Ethereum Price Drops to $3,300 Today: Whales Accumulate ETH on the Way Down

Jakarta, Pintu News – In early November, Ethereum (ETH) experienced a drop in value of more than 12%. However, large holders capitalized on this decline by buying in large amounts, investing around $1.37 billion in just three days to accumulate the second-largest crypto.

This aggressive buying action shows the strong conviction of major investors, despite the overall crypto market still being under pressure.

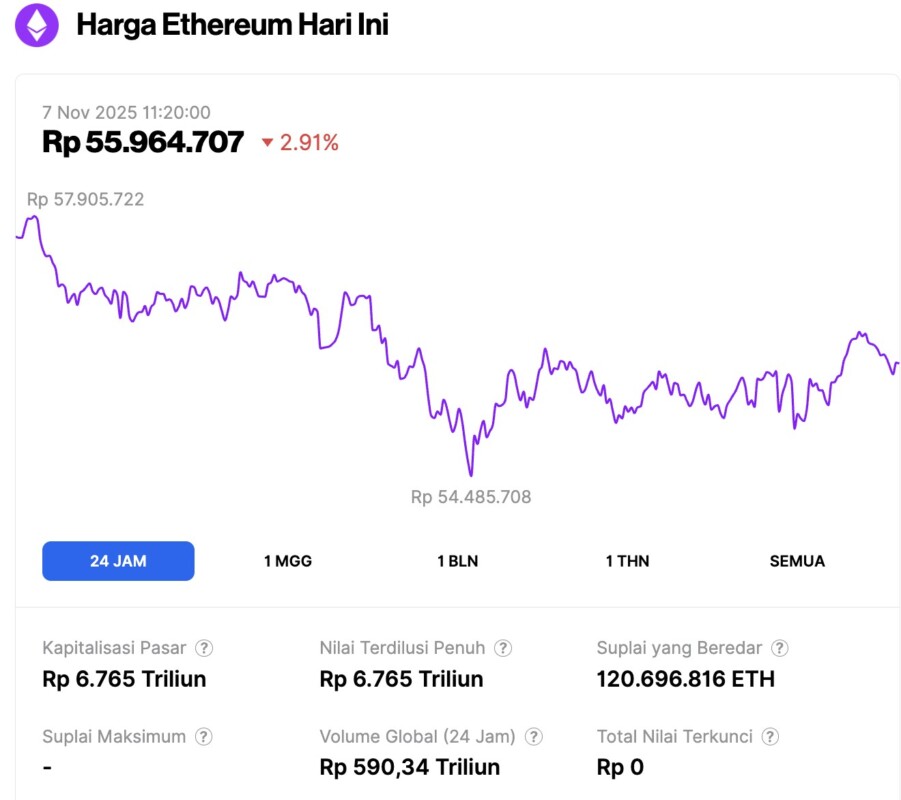

Ethereum Price Drops 2.91% in 24 Hours

On November 7, 2025, Ethereum was trading at approximately $3,339, which is equivalent to IDR 55,964,707 — marking a 2.91% decline over the past 24 hours. During this period, ETH dropped to a low of IDR 54,485,708 and reached a high of IDR 57,905,722.

At the time of writing, Ethereum’s market capitalization is estimated at around IDR 6,765 trillion, while its daily trading volume has decreased by 0.63% to approximately IDR 590.34 trillion over the last 24 hours.

Read also: Bitcoin Price Touches $101,000 Today: Whale Buys 29,600 BTC in a Week

Ethereum Whales Buy on Price Drops

Ethereum experienced its sharpest daily decline in months. The altcoin dropped to around $3,000 on Tuesday, hitting its lowest point in nearly four months.

On November 6, ETH was trading at $3,384, reflecting a daily recovery of 1.45%. Although ETH has not been able to make the $3,400 level a support, holders seem to see this drop as a buying opportunity, not a reason to worry.

On-chain analytics firm Lookonchain reported that there was massive accumulation by whales during this period of decline. Data shows that eight large entities collectively bought 394,682 ETH, worth approximately $1.37 billion in the last three days.

