Altcoin Season on Hold? $1.6 Trillion Hurdle Halts Altcoin’s Progress!

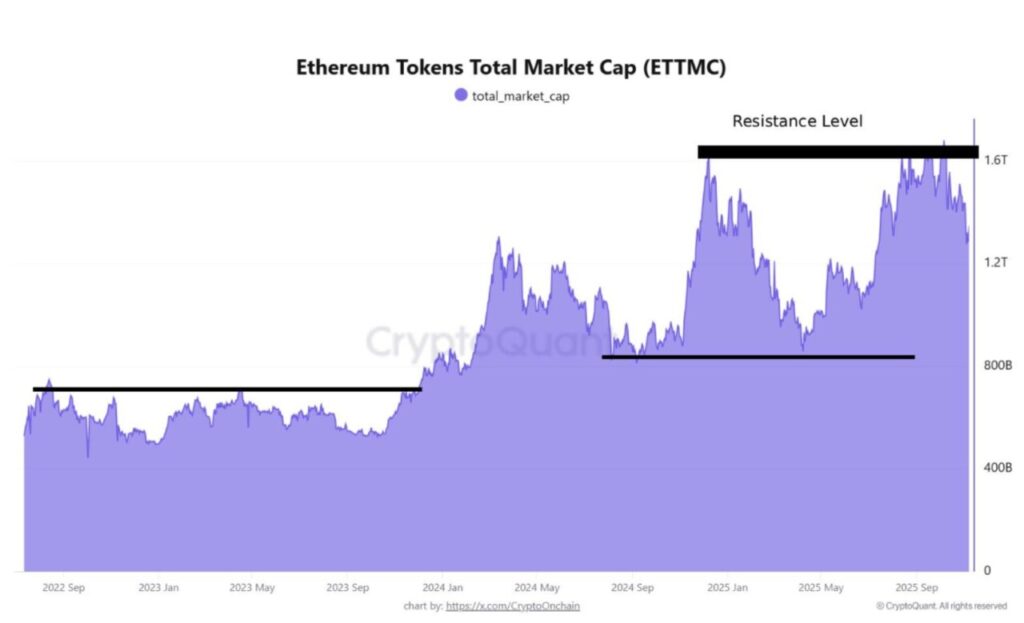

Jakarta, Pintu News – According to Crypto News Flash, the altcoin market is now under pressure again after a second attempt to break the $1.6 trillion market capitalization limit failed. So, what will happen next?

Altcoin Market Fails to Break $1.6 Trillion in Capitalization

Based on the latest on-chain analysis shared by CryptoOnchain via CryptoQuant, Ethereum’s total token capitalization (ETTMC)-often used as a measure of altcoin strength-should acknowledge the strength of resistance at these levels.

Read also: 3 Major Token Unlocks This Week, What Will Happen?

This is not the first time this level has been a barrier. On October 6, sudden selling pressure forced ETTMC to correct to $1.34 trillion, which is exactly what happened in December 2024.

This has raised concerns regarding the formation of a double top pattern, which is technically considered a bearish signal. Although not fully confirmed, this pattern suggests a significant supply gap around the price peak.

In other words, the $1.6 trillion level is now a crucial point that must be broken to open up the opportunity for a massive altcoin season.

Technical Pattern Triggers Altseason Speculation

On the other hand, there is technical data that shows that the market’s hopes for the alt-season have not been completely dashed.

Crypto Panda technical analyst JR revealed that the ratio of altcoin market capitalization to Bitcoin (OTHERS/BTC) has now returned to historically low levels-an area that was previously the starting point of the altseason in 2017 and 2021.

Read also: Bitcoin Price Held at $105,000 Today: BTC Starts to Recover?

He highlighted the formation of a descending wedge pattern, a technical formation that often signals a potential upward reversal. In addition, the long-term chart shows a recurring pattern: altseasons usually start from strong support levels and surge as Bitcoin (BTC) approaches the peak of its bull run cycle.

When altcoins begin to outperform Bitcoin, capital flows tend to shift, creating price spikes as seen in previous cycles. In the current context, Crypto Panda JR thinks the accumulation phase is almost complete. If the flow of funds begins to return, Bitcoin’s dominance could be displaced.

However, market attention remains focused on the $1.6 trillion level. This figure is not just a technical limit, but also an important psychological terrain for market participants.

A break above this level could invalidate the existing bearish signals and become the main trigger for the altseason. Conversely, as long as it has not been broken, the market will remain cautious.

Furthermore, the current technical structure is very similar to the previous two major altseasons. In fact, the OTHERS/BTC ratio chart shows a potential vertical upward curve, similar to what happened during the altcoin euphoria a few years ago.

It may not be this week, and it may not be this month, but if the pattern repeats itself, 2025 could be the start of the next alt-season. For now, some traders prefer to wait for more convincing technical confirmation before taking a position.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News Flash. Altseason on Hold as $1.6 Trillion Barrier Stops Altcoin Momentum. Accessed on November 11, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.