10 Altcoins that Crashed During the Month of November 2025

Jakarta, Pintu News – The crypto market was volatile again throughout November 2025, with a number of altcoins recording extreme declines in the last 30-day period. Based on the data in the available screenshots, some assets recorded corrections of more than 70% to 97% in a month. This sharp decline exposes the immense pressure in the altcoin sector, especially on projects that are in the low liquidity and micro-capitalization categories.

Below is a list of the 10 altcoins with the deepest drop in November 2025, complete with a description of the project and its price performance.

1. LooksRare (LOOKS)

LooksRare (LOOKS) is a decentralized NFT marketplace designed as an alternative to OpenSea, with a focus on rewards for active users. Throughout November 2025, LOOKS experienced a monthly price drop of 79.08%, bringing it down to around Rp31.52.

The weakening global NFT trading volume since Q3 2025-down 41% according to Cryptoslam-has been one of the triggers for this utility token’s decline. This sharp decline is also related to the declining sales activity of blue-chip NFTs, which have accounted for the largest liquidity.

At the same time, on-chain data shows staking in LooksRare fell by more than 30% during the month, reducing buying pressure and putting further pressure on LOOKS’ price. The token’s market cap now stands at IDR31.2 billion, putting it in a high-risk zone compared to other NFT platforms that are still maintaining adoption. With weak macro conditions and negative sentiment towards NFTs, LOOKS became one of the worst performing tokens in November.

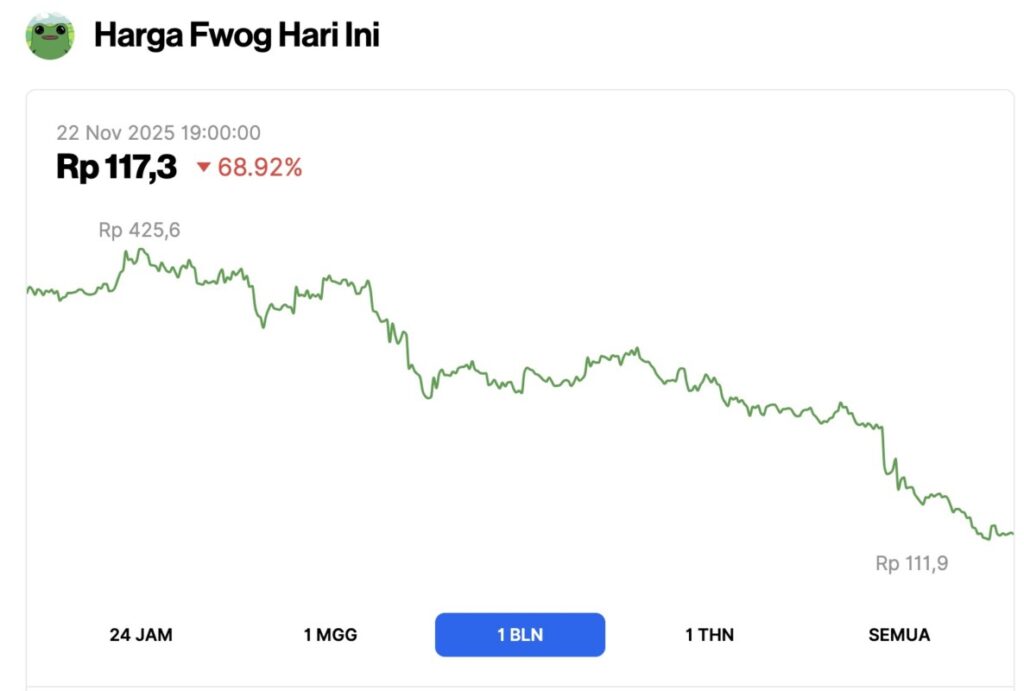

2. Fwog (FWOG)

Fwog (FWOG) is a community-based meme token that went viral in the Solana ecosystem during early 2025. Although it had recorded a big rally in the previous quarter, November became a month of extreme correction with a 68.79% drop in 30 days.

The price of FWOG is now hovering around IDR118.2, having previously peaked above IDR350 in October. This decline was largely triggered by massive profit-taking from whales that dominated the token distribution.

