Crypto Market Surge: What’s Driving Today’s Rise? (10/11/25)

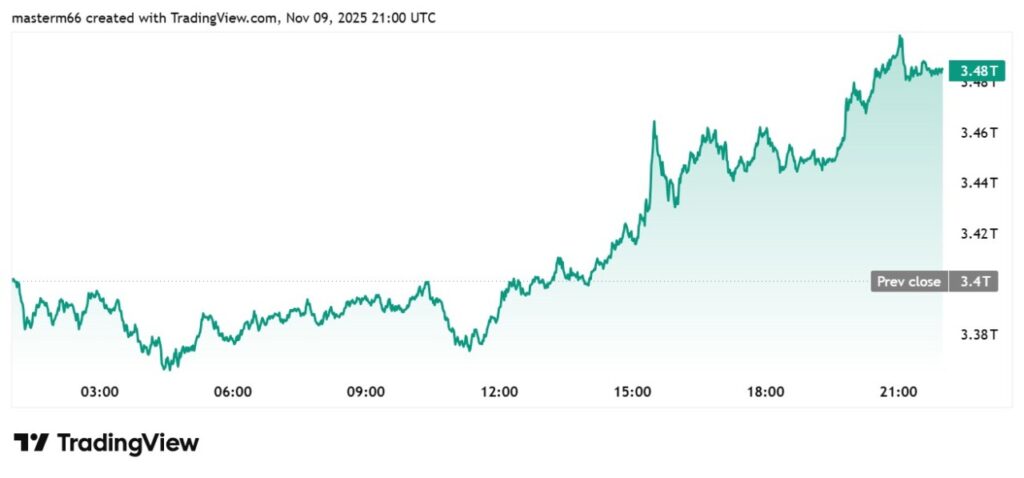

Jakarta, Pintu News – Crypto markets experienced a significant increase today, driven by a series of policy and regulatory actions in the United States that boosted investor confidence and liquidity expectations. Bitcoin (BTC) managed to break the $103,000 mark, while Solana (SOL) and Ethereum (ETH) also showed impressive recoveries.

Dividend Rates of $400 Billion as the Main Driver

President Donald Trump recently announced the distribution of a $2,000 tariff dividend to most American adults, totaling over $400 billion in tariff revenue. The move is similar to previous stimulus handouts and is expected to inject massive liquidity into the crypto market economy. This policy has created widespread optimism among risk assets.

This news not only raised investors’ hopes but also triggered a significant increase in cryptocurrency exchange rates. With additional funds available for investment, many are predicting that this flow of funds will continue to push the crypto market to greater heights in the coming weeks.

Also Read: Market Crash? Here are 5 Cryptos Predicted to Explode Due to Whale Activity in Futures Market

Government Closure Deal and CFTC Support

The US Senate is making progress towards ending the government shutdown with a report from Axios stating that at least 10 Democratic senators are ready to support a bipartisan spending package. The package is expected to reopen government operations until January and includes policies to reverse recent federal layoffs as well as extend Affordable Care Act tax credits.

On the other hand, Caroline Pham, acting chair of the Commodity Futures Trading Commission (CFTC), confirmed that she is working to launch a regulated crypto spot trading product. Pham emphasized that these plans will proceed without waiting for new legislation, which adds optimism to the crypto market outlook.

Weekend Recovery and Positive Macroeconomic Indicators

In addition to the direct impact of the tariff dividend policy, the crypto market also received support from the recovery that took place over the weekend. Solana (SOL) and Ethereum (ETH) in particular, showed a significant increase. This recovery was driven by positive macroeconomic indicators that added to investors’ confidence in digital assets.

Crypto markets are often highly responsive to global macroeconomic and policy changes. With positive signals from various external factors, expectations for further growth in this market remain high. Investors and analysts alike are watching closely to see how this trend will continue.

Conclusion

With a series of new policies and strong regulatory support, today’s crypto market is showing remarkable strength. These measures have not only increased liquidity but also investor confidence, both of which are key to sustainable growth. Looking ahead, the market may continue to experience volatility, but with a more stable foundation and government support, the long-term outlook looks bright.

Also Read: 3 Memecoins that Whale is Starting to Look at in the Futures Market as of November 2025

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Why is Crypto Market Up Today. Accessed on November 10, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.