Will Bitcoin (BTC) Recover Soon? Check out the latest analysis (11/17/25)

Jakarta, Pintu News – The cryptocurrency market, especially Bitcoin (BTC), is always full of unpredictable dynamics. Lately, many analysts have been trying to predict whether Bitcoin (BTC) has hit bottom or will continue to decline. Various data and technical analysis are used to describe the current state of the market. This article will review some insights that can help investors understand the current Bitcoin (BTC) market situation.

Bitcoin Low Point Proximity Signals

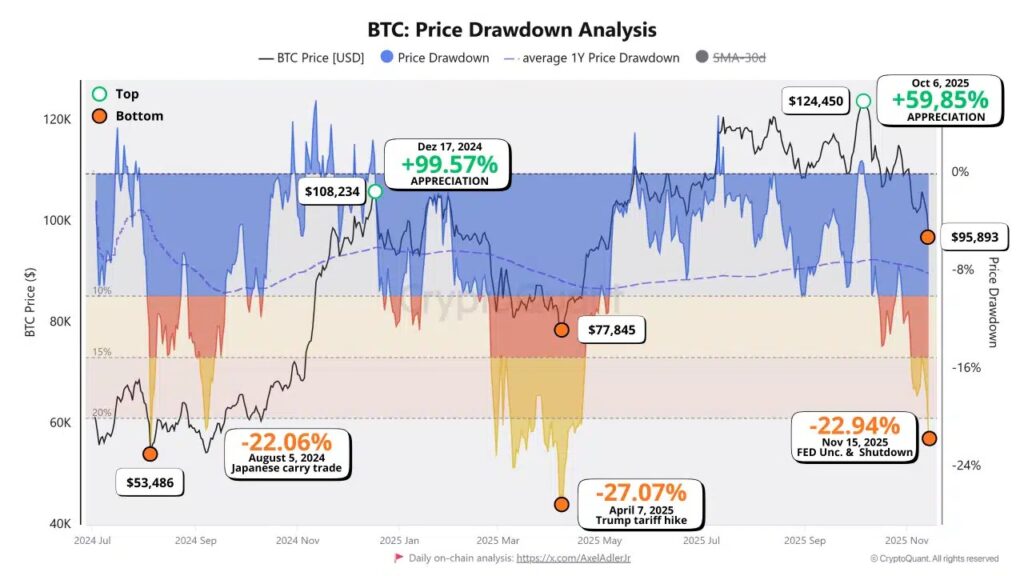

According to analysis from GugaOnChain at CryptoQuant Insights, the decline in Bitcoin (BTC) price over the past year suggests we may be nearing the end of the downturn. History shows that after a decline of about 22%-27% from its peak, the market will usually experience a 60% to 100% bounce back. This provides some hope for investors looking for entry points.

A low Stablecoin Supply Ratio also indicates further upside potential. This ratio indicates high buying power of stablecoins against Bitcoin (BTC), which could be a positive signal for buyers. However, high volatility in the market can still cause losses for traders and investors if they are not careful in their decisions.

Also Read: 3 Powerful Altcoins Predicted to Rival Solana, What Are They?

Bearish Arguments that Should Not Be Ignored

On the other hand, Axel Adler Jr in his post on X, reminded that we may still be in a bear market. Some key metrics such as the 200D SMA, 111D SMA, and STH Realized Price have turned into resistance indicating selling pressure. Losing 365-day moving average support and dropping below $100,000 has been a psychological blow to the bulls.

Furthermore, a drop below this psychological level opens up the possibility of a decline to the $74,000-$87,000 range. It remains unclear if Bitcoin (BTC) has reached a cyclical bottom or if the downtrend will continue to deeper support. Trend followers will probably wait for a recovery of the long-term averages before deciding to enter the market.

Is It the Right Time to Buy?

Although the structure of the current decline is similar to previous declines followed by recoveries, this remains a case of high-risk accumulation. Investors considering buying at this low should clearly set invalidation levels and be ready to exit if the price moves below those levels.

The decision to buy should be based on careful analysis and a good understanding of the risks involved. Taking all these factors into consideration, investors should remain vigilant and not rush into making investment decisions.

The cryptocurrency market is highly unpredictable, and while there is great potential for profit, the risk of loss is also high. Therefore, a cautious and informed approach is key in investing in this market.

Conclusion

In the face of this uncertain Bitcoin (BTC) market, it is important for investors to keep themselves updated and analyze various sources before making investment decisions. Understanding the depth and nuances of the market will help in taking the right steps at the right time. Whether it is the right time to buy or sell, only time will tell.

Also Read: 10 Most Popular Coin Memes of November 2025: The talk of the town!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is Bitcoin (BTC)?

Bitcoin (BTC) is a digital currency or cryptocurrency that was created in 2009 by a person or group using the pseudonym Satoshi Nakamoto.

Q2: What are 200D SMA and 111D SMA in the context of Bitcoin (BTC)?

The 200D SMA (200-Day Simple Moving Average) and 111D SMA are technical indicators used to analyze the price movement of Bitcoin (BTC) over a period of time.

Q3: Why is the stablecoin supply ratio important in Bitcoin (BTC) market analysis?

The stablecoin supply ratio shows the buying power of stablecoins against Bitcoin (BTC), which can be an indicator of a potential rise in Bitcoin (BTC) price if the ratio is low.

Q4: What is a bear market?

A bear market is a market condition where the price of an asset, such as Bitcoin (BTC), shows a continuous downward trend.

Q5: How should investors respond to Bitcoin (BTC) market volatility?

Investors are advised to conduct careful analysis, clearly set invalidation levels, and be ready to exit if market conditions turn unfavorable.

Reference

- ambcrypto.com. Bitcoin’s drawdown resembles past recoveries, but this time one risk stands out. Accessed on November 17, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.