Texas Makes Large Investment in BlackRock Bitcoin ETF

Jakarta, Pintu News – The Texas government has taken a big step into the cryptocurrency world by purchasing $5 million of the BlackRock IBIT Bitcoin (BTC) ETF. This decision comes after the allocation of $10 million from general revenue, of which only half has been used for this purchase. Clarity on the use of the remaining funds is yet to be determined, whether they will be used to buy Bitcoin (BTC) or other cryptocurrencies.

Investment and Market Dynamics

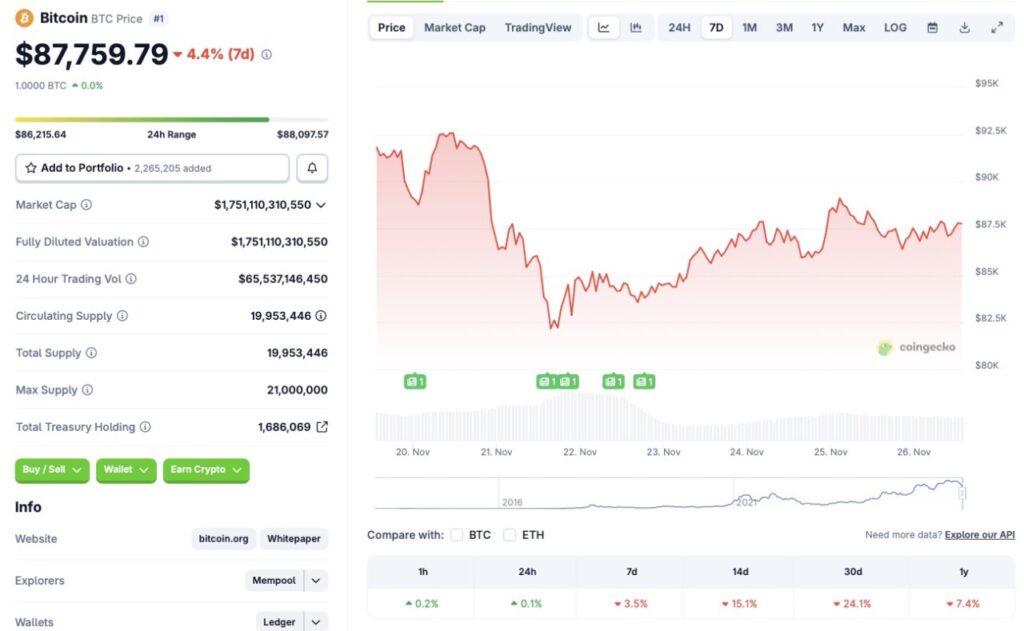

This investment was made on November 20, when the price of Bitcoin (BTC) was still above $90,000. However, the next day, the price of Bitcoin plummeted to $82,000. While Texas may have missed out on the opportunity to buy at the lowest price, expectations of future Bitcoin price increases remain high. The cryptocurrency market is known for its volatility, and this investment shows Texas’ commitment to blockchain technology and its potential.

Bitcoin (BTC) has shown a recovery in recent days, with prices returning to the $87,000 level. According to data from CoinGecko, Bitcoin rose 0.1% in the last 24 hours, despite declines in other time frames. These fluctuations reflect the macroeconomic uncertainties affecting global markets, including slow economic growth and rising inflation.

Also Read: Invest $1,000 in XRP: Potential Profits to Reach Tens of Thousands of Dollars in 2040?

Causes and Impact of Bitcoin Price Crash

Bitcoin’s (BTC) recent price drop is one of the largest and fastest in recent memory. This decline was triggered by macroeconomic uncertainties, such as slow economic growth, rising inflation, and high employment numbers in September.

In addition, the chances for another interest rate hike in 2025 have diminished substantially, which impacts risky assets such as Bitcoin. Although the cryptocurrency market is under pressure, there is hope that improving macroeconomic conditions as early as 2026 could bring relief.

However, the risk of entering a colder period in the crypto market, known as “crypto winter,” still exists. Investors and market watchers should remain vigilant to possible changes.

The Future of Texas Investing in Cryptocurrency

Texas’ bold move in investing a portion of its general revenue into the BlackRock Bitcoin ETF marks a watershed moment in the adoption of cryptocurrencies by government entities.

Going forward, this decision may be followed by other states seeking asset diversification and innovation in their investment portfolios. While the cryptocurrency market is still fraught with uncertainty, this move may be a turning point in the way governments interact with digital assets.

Also Read: Hedera (HBAR) Needs Nearly 40% Hike to Recover November Losses

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is the BlackRock IBIT Bitcoin ETF?

The BlackRock IBIT Bitcoin ETF is an exchange-traded fund that invests directly in Bitcoin (BTC), allowing investors to gain exposure to the price of Bitcoin without the need to physically own Bitcoin.

Why would Texas choose to invest in a Bitcoin ETF?

Texas invests in Bitcoin ETFs as part of its asset diversification strategy and to capitalize on the growth potential of blockchain technology and cryptocurrencies.

How much does Texas invest in Bitcoin ETFs?

Texas has invested $5 million in the BlackRock IBIT Bitcoin ETF out of a total of $10 million allocated from general revenue.

How will this investment impact the price of Bitcoin?

These investments are made when the Bitcoin price is still high, and the price drops soon after. However, long-term investments like these often focus more on long-term growth potential rather than short-term fluctuations.

What are the risks of this investment for Texas?

The main risks include Bitcoin’s high price volatility, which can result in significant losses. However, the diversification and long-term growth potential of Bitcoin may offset this risk.

Reference

- Watcher Guru. Texas Buys $5 Million Worth of BlackRock Bitcoin ETF. Accessed on November 27, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.