Death Cross Confirmed: Is Bitcoin Nearing a Bottom or Headed for a Deeper Slide?

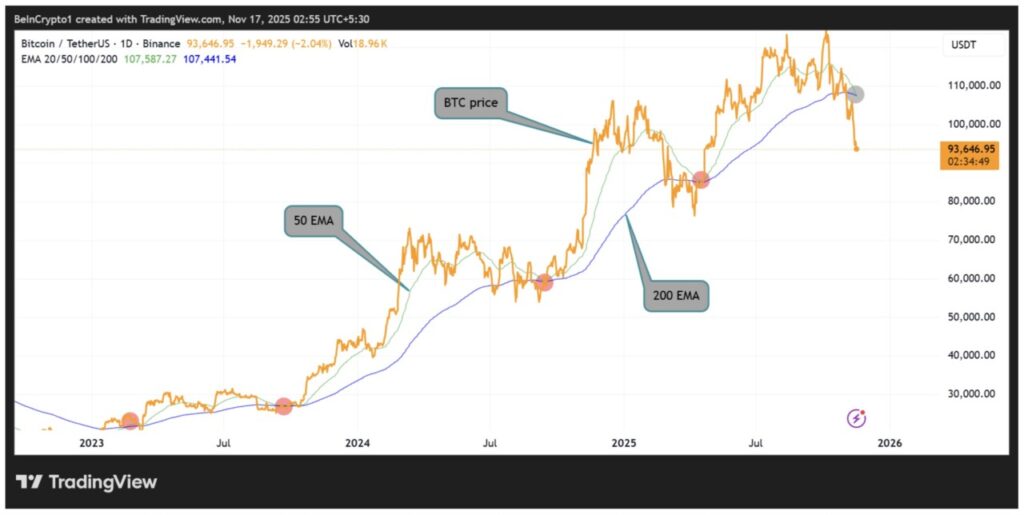

Jakarta, Pintu News – Bitcoin (BTC) price action triggered the formation of a Death Cross pattern on Sunday, November 16, when its 50-day moving average fell past its 200-day moving average.

Historically, this pattern is known as a bearish technical signal, and its reappearance has sparked debate among traders and analysts. The main question that arises is whether it marks a local bottom or indicates a potential further decline.

What is a Death Cross and Why it Matters Right Now for the Bitcoin Price

In technical analysis, a Death Cross is when short-term price momentum drops past the long-term trend, signaling potential downward pressure. Currently, Bitcoin’s price is hovering around $93,646, after dropping below the $94,000 threshold for the first time since May 5.

Read also: Is the Crypto Market in a Bear Market? Here’s What the Experts Say

Market sentiment is at a very negative point, reflected by the Fear & Greed Index plummeting to level 10, indicating extreme fear. At the same time, sell-offs bywhales and outflows from spot ETFs have accelerated the recent downward trend in prices.

However, analysts emphasize that the appearance of a Death Cross does not necessarily signal a price crash. Historical data from 2014 to 2025 shows mixed short-term results, but many cycles record strong recoveries in the medium to long term.

Historical Performance: Short-term Loss, Medium-term Potential Recovery

Data compiled by Mario Nawfal and a number of on-chain analysts shows the following pattern:

- 1-3 weeks after the Death Cross: The probability between gains and losses is almost balanced, with a slightly positive median return in the range of 0.25-2.35%.

- 2-3 months later: Average returns rise sharply to 15-26%, indicating a potential recovery if historical patterns repeat.

- 12 months later: Results varied widely; some cycles recorded gains of more than 85%, while others saw significant declines, depending on the macroeconomic conditions at the time.

According to analysts such as Benjamin Cowen and Rekt Fencer, many previous Death Crosses have marked local bottoms, not market tops.

However, the moment of the next bounce is crucial; if Bitcoin does not rally in the next 7 days, analysts warn of a possible further decline before a larger recovery.

Read also: Bitcoin Tends to Be Bearish, These 3 Altcoins are in the Spotlight

Next Directions for Bitcoin Investors: Key Levels and Market Signals

Technical and macroeconomic indicators highlight some important thresholds:

- Support zone: between $60,000-$70,000, potentially a new floor if selling pressure increases.

- Bullish confirmation: re-strengthening above the 200-day moving average could potentially indicate the start of upside momentum again.

- Long-term indicators: analyst Brett thinks that the 50-week moving average is more accurate for the long term than the Death Cross signal itself.

Historically, a Death Cross that occurs in a bull market phase is often followed by a rally to new highs. Conversely, if it occurs in a bear market, it is usually temporary.

However, investors need to watch short-term price movements carefully. Historical data indicates:

- If there is a price bounce during the week, it is likely that the bullish cycle will continue.

- If there is no bounce, there could be a new drop that creates a macro lower high before the next long-term rally.

Meanwhile, medium-term projections remain optimistic with a potential upside of 15-27% in the next 2-3 months, if historical trends repeat. While the long-term outlook remains open, the level of uncertainty remains high, emphasizing the importance of a thorough analytical approach: technical, on-chain and macro.

While Death Cross signals caution, history shows that Bitcoin often recovers after going through similar phases. Traders are advised to stay alert to key support levels and be prepared for short-term volatility, while anticipating medium- and long-term recovery opportunities.

FAQ

What is a Death Cross in the context of Bitcoin (BTC)?

A Death Cross is a condition in financial markets where the short-term (50-day) price moving average falls below the long-term (200-day) price moving average, which is often considered a bearish indicator.

How has Bitcoin (BTC) historically performed after a Death Cross?

Based on historical data, Bitcoin (BTC) often experiences a short-term decline after a Death Cross, but it is usually followed by a strong recovery in the medium to long term.

What impact does a Death Cross have on market sentiment?

Death Crosses tend to trigger bearish sentiment in the market and can lead to further price drops, as seen from the Fear & Greed Index reaching 10, indicating extreme fear.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Death Cross Price History 2025. Accessed on November 17, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.