On the other hand, FWOG’s market cap still stands at IDR115.42 billion, reflecting the community base that remains active. However, FWOG’s volatility has increased dramatically-more than 160% according to SolanaFloor-making it one of the most volatile assets in Solana’s microcap market. With meme coin market sentiment weakening, FWOG’s decline reflects structural risks in hyper-speculative assets.

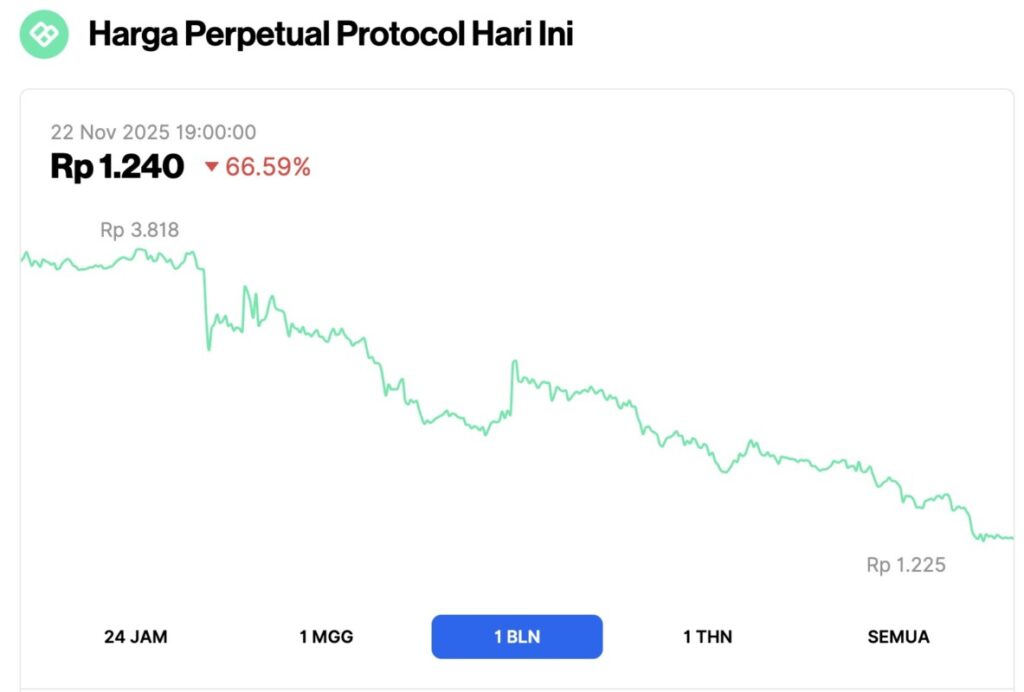

3. Perpetual Protocol (PERP)

Perpetual Protocol (PERP) is a decentralized derivatives platform that offers perpetual futures without intermediaries. During November, PERP fell 67.03% and is now trading at around Rp1,240.

This decline was influenced by the drop in global DeFi derivatives trading volumes which decreased by more than 28% according to CoinGecko. Tight market liquidity and rising funding costs are driving traders away from risky derivative assets.

PERP’s market cap now stands at IDR90.96 billion, far from its annual high. Data from Dune Analytics also shows that open interest in Perpetual Protocol fell 35% throughout November. A number of DeFi analysts noted that fierce competition with dYdX and GMX also exacerbated the pressure on PERP, making it difficult to maintain performance amid a bearish crypto derivatives market.

