Will Bitcoin experience a slump like last April? This is what analysts say!

Jakarta, Pintu News – Bitcoin (BTC) recently experienced a sharp drop below $100,000, sparking fears of a deep bearish phase. The crypto market, which was previously in a bullish state, now seems to be changing direction after the October 10 crash. This evokes memories of a similar drop in April, where Bitcoin (BTC) briefly fell to $74,500 before bouncing back.

Similarities with April: Will History Repeat?

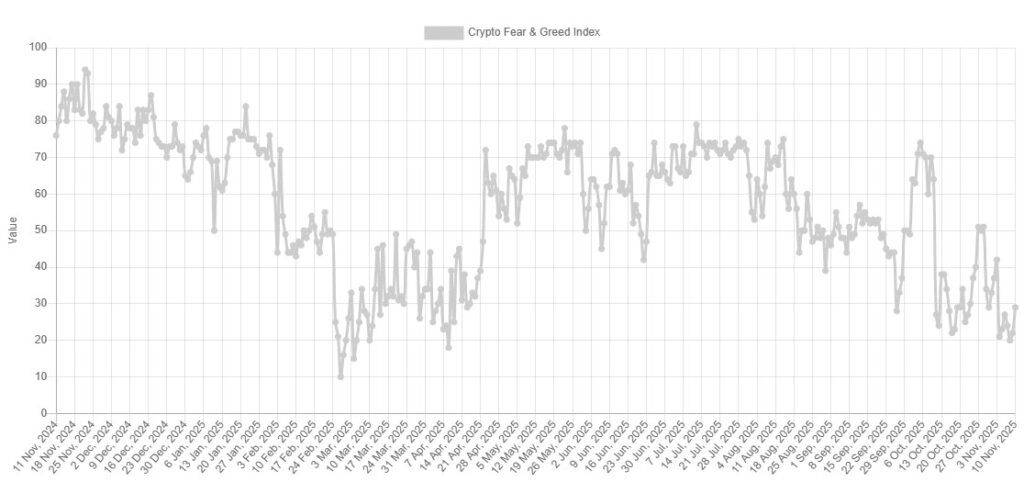

The Fear and Greed Crypto Index on November 10 stood at 29, and had dropped to 20 a few days earlier, a number last seen in mid-April. In early 2025, Bitcoin (BTC) was trading in a stable range, but lost that range in March, causing a significant price drop.

In recent months, a similar trading pattern was seen, where Bitcoin (BTC) again lost its range. When referring to previous market dynamics, it is likely that the market will experience a month-long bearish period before a potential recovery takes place. However, keep in mind that despite the similarities, there is no guarantee that the situation will repeat itself with certainty.

Read More: Bitcoin, Gold, & Silver Price Movements: Increased Correction Potential? Here’s What Analysts Say!

Other Market Base Potential

The Unrealized Profit/Loss Margin shows that holders are currently incurring losses, but not as severe as what happened in March and April. Currently, Bitcoin (BTC) is trading well below its realized price of $115,100. If the same scenario as April occurs, it suggests that the current downtrend Bitcoin (BTC) is experiencing could fall even lower than $98,900.

The similarities in market sentiment, price action, and unrealized losses by holders indicate the potential for a market bottom similar to the one in March and April. Nonetheless, it is important to remain vigilant and not assume that history is bound to repeat itself.

A Bull Cycle That Hasn’t Reached Peak Euphoria

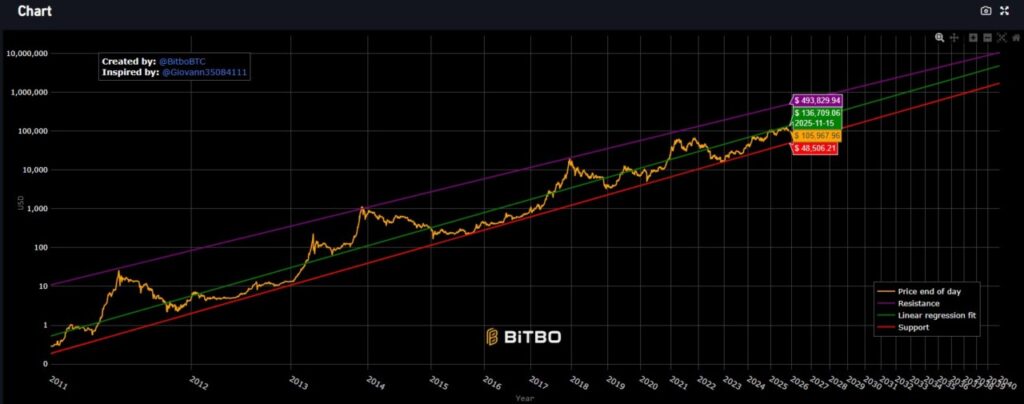

The Power Law model shows that the recent rise in the bull cycle has not yet reached the explosive rally that usually marks the end of the previous cycle. The phase known as the blow-off peak, which is a phase of pure market euphoria, is yet to be seen. Perhaps conditions are different this time, and that phase will not occur.

Or perhaps, the macro picture needs more time to align and push crypto to higher levels. Right now, both possibilities seem equally likely, which explains the fear and uncertainty present in the market.

Be Alert and Ready for Any Possibilities

With current market conditions looking similar to last April, investors and market watchers should remain vigilant. Despite the significant similarities, crypto markets are known for their high volatility and do not always follow historical patterns exactly. Therefore, it is important to prepare for any eventuality, be it a recovery or further decline.

Also Read: Bitcoin Poised to Surge After US Government Shutdown Deal: History Repeats?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin sentiment sinks to 20%, a recap of March-April’s bottom incoming. Accessed on November 11, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.