3 Strong Signals that Hit Pi Network (PI) Price in November 2025

Jakarta, Pintu News – Pi Network’s (PI) price movements in November showed increasing selling pressure amid weakening global crypto market sentiment. Although the cryptocurrency has fallen more than 90% from its peak price, a number of on-chain indicators show that the downward pressure is not over yet.

Recent data shows a significant increase in the number of unlocked tokens, rising PI reserves on exchanges, as well as weak trading volumes. These conditions raise big questions about the potential movement of PI prices towards the end of the year.

Surge in Number of Unlocked Pi Tokens

Data from Piscan revealed a significant increase in the number of Pi tokens being unlocked each day in November. In a single day, approximately 4.85 million PIs were released to the market, while estimates for the next 30 days stand at 145 million PIs.

This amount of unlocking pressure often has the potential to increase supply in the market and weaken cryptocurrency prices on exchanges. This situation poses a challenge for PIs who are trying to maintain value amid bearish market sentiment.

Piscan also mentioned that in December it is expected that more than 173 million Pi will be unlocked, making it the month with the highest number of token releases until September 2027. This consistently increasing supply pressure opens up the opportunity for a deeper price drop if market demand does not grow significantly.

This creates a major obstacle to a potential recovery in PI prices in the near future. This sustained pressure leaves the market to deal with an ever-flowing supply without any new demand impetus.

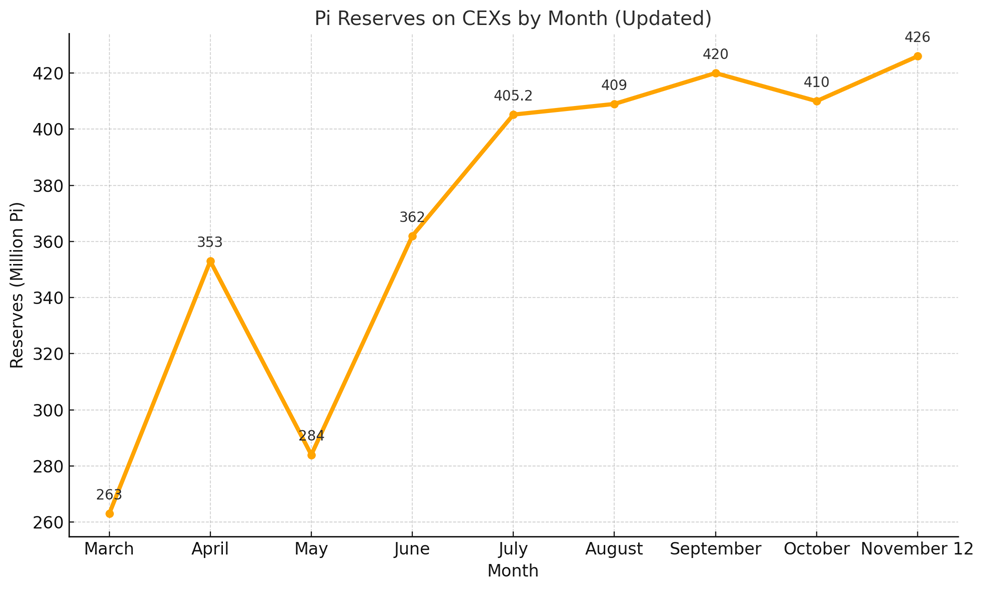

Increase in Pi Reserves on CEX Exchange

In addition to supply pressure from unlocking, the number of PI tokens held on crypto exchanges continued to rise throughout November. Reports earlier in the month showed there were around 423 million PI on exchanges, and this figure rose to almost 426 million PI by mid-month.

The figure is a record high in Pi Network’s history, signaling that the supply ready to be traded or sold is growing. This trend usually indicates stronger selling pressure, especially in cryptocurrencies with weakening market sentiment.

Also read: Will Crypto Crash in 2026?

Increasing Pi balances on exchanges could potentially be a catalyst for price weakness as the number of tokens that traders and investors have easy access to for sale grows. Under conditions of high volatility, an increase in supply on exchanges could trigger a massive sell-off.

This situation could hold back any attempts at price increases in the short term. As such, analysts consider that this trend provides a strong signal that downward pressure on prices is still very likely to continue.