Read also: 7 Crypto Neobanks with the Potential to Shine in 2026

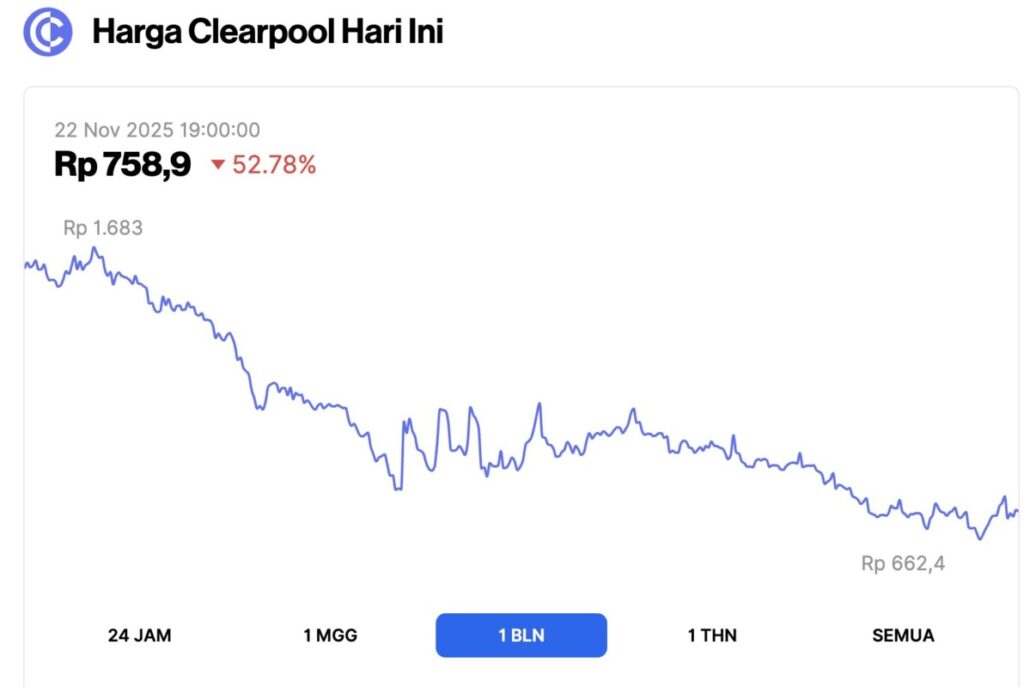

4. Clearpool (CPOOL)

Clearpool (CPOOL) is a decentralized liquidity lending protocol that allows institutions to borrow unsecured assets through a dedicated pool. Throughout November, CPOOL experienced a sharp decline of 61.01%, bringing its price down to IDR 756.1.

This decline was triggered by reduced demand for institutional loans, following increased credit risk after several defaults that occurred on DeFi protocols in early 2025.

Despite this, Clearpool still has a market cap of IDR626.27 billion, making it one of the largest on-chain credit projects. However, liquidity inflow into the loan pool fell by almost 45% month-on-month, according to DefiLlama. The lack of new loan issuance and the exit of large lenders led to increased selling pressure throughout November.

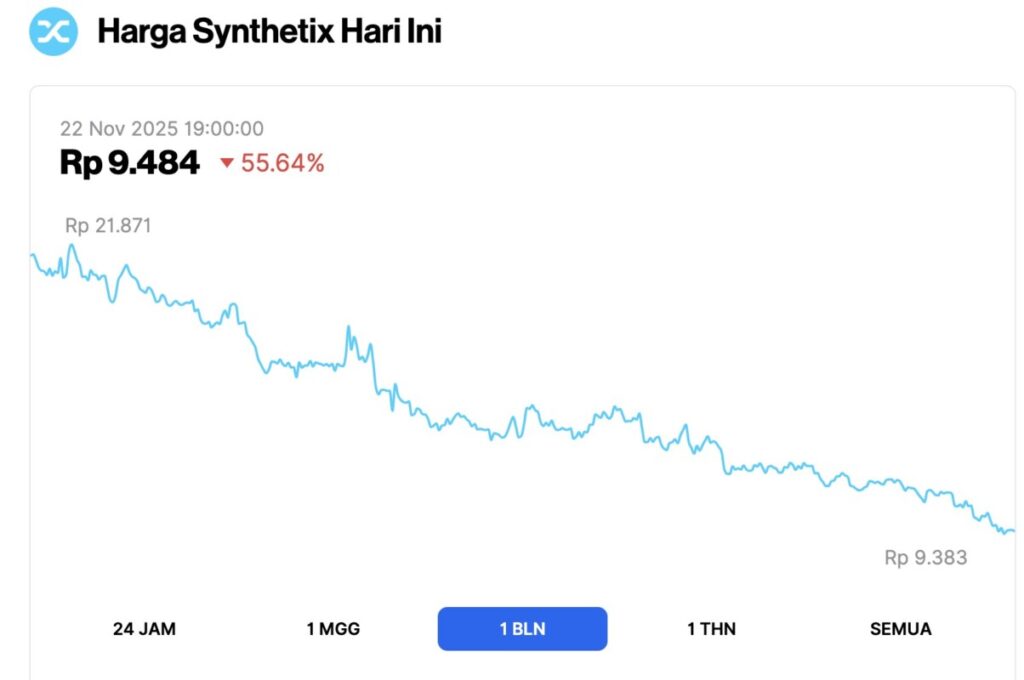

5. Synthetix (SNX)

Synthetix (SNX) is a popular DeFi protocol for issuing synthetic assets such as stocks, commodities and indices. In November, SNX fell 60.00%, with a trading price of IDR9,467.

