Invest $1,000 in XRP: Potential Profits to Reach Tens of Thousands of Dollars in 2040?

Jakarta, Pintu News – Ripple (XRP) continues to demonstrate its potential as one of the leading crypto assets, especially amidst the growing interest in crypto-based Exchange-Traded Funds (ETFs). With 18 ETFs awaiting SEC approval in the United States, XRP is strategically positioned to capitalize on this momentum. Moreover, its primary focus on cross-border payments gives XRP a unique competitive advantage among other digital assets.

XRP’s Dominance in Global Payments and Institutional Support

XRP is slowly establishing a price trajectory independent of other cryptocurrencies, along with the adoption of blockchain technology in international payments. One of the most recent recognitions came from Franklin Templeton, a global asset manager with $1.7 trillion in assets under management, who called XRP an important asset in the global settlement infrastructure. Ripple’s partnerships with major financial institutions and its presence in the global payments system provide a strong foundation for long-term growth.

Also Read: 7 Ways to Buy and Sell Tokenized Gold at the Door, Starting from Rp11,000 and Can be 24/7

XRP 2040 Price Prediction: Can it Reach $82?

According to data from Flitpay, Ripple (XRP) is projected to reach a maximum price of $82 by 2040, with an average price of $76 and a minimum of $71. This optimism is driven by growing adoption, community support, and long-term stability. XRP’s community support has proven to be strong, especially after going through a long lawsuit with the SEC that finally strengthened XRP’s legitimacy as a digital asset.

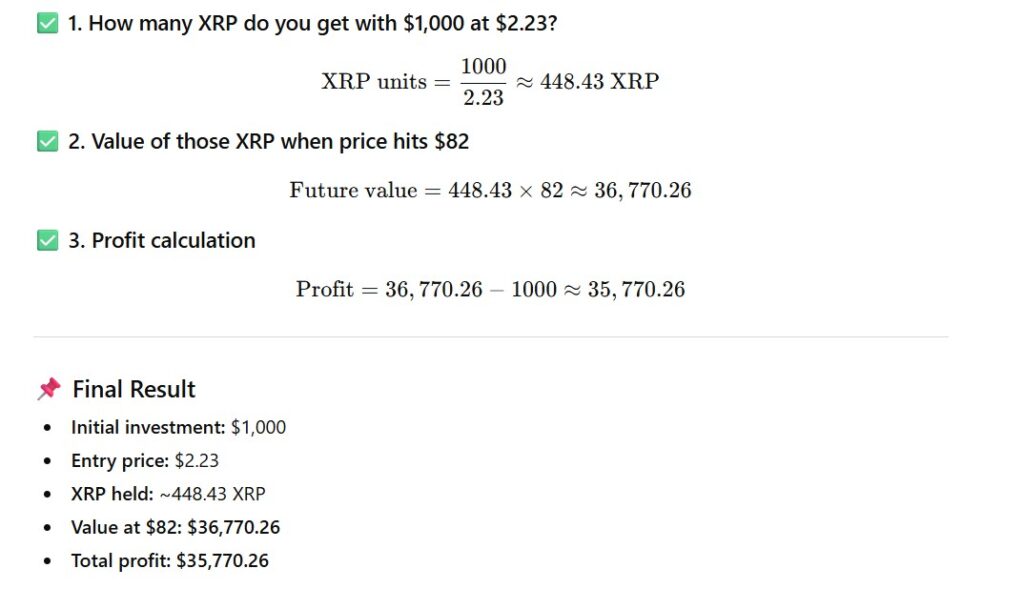

Investment Simulation: What If You Invested $1,000 in XRP Now?

If investors buy $1,000 worth of XRP at the current price of $2.23, they will get around 448 XRP tokens. If the predicted maximum price of $82 in 2040 comes true, the value of that investment could grow to $36,770, or around Rp580 million (exchange rate of Rp15,800/USD). This represents a tremendous potential return, although one must be cognizant of the high volatility of the crypto market.

Risks and Potential Paths Along

While the projected price figures look promising, the crypto market remains highly subject to fluctuations and regulation. Ripple (XRP) has a great opportunity as a long-term asset, but investment decisions should be based on thorough research and risk awareness. Diversification and the use of ready-to-invest funds (cold money) are wise strategies to adopt.

Also Read: A Complete Guide to Saving Digital Gold in 2025 – Simple, Safe, Can Start from Rp11,000!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ – Investing in Ripple (XRP)

Q1: What is Ripple (XRP)?

A1: XRP is a crypto asset developed by Ripple Labs, focused on fast and low-cost cross-border payment solutions for financial institutions.

Q2: What is the predicted maximum price of XRP in 2040?

A2: The predicted maximum price of XRP in 2040 is $82 per token.

Q3: What is the potential return on a $1,000 investment in XRP until 2040?

A3: If the price of XRP reaches $82 in 2040, the initial investment of $1,000 (at $2.23 per XRP) could become $36,770.

Q4: What are the main risks in XRP investment?

A4: The main risks include price volatility, regulatory uncertainty, as well as competition from other blockchain technologies.

Q5: Is XRP backed by large institutions?

A5: Yes, XRP has attracted the attention of institutions such as Franklin Templeton and formed many partnerships with global banks and financial institutions.

Reference

- Watcher Guru. XRP Price in 2040: What Your $1000 Could Grow Into Will Shock You. Accessed on November 26, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.