.

Read also: XRP Price Prediction: Ahead of Death Cross Formation, Will XRP Fall Below $2?

The price chart shows a volatile trend throughout the day, with PI touching a low of $0.2039 and a high of $0.2309 in the span of 24 hours. Pi Network’s market capitalization currently stands at $1,823,754,761, while its fully diluted valuation stands at $2,805,776,555.

Trading volume in the last 24 hours was also quite high, reaching $62,941,014, indicating active buying and selling amid price fluctuations.

Pi Coin price weakens as $0.20 support comes into view

Pi Coin’s price continues to be under pressure after breaking out of a symmetrical triangle pattern on November 3, signaling that sellers are back in control of the market. A drop below the $0.2276 level erased the previous gains and turned the level into a defense zone for sellers.

Since then, every attempt at a small recovery has been rebuffed, suggesting that buyers are not yet strong enough to sustain the recovery momentum. Market sentiment remains cautious, with short-term traders reluctant to take positions as the general market structure remains bearish.

The DMI indicator also explains this imbalance in more depth. The +D line at level 10 indicates that buying interest has weakened, reflecting diminishing confidence from short-term market participants. Conversely, the -D line at level 31 signals increasing selling pressure, as sellers dominate intraday price movements.

In addition, the ADX reading at 29 shows that this downtrend still has real strength, meaning that the correction is not yet complete. However, when the momentum starts to slow down, the same indicator could change direction and favor buyers trying to build strength from the $0.20 base level.

Therefore, Pi Coin’s price outlook going forward is very important, as the potential for recovery largely depends on how the market reacts around this level. If the bulls manage to hold the $0.20 support and reverse the direction of the DMI, the Pi price could potentially start a gradual rebound towards the long-term recovery target of $0.70.

Read also: Crypto Whales Buy Solana Amid Medium-Term Bearish Sentiment, What’s Happening?

Pi Token Opening Expected to Strengthen Price Correction

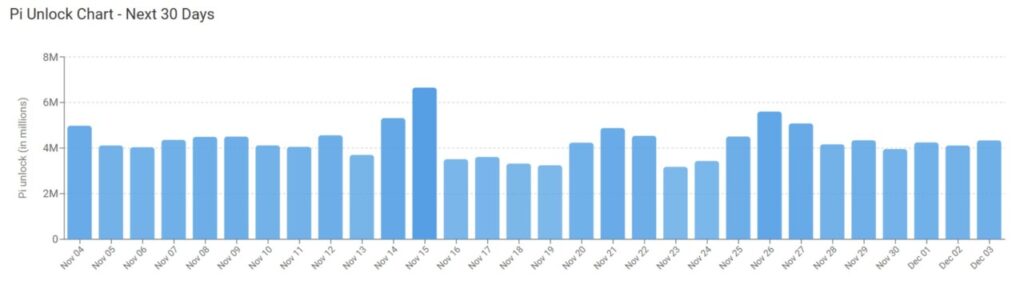

The upcoming Pi token unlocking event adds immense pressure to an already fragile market. Around 121.5 million Pi tokens – equivalent to about 2.39% of the total supply still locked up – will begin to enter circulation throughout this month.

The largest release is expected to occur on November 15, with over 5.7 million tokens worth more than $1.5 million to be unlocked. Events like this often trigger volatility as supply increases faster than the market’s ability to absorb it.

Short-term investors will likely take advantage of this moment to realize profits, especially after prices have continued to fall in recent weeks. This kind of behavior could push Pi Coin’s price closer to the $0.20 zone before attracting buying interest again.

However, deeper corrections during unlock periods are often turning points once the market has managed to absorb the new supply. As liquidity stabilizes again and selling volumes begin to subside, the price of Pi could potentially rebuild its strength.

Therefore, while short-term downside risks remain high, the broader market structure suggests that this unlocking process could be a moment to reset valuations, giving patient investors the opportunity to re-enter at a cheaper price.

In conclusion, the combination of the bearish chart and the token’s opening schedule suggests that a deeper correction is likely before the recovery begins. A retest to the $0.20 level looks quite likely as sellers dominate in the near term.

However, this zone could also be the basis for renewed accumulation once the selling pressure subsides. If a recovery is formed, Pi Coin’s price could gradually move from a correction phase to consolidation, paving the way for future gains.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Is a Pi Coin Price Meltdown Ahead? November’s 2.4% Supply Unlock Sparks Warnings. Accessed on November 5, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.