This drop comes after trading activity on Synthetix Perps decreased by 38% compared to October. Reduced demand for synthetic assets amidst a bearish market also depressed the value of SNX as a utility token.

SNX’s market cap stood at IDR3.26 trillion, still showing the relevance of the project in the DeFi sector despite the heavy correction. Data from TokenTerminal showed protocol revenue fell 27% in November, contributing to the negative market sentiment. This decline was further exacerbated by the exit of several market makers that had been supporting liquidity.

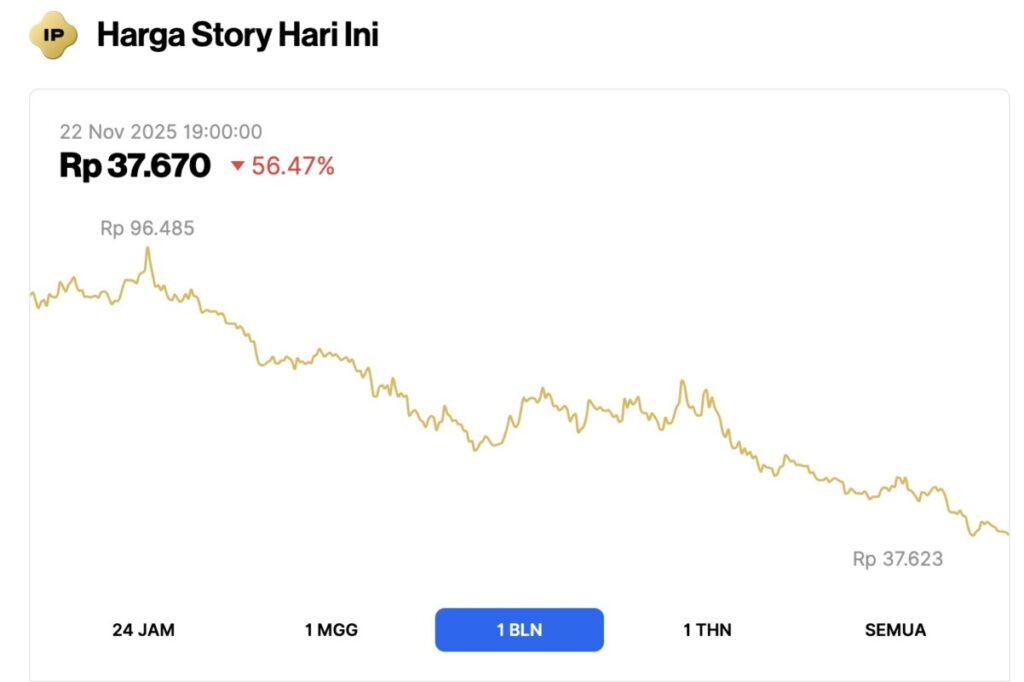

6. Story (IP)

Story Protocol (IP) is a Web3 project that focuses on monetizing IP (intellectual property rights) through tokenization. Although the blockchain IP sector experienced initial growth in 2025, the IP token fell 58.52% in November and is now at IDR37,676.

Retail investors were seen exiting IP projects after the initial hype died down, especially after data showed a 50% drop in on-chain creative content minting activity.

Story’s market cap stands at IDR12.63 trillion, which shows the large scale of this project despite the depressed token price. The daily decline of 1.25% and the weekly correction of 25.49% indicate continued selling pressure. Many analysts think this decline is related to negative sentiment towards the tokenization of the creator economy, which is considered not to generate significant revenue in the short term.

