Meta vs Google: Tech Giants Stock Analysis!

Jakarta, Pintu News – Meta Platforms (METAX) and Alphabet (GOOGLX) continue to dominate the digital advertising market, but recent analysis shows significant performance differences between these two companies.

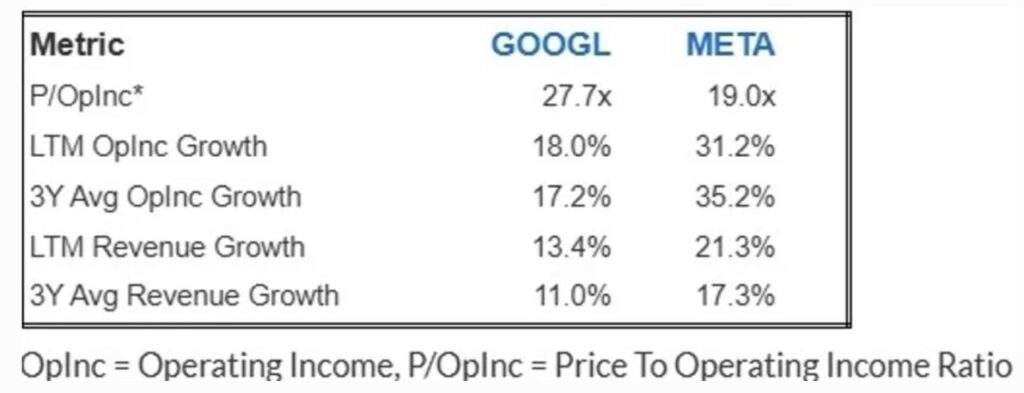

Meta shows faster growth in revenue and operating profit, while Alphabet, despite having a broader product portfolio, seems less impressive in terms of recent revenue growth.

Performance and Valuation Comparison

Meta Platforms offers a more attractive valuation with a lower price to operating income ratio compared to Alphabet. This attracts investors looking for better efficiency and growth in their investments. Although Alphabet has a wider diversity of products, its revenue growth is not as fast as Meta.

Read also: Short-Term Bullish Sentiment Nvidia Shares Strengthen Ahead of Earnings Release!

On the other hand, Meta’s higher revenue growth and operating profit indicate greater potential for future increases in share value. Investors may find Meta a more attractive option due to its higher potential returns compared to an investment in Alphabet.

Trend Analysis of the Last One Year

Analyzing the performance trends of Alphabet and Meta over the past year can provide insight into whether the current stock price difference is temporary. If Alphabet shows a significant improvement in performance compared to the previous year, there may be a chance that its stock valuation will adjust accordingly.

However, if Alphabet continues to show lower revenue growth and operating profits compared to Meta, this could strengthen the argument that its shares are overpriced compared to its competitors. It also suggests that it may take longer for Alphabet to recover its stock value.

Trefis Portfolio Strategy

Buying stocks based on valuation is attractive, but it needs to be carefully analyzed from multiple perspectives. Trefis develops its portfolio strategy with multifaceted analysis to reduce stock-specific risks while providing exposure to potential gains.

Read also: Ethereum Foundation Launches “Trustless Manifesto” to Affirm Commitment to Decentralization

Trefis’ High Quality Portfolio has outperformed its benchmark, which is a combination of the S&P 500, Russell, and S&P midcap indices. It offers an alternative for investors seeking growth with a more stable experience compared to individual stock investments.

Overall, in choosing between Meta and Alphabet stocks, investors need to consider not only the current valuation and performance aspects but also the long-term growth potential and stability.

Taking all these factors into account, Meta seems to offer more promising prospects thanks to faster revenue growth and operating profits as well as a more attractive valuation.

Trading US Stock Tokens on the Door

Imagine being able to buy shares of big companies like Tesla (TSLAX), Apple (AAPLX), and Nvidia (NVDAX) in token form for as little as a few thousand dollars. The good news is that you can now buy/sell tokenized US stocks from xStocks at Pintu.

By leveraging blockchain technology, you can now enjoy a faster settlement process for tokenized US stocks, more affordable start-up capital, and a more global investment experience.

Trade on the Door Now!

FAQ

What are Meta Platforms and Alphabet?

Meta Platforms (META) and Alphabet (GOOGL) are two leading companies in the digital advertising sector. Meta is known for its social platforms such as Facebook, while Alphabet is the parent company of Google that offers a wide range of services including search, advertising, and cloud solutions.

Why does Meta have a more attractive valuation than Alphabet?

Meta has a lower price to operating income ratio compared to Alphabet, which suggests that its shares may be undervalued relative to its profits.

How did Meta’s revenue and operating profit performance compare to Alphabet?

Meta showed higher revenue growth and operating profit compared to Alphabet, indicating better operational efficiency and momentum.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with various advanced trading tools

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Forbes. Meta Vs. Alphabet Stock: Which Offers More Upside?. Accessed on November 14, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.