Price of 1 Pi Network (PI) in Indonesia Today (11/18/25)

Jakarta, Pintu News – The price of 1 Pi Network (PI) in Indonesia on November 18, 2025 is moving in dynamic market conditions, as Pi ecosystem activity increases ahead of the mainnet launch. This relatively volatile daily price movement cannot be separated from the stretch of technical developments on Testnet, especially through the emergence of new tokens and the formation of liquidity pools that further heat up the testing process.

In addition, the increase in DEX and smart contract activity is shaping market sentiment, as this phase demonstrates the readiness of Pi’s infrastructure to support the full utility of DeFi. The combination of these factors makes PI price monitoring increasingly relevant to the crypto community in Indonesia, both in terms of adoption and long-term prospects.

How much is 1 PI in Indonesia today?

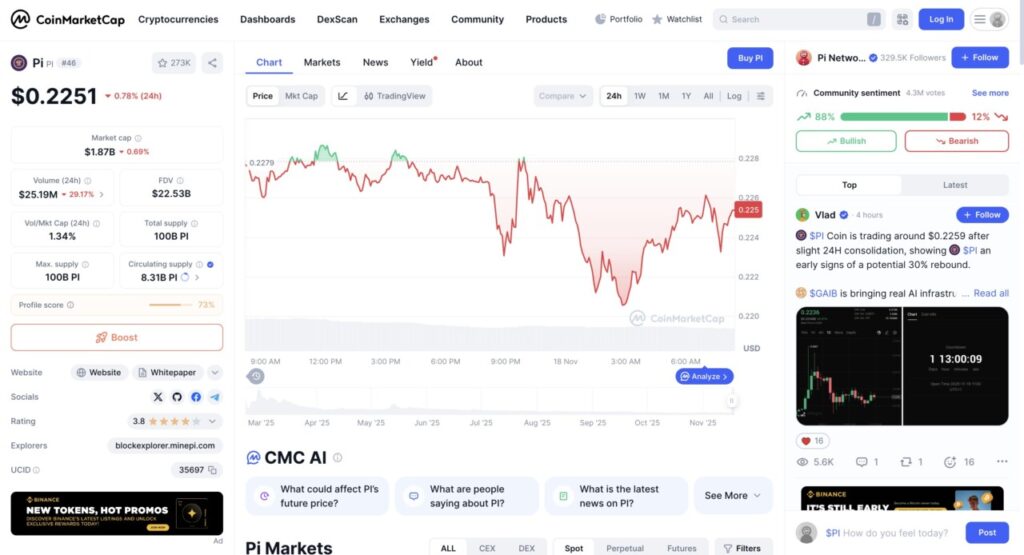

The Pi Network (PI) price chart within a 24-hour span shows volatile movements with a weakening trend. At the beginning of the period, the price had moved in the range of 0.2279 US dollars before entering a mild correction phase. After reaching this point, the price moved sideways with several rebound attempts, but selling pressure continued to dominate the market.

Midway through the session, the chart displayed a sharper decline, characterized by a gradual drop until it reached levels around US$0.221 – one of the lowest points in the last 24 hours. Despite a brief recovery, the price again lost momentum and moved in a consistent downward pattern. This phase saw an increase in volatility, which was reflected by the chart color changing between green and red with every minor fluctuation.

Towards the end of the period, the price of Pi (PI) tried to rebound again, but the recovery was limited. The chart shows that the price last moved around US$0.225, slightly lower than the starting point of the observation. Overall, the chart pattern shows strong selling pressure throughout the day, in line with the more than 29 percent drop in 24-hour trading volume.

On the other hand, the community sentiment indicator seen on the right side of the chart shows a predominance of positive opinions with around 88% of users voting bullish, despite the 24-hour price movement recording a 0.78% decline. This imbalance indicates that despite the short-term pressure on the price, most of the community still sees potential for recovery in the near future.

Also read: 10 Crypto Cross-Chains that Have the Potential to Rise in 2026

New Tokens and Liquidity Pool Heat up Testnet

In recent days, a number of new tokens have appeared on Testnet, including LatinChain, BTC test tokens, CYBER, Archimedes, and ShrimpSwap. All of these tokens utilize Test-Pi as a simulated asset to test basic mechanisms such as price discovery and liquidity management.

This testing is important as it ensures that the trading mechanism is stable before it is deployed on a mainnet environment using real-value crypto assets. The community noted that the integration of these tokens with Pi Browser is now much smoother than in the past.

LatinChain was one of the first tokens to launch a liquidity pool on Testnet DEX via Pi Browser. The token features a small circulating supply and basic market metrics designed for technical experimentation only.

This progress confirms that the system upgrade released in October has significantly improved Testnet performance. The developers state that the current test conditions are increasingly representative of the Pi Network ecosystem when it enters its full mainnet phase.

Also read: 3 Pi Network (PI) Bullish Signals Emerging Amid Token Unlock Pressure

Increased DEX and Smart Contract Activity

DEX testing is becoming more active as community and developer interaction increases. Reports show simulated trading, increased liquidity, and deployment of new smart contracts that mimic the real-world functionality of a decentralized exchange.

This testing period is crucial as the Pi Core Team is preparing the official DEX, the PiCoin DEX, as the hub of decentralized financial activity. With community involvement, potential bugs and interface issues can be identified sooner before the final release.

The activity also gives an idea of the flow of crypto asset movement in the Pi Network ecosystem. As native liquidity begins to enter the mainnet, cryptocurrency transactions on the platform are expected to increase sharply.

Testing by external developers, including the issuance of BTC test tokens, shows external interest in the potential for cross-ecosystem integration. This opens up the opportunity that Pi Network could become one of the platforms that support Web3 application development on a wider scale.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinfomania. Pi Network Testnet Activity Surges with New Tokens and DEX Tools. Accessed November 18, 2025

- Featured Image: Bitcoin News

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.