Also read: 6 Altcoins that Crypto Whales Collect When Markets Bleed

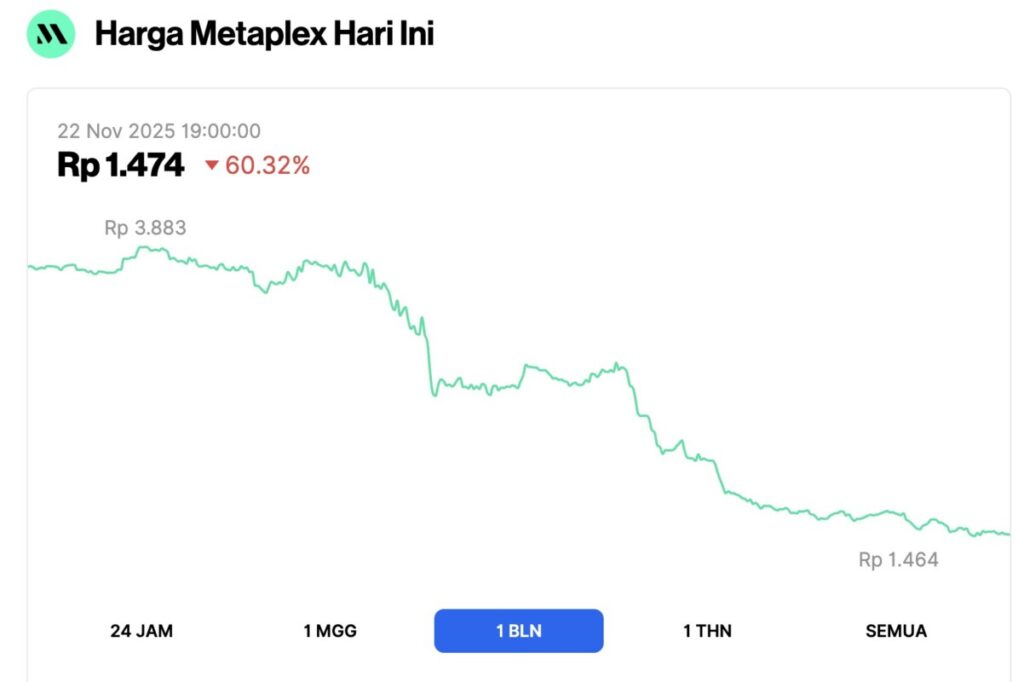

7. Metaplex (MPLX)

Metaplex (MPLX) is Solana’s ecosystem of NFT makers and publishers, best known as the technological foundation for most of Solana’s NFTs. In November, MPLX collapsed 58.13%, trading at Rp1,471.

This is in line with Solana NFT volumes, which fell 32% during the month according to Helius. Reduced creator activity and lower listings on marketplaces have increased selling pressure.

With a market cap of IDR830.3 billion, Metaplex remains a core project in the Solana ecosystem. However, the MPLX token has been pressured by changes in fee structure and governance debates regarding NFT royalties. The 75.81% monthly drop from its peak marks one of the project’s worst months since launch.