The average purchase price was around $3,462. Lookonchain identified a “whale Aave (AAVE)” as the largest buyer. This entity bought 257,543 ETH worth approximately $896 million.

Bitmine Buys $139.6 Million Worth of ETH

The second largest buyer was the largest corporate holder of ETH, Bitmine Immersion Technologies. The company acquired 40,719 ETH for approximately $139.6 million. Data from OnChain Lens shows that Bitmine first purchased 20,205 ETH from Coinbase and FalconX, then received an additional 20,514 ETH from FalconX.

Read also: Crypto Heist: Balancers Lost $128 Million in 2025’s Biggest Cyber Attack

This move is in line with Bitmine’s consistent strategy of accumulating Ethereum during market corrections. In late October, the company also made a large purchase worth $250 million, which was followed by an additional investment of $113 million in ETH.

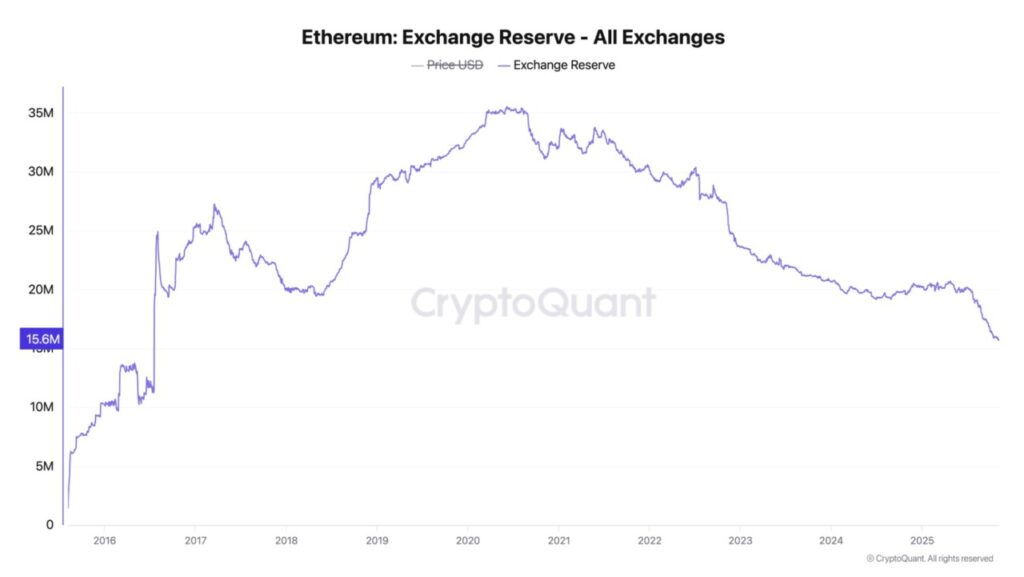

At the same time, broader network data also reflects similar behavior from investors. Data from CryptoQuant revealed that Ethereum reserves on crypto exchanges fell to their lowest level since 2016.

Typically, lower reserves on exchanges indicate that investors are moving their ETH assets into long-term storage outside of trading platforms, reflecting increased confidence in the asset’s future.

This trend also reduces the supply available for immediate sale, which in turn may reduce selling pressure and support potential price increases.

On-Chain Metrics Show Buy Signal for ETH

On-chain analysis from Santiment supports Ethereum’s recent accumulation trend. The data shows that Ethereum is giving strong buy signals based on the Market Value to Realized Value (MVRV) metric.

According to Santiment, traders who have been active in the last 30 days are currently experiencing an average loss of 12.8%, signaling considerable short-term pressure.

From a long-term perspective, traders who have been active in the past one year have also started to experience slight losses, with an average return of -0.3%.

“When both the short-term and long-term MVRV for an asset are in the negative zone, this has historically signaled a strong buying opportunity with low risk-when the market is ‘bleeding,'” writes Santiment.

Overall, the combination of large accumulations by whales, declining ETH reserves on exchanges, as well as favorable on-chain metrics point to growing investor confidence in Ethereum. If this trend continues and general market conditions improve, Ethereum could potentially experience a price recovery in the near future.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Whales Buy ETH Despite November Drop. Accessed on November 7, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.