Ethereum Plunges to $2,900 Today — Is a Recovery on the Horizon for ETH?

Jakarta, Pintu News – At the start of the week (17/11), the price of Ethereum (ETH) stabilized above the $3,100 level despite Bitcoin’s (BTC) sharp drop to below $94,000, creating a clear divergence ahead of a week of macroeconomic uncertainty.

Traders are now bracing for the release of the FOMC meeting minutes, as well as a number of key US economic indicators – including jobless claims, PMI data, and the Currency Report from the Treasury Department – all of which have the potential to spark fresh volatility in the crypto markets.

Amidst this risky situation, ETH has actually performed better than BTC, supported by stronger derivatives positions and healthier liquidity flows. So, how will Ethereum price move today?

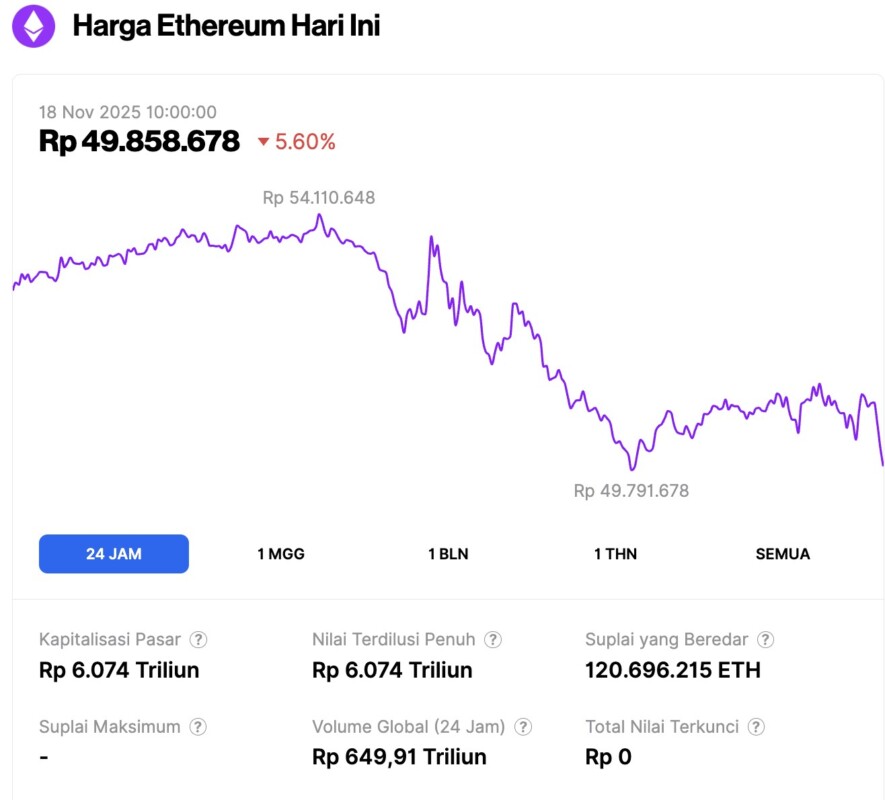

Ethereum Price Drops 5.60% in 24 Hours

On November 18, 2025, Ethereum was trading at approximately $2,968, equivalent to IDR 49,858,678—marking a 5.60% decline over the past 24 hours. During this period, ETH hit a low of IDR 49,780,675 and a high of IDR 54,110,648.

At the time of writing, Ethereum’s market capitalization is around IDR 6,074 trillion, with a 68% surge in daily trading volume to IDR 649.91 trillion over the same timeframe.

Read also: Bitcoin Plunges to $91,000 — Is a Recovery on the Horizon?

ETH shows stronger performance amid risk-off action

Earlier this week, Ethereum briefly traded in the $3,190 range, staying above the key $3,100 zone despite general crypto market pressure. While Bitcoin plummeted nearly 6% in the last 24 hours to drop below $94,000, ETH only fell 2.1% in the same period and managed to maintain levels above $3,100.

The ETH/BTC ratio also rose 1.8% from the weekly low, indicating a significant capital rotation towards Ethereum despite the market being in risk-off mode.

Derivatives market data shows that the number of long liquidations on ETH is 40% lower than BTC, which helps to suppress volatility and prevent chain selling pressures like the one on Bitcoin. This combination of factors strengthens ETH’s position as a more resilient asset ahead of a stressful macroeconomic week.

Derivatives Liquidation Map: Strengthening Potential on the Horizon

The latest 30-day liquidation map data shows that Ethereum has a more favorable technical position than other crypto assets.

The chart shows a liquidation pool of long positions between $2,950 and $3,050, which is the closest zone with a potential spike in volatility if the ETH price hits that level.

However, the more decisive signal is on the upside:

Most of the large, high-volume liquidations have been on the short side, specifically in the $3,250-$3,600 range. If ETH manages to get into this zone, there could be a short squeeze – a forced closing of short positions that could drive a technical price rally.

Brief Conclusion:

- Downside risks are present, but limited to one narrow zone ($2,950-$3,050).

- Upside potential increases if ETH regains momentum.

- Derivatives positioning supports the view that ETH is stronger than BTC heading into next week.

- This is in line with the stability of the ETH spot market and reinforces the narrative of its relative strength.

ETH Price Analysis: Structure Remains Strong Amid Volatility

As of November 17, ETH briefly traded in the range of $3,150-$3,200 and remained above the key demand zone that was previously the bounce point during September and early November. However, technically, ETH is still showing a pattern of lower highs and lower lows, indicating weakness from the buyers’ side.

The price has recently lost an important support zone between $3,530 and $3,589, which has erased most of the gains made in the past 3 to 4 months.

Nonetheless, technical indicators point to a potential rebound, but the question is: are bulls able to push ETH prices to reclaim crucial support-turned-resistance levels?

ETH is trying to bounce off support at $3,020, a level it has already successfully defended twice this month. The RSI is still weak around 37, signaling limited momentum, while the MACD remains in bearish territory – indicating seller dominance.

Read also: Is the Crypto Market in a Bear Market? Here’s What the Experts Say

To show short-term strength, ETH must break the supply zone between $3,360-$3,420. If it fails, the price could retest $3,020, and if this level is broken, ETH could potentially drop to $2,850. Conversely, if it breaks $3,420, the next upside target is $3,875.

ETH Opportunities Increase If Macro Data Helps

Next week’s macroeconomic data releases will determine whether the market remains in risk-off mode or begins to show stabilization. ETH is currently one of the most pressure-resistant large assets, and even a slight improvement in sentiment could trigger an upward liquidity rally.

The $3,250-$3,320 level is the main trigger that needs to be watched. If this level is broken, ETH could immediately target the short-liquidation zone at $3,480-$3,600.

Meanwhile, a correction to the $2,950-$3,050 zone is still possible, but it will not change the overall trend unless accompanied by very heavy macroeconomic pressures.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Ethereum Price Analysis: ETH Eyes $3,600 Liquidation Zone as BTC Crashes-Is a 12% Rebound Coming?

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.