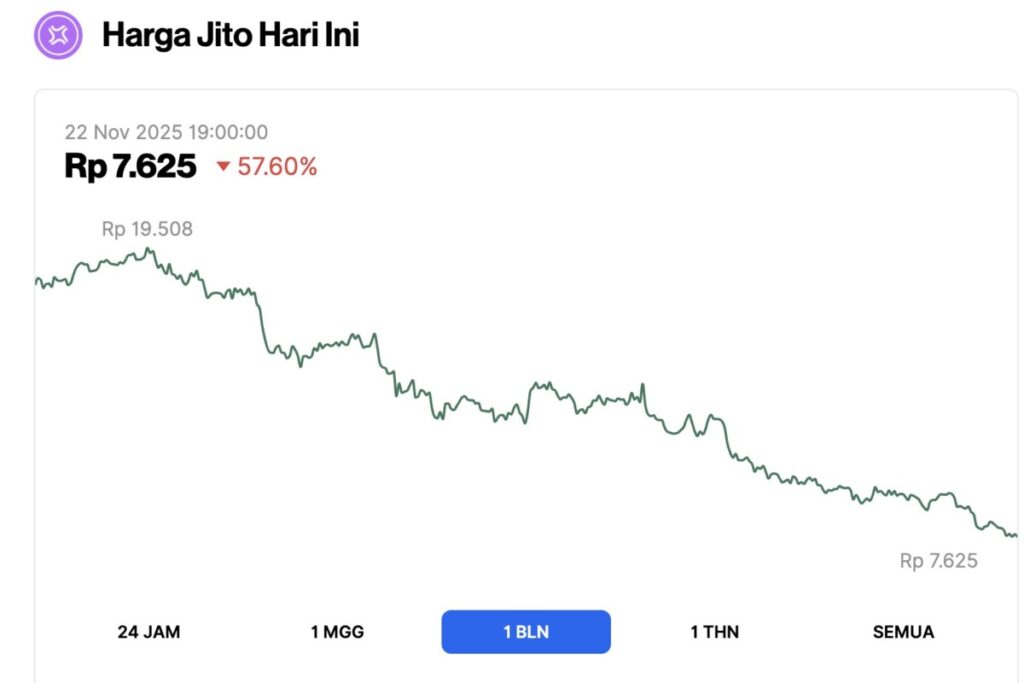

8. Jito (JTO)

Jito (JTO) is Solana’s liquid staking protocol that provides additional yield through MEV staking. Throughout November, JTO fell 57.90% to a price level of IDR7,642. This decline coincided with Solana’s staking APY dropping from 8.1% to 6.4% in a month, reducing the incentive for users to participate.

JTO’s market cap of IDR3.1 trillion makes it one of the largest LST (liquid staking token) tokens in Solana. But a sharp 85.74% correction over the past year has put retail investors on the defensive. Decreased staking activity and increased competition from other LST projects such as Marinade contributed to the pressure on JTO.

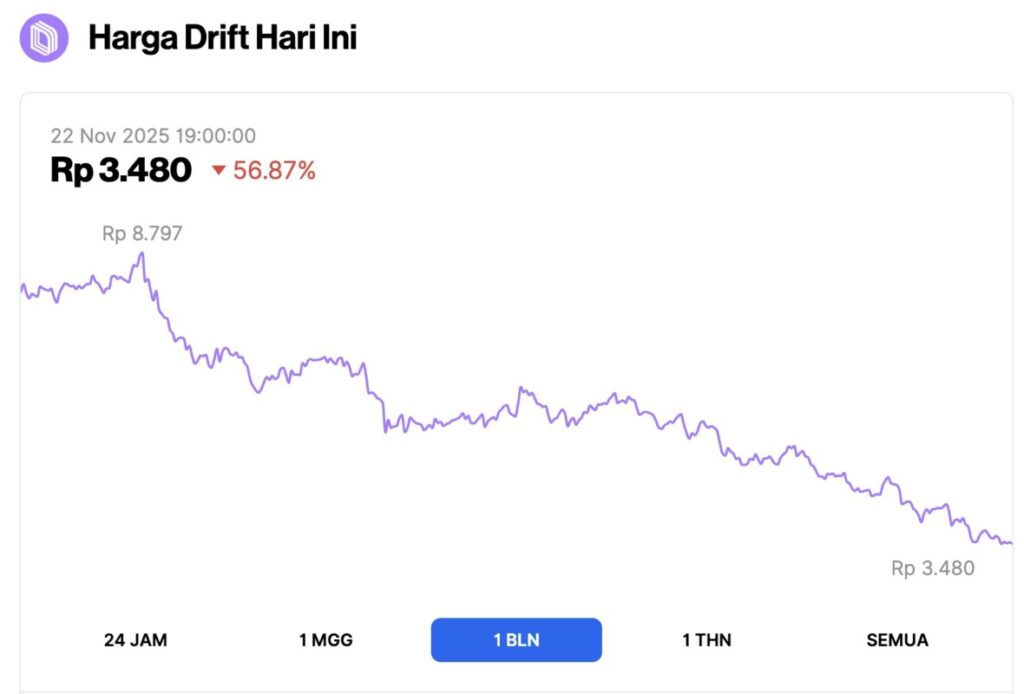

9. Drift (DRIFT)

Drift Protocol is a decentralized perpetual futures platform on Solana that offers leveraged trading. In November, DRIFT fell 57.28% to IDR3,484. This decline is in line with Solana’s declining derivatives volume, which fell 35% according to Coinalyze. The lack of new traders and the liquidation of leveraged positions put the Drift utility token under pressure.

Despite this, DRIFT’s market cap still stands at around IDR1.45 trillion, reflecting relatively strong adoption in Solana’s derivatives sector. However, protocol revenue fell significantly during the month, weakening the token’s fundamentals.

