Bitwise’s Chainlink ETF Officially Listed on DTCC, LINK Price Plummets to $15?

Jakarta, Pintu News – The Chainlink ETF managed by Bitwise has now been listed on the DTCC website under the ticker CLNK. The listing is part of the standard clearing and settlement process run by the DTCC and is not an indication of regulatory approval. While this is a step forward for Bitwise, the market has responded to this news with less positive sentiment towards Chainlink (LINK).

Chainlink ETF Listing Process

Bitwise’s listing of the Chainlink ETF on the DTCC marks an important phase in the process of distributing new financial products in the market. While the listing is only part of the operational procedure and not an indication of regulatory approval, it is still an important point for Bitwise in expanding its product range.

Listing on the DTCC allows these ETFs to be accessed by a wider range of investors, increasing liquidity and growth potential. However, investors and market watchers should understand that this move still requires a few more stages before it gets the full green light from the relevant authorities.

Read also: JPMorgan Officially Launches ‘JPM Coin’, a Blockchain-Based Institutional Transfer Solution

LINK Price Drop

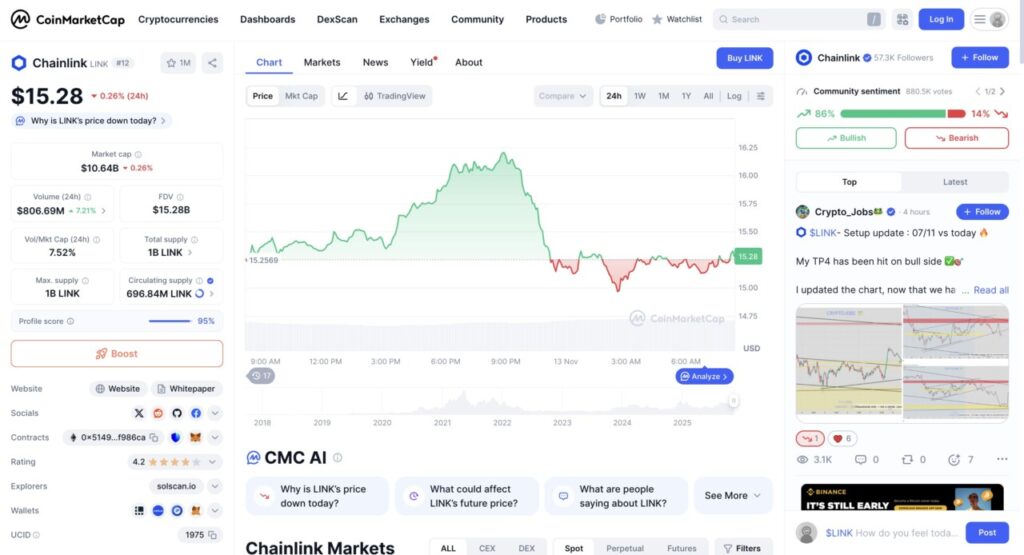

In the past 24 hours, the price of Chainlink (LINK) has decreased by more than 7%, with the current price standing at $15.36. This decline comes after the price reached a high of $16.66 and a low of $15.23 over the same period.

This decline was also followed by a 20% drop in trading volume, indicating a decline in interest among traders. These factors suggest that the news of the ETF listing may have been received with mixed reactions from the market.

Implications for Investors and Markets

Bitwise’s listing of the Chainlink ETF on the DTCC could have several implications for investors and the market as a whole. For investors, it offers a new opportunity to invest in products based on blockchain technology through more traditional instruments such as ETFs.

On the other hand, the market reaction to this listing and the decline in LINK’s price could be an important indicator for investors considering entering into this investment. Investors need to carefully consider the risks and potential before making an investment decision.

Conclusion

While Bitwise’s listing of the Chainlink ETF on the DTCC is a step forward, there are still many stages to go through before this product can be truly accepted in the market. Investors and market watchers will be keeping a close eye on further developments, especially the regulator’s reaction to this ETF and the changing price dynamics of LINK.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Bitwise Chainlink ETF Gains Listing on DTCC, CLNK Ticker LINK Falls. Accessed on November 13, 2025

- Featured Image: Finimize

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.