Drastic Increase in Aster (ASTER) Buyback: Can it Stay Above $1? (11/11/25)

Jakarta, Pintu News – Aster is back in the spotlight after its team increased the token buyback rate, which had a significant impact on the price performance in the market. With a 50% increase in the buyback rate, the total funds spent reached $39 million with 18 million tokens burned, creating positive pressure on the price. The big question is whether Aster can maintain its position above $1 and move towards higher resistance levels.

Why are daisies making a comeback?

A significant increase in the buyback rate by the Aster team was the main catalyst behind the token’s price recovery. From $5,000 per minute to $7,500 per minute, this increase means that the Aster team will spend $10 million per day if this pace continues. In the last 24 hours alone, the team has bought 2.4 million Aster tokens.

Since the buyback program was launched, the Aster team has spent a total of $39 million to purchase 37.7 million tokens. About 50% of the purchased tokens have been burned, reducing the number of tokens circulating in the market. This strategic move has not only reduced supply, but also helped stabilize prices in the market.

Read More: Bitcoin, Gold, & Silver Price Movements: Increased Correction Potential? Here’s What Analysts Say!

Spot Market Demand Increases

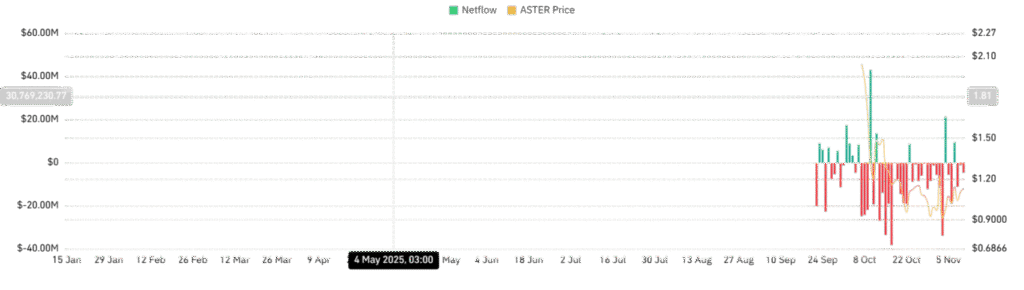

Following the announcement of increased buybacks, buying activity in the spot market became more intense. ASTER Spot netflow fell for the third consecutive day to -$8.04 million, with outflows ($129.28 million) exceeding inflows ($121.24 million). This suggests that traders prefer to hold onto tokens rather than depositing them on exchanges.

The negative Netflow indicates accumulation pressure in the market, with traders choosing to hold their tokens. This reflects positive expectations for ASTER’s price performance going forward, driven by the Aster team’s aggressive buyback policy.

Futures Traders Join the Rally

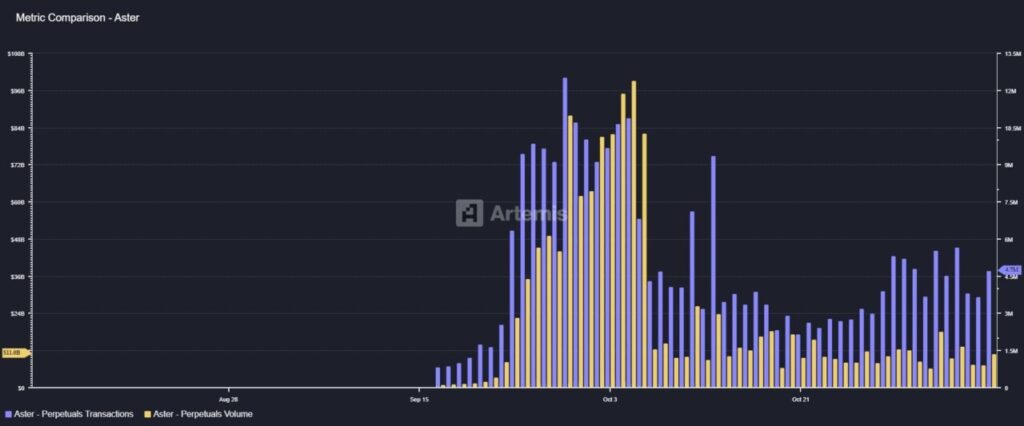

Along with the recovery signals from Aster, investors started to enter the futures market strategically. Data from Artemis showed that Perpetual transactions jumped to 4.7 million, while Perpetual volume rose to $11 billion. The simultaneous increase in volume and transactions signaled increased participation and capital flow into the futures market.

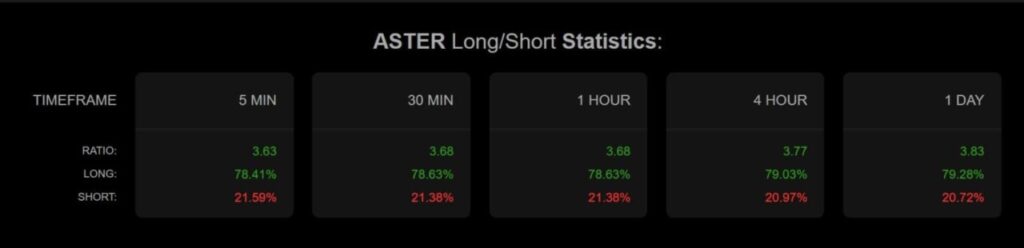

The Long/Short ratio rose to 3.83, with 79.28% of positions being long. This shows that most traders anticipate more price increases. This indicates strong optimism among traders towards the potential for further ASTER price increases.

Can ASTER Survive Above $1?

The Stochastic Momentum Index on TradingView has risen to 18, indicating stronger buyer dominance. If this momentum continues, ASTER may break the next resistance at $1.17 and attempt $1.23. However, if demand cannot be sustained, prices could return to $1.00 support, although the bullish bias remains as long as ASTER trades above that level.

Conclusion

With an aggressive buyback strategy and a positive response from the market, Aster shows the potential to not only maintain, but also increase its value above $1. Future market performance will largely depend on the team’s ability to continue implementing an effective strategy and the market’s response to these measures.

Also Read: Bitcoin Poised to Surge After US Government Shutdown Deal: History Repeats?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Asters buybacks jump 50% to $7.5k per minute; Can bulls defend the $1 zone?. Accessed on November 11, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.