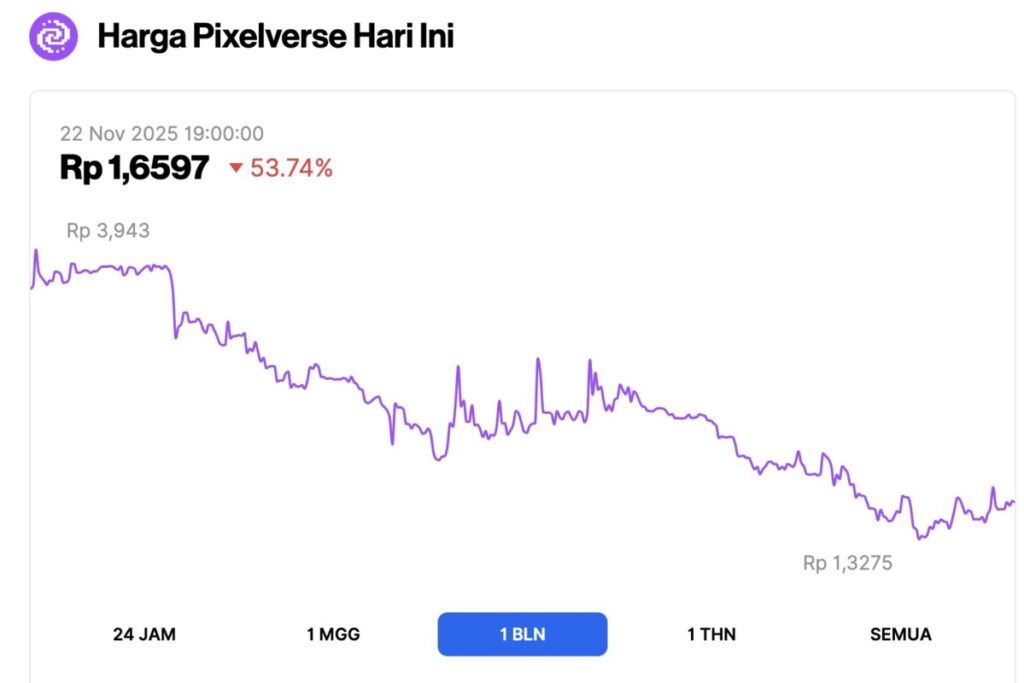

10. Pixelverse (PIXFI)

Pixelverse (PIXFI) is a Web3 gaming project based on an open-world and tokenized character economy. In November, PIXFI experienced an extreme drop of 97.13%, making it one of the worst tokens of the month. The token price is now at Rp1.6681, reflecting the near total loss of the project’s capitalization.

A 90%+ drop in in-game transaction volume and a failed roadmap update were the main triggers for this major correction. With a market cap close to zero, PIXFI falls into the extreme risk category according to the evaluation of some Web3 gaming analysts.

FAQ

What were the main factors that caused many altcoins to crash during November 2025?

The decline of altcoins was influenced by bearish crypto market conditions, massive selling pressure, as well as falling trading volumes. Data from November 2025 shows that the majority of altcoins have lost more than 50% in the last 30 days.

Why have many DeFi projects been heavily impacted?

DeFi projects such as Synthetix (SNX) and Perpetual Protocol (PERP) recorded a decline of more than 60% due to lower on-chain activity and increased leverage risk.

Why did altcoins with large market caps like Synthetix (SNX) also plummet?

Large-cap altcoins such as Synthetix (SNX), with a market cap of IDR3.26 trillion, are also under pressure due to weakening market sentiment and declining demand in the DeFi sector. Decreased liquidity also exacerbated the price correction.

How much risk is there in investing in altcoins during a bear market?

Risk increases as volatility is higher and many altcoins have experienced declines of more than 50% in a month, such as LookRare (LOOKS) which fell 79.08% in 30 days. This makes altcoins more sensitive to negative sentiment.

When could the altcoin market potentially recover after a downturn?

Altcoin recoveries usually occur after Bitcoin (BTC) stabilization, an increase in trading volume, and a recovery in investor sentiment. However, historical data shows that recovery times vary and cannot be guaranteed.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Market Door

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.