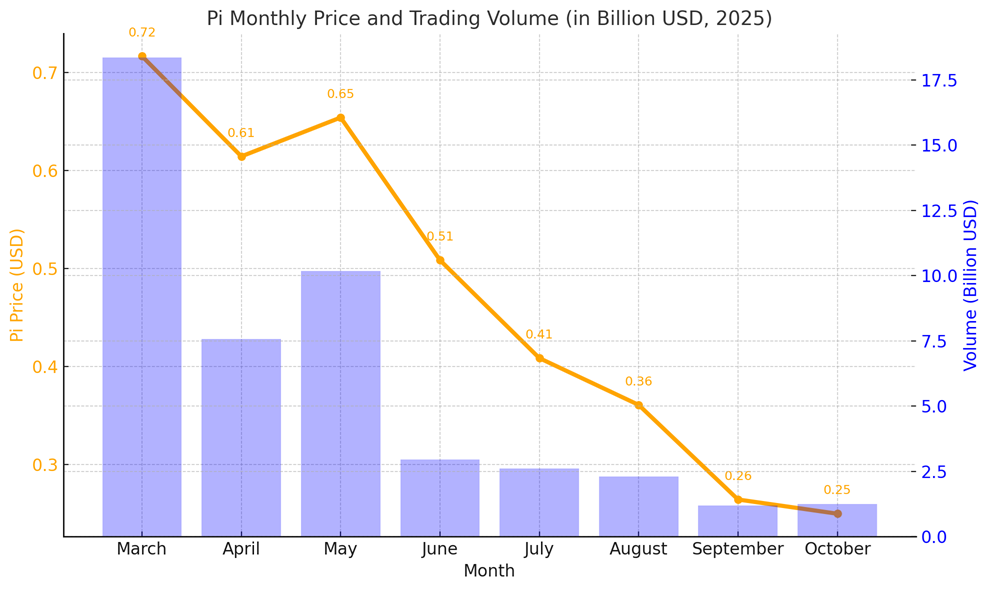

Trading Volume Remains Weak

Pi Network trading volumes on centralized exchanges also showed a trend that was less supportive of price recovery. Daily volume was recorded at around US$30 million equivalent, a figure that reflects low market activity.

With stagnant volumes, PI liquidity is limited, making it difficult for healthy price movements to occur. Cryptocurrencies with low volumes are usually more prone to negative volatility and large sell-offs.

The CoinMarketCap report also featured a significant drop in PI’s monthly trading volume which only reached US$1.2 billion in the previous month. The parallel decline in price and volume shows the weak market interest in Pi Network during this period.

Read also: 10 Layer-1 Crypto that Potentially Reach ATH in 2026

The combination of low volume and increased supply has the potential to deepen downward pressure on prices. This signals that the market needs a fresh sentiment boost to break the ongoing bearish trend.

Pi Supporters’ Optimism Persists

Amid weakening market indicators, Pi Network supporters continue to show optimism for the future of this cryptocurrency. One account on the X platform called Dao World stated that although the total supply of Pi is quite large, the amount actually in circulation is only about 3 billion PIs.

He emphasized that the Pi Core Team is not making aggressive sales that could push the price down further. This statement is one of the positive narratives that maintain community trust.

Some other proponents also think that the price of around US$0.20 or Rp3,342 per PI is a long-term accumulation opportunity. They believe that the current selling pressure is mostly coming from some market makers on certain exchanges.

As this selling pressure subsides, they predict prices will gradually recover. This perspective shows that despite strong technical pressure, community-based fundamentals are still the main pillar of Pi Network.

Conclusion

Pi Network’s market indicators in November 2025 showed a combination of supply pressure, rising stockpiles and weakening volumes, posing the risk of a deeper price decline.

However, the Pi Supporters community remains confident that the long-term value of PI will rest on its relatively limited supply and the stability of its ecosystem. Given the ever-changing state of the crypto market, Pi Network’s prospects in the months ahead depend largely on demand dynamics and global investor sentiment.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Signs Pointing to Mounting Selling Pressure on Pi Network in November. Accessed November 15, 2025

- Featured Image: Bitcoin News

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.