Antam Gold Price Chart Today November 27, 2025: Up or Down?

Jakarta, Pintu News – The price of gold, especially Antam gold, is again in the spotlight of investors and Indonesians towards the end of November 2025. Based on the latest data from the HargaEmas.com website, today’s gold price movements show interesting fluctuations, both in terms of international spot prices, the rupiah exchange rate against the dollar, and the trend of the Antam price chart on a daily basis.

Global Gold Spot Price as of November 27, 2025 (15:40 WIB)

Here is the latest spot gold price data:

- Spot Gold Price (USD/oz): USD 4,164.20 (down 4.60 points)

- USD/IDR rate: IDR16,633.43 (down 2.67 points)

- Gold Price in Rupiah per gram (IDR/gr): IDR 2,226,919 (down IDR 2,337)

- Daily Price Range (Hi – Lo):

- Highest: IDR 2,232,086

- Lowest: IDR 2,200,266

This small decline reflects minor pressure on the world gold market, although overall it is still in a stable range for medium- and long-term investors.

Also Read: Invest $1,000 in XRP: Potential Profits to Reach Tens of Thousands of Dollars in 2040?

Spot Gold Movement Chart (IDR)

The chart data from November 26 and 27 shows the relatively dynamic fluctuation of spot gold price in Rupiah. It can be seen that on November 27 (orange line), gold prices tended to stabilize in the morning, experienced a significant drop towards noon, and then rebounded quickly towards the afternoon.

These price movements indicate considerable market activity, influenced by global factors such as the weakening US dollar, demand for precious metals, and financial market volatility.

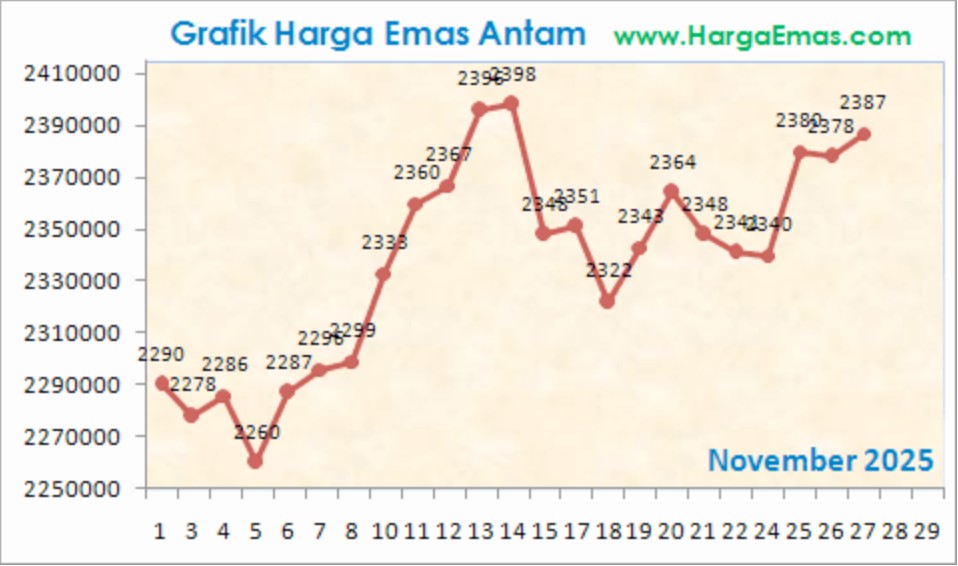

Monthly Antam Gold Price Chart (November 2025)

The daily chart of Antam gold for November 2025 shows a consistent upward trend after touching a low of around IDR2,260,000 on November 5. Since then, prices have continued to creep up, breaking the Rp2,398,000 level in the middle of the month before correcting, then strengthening again towards the end of the month.

On November 27, 2025, Antam ‘s gold price was recorded at IDR 2,387,000 per gram, up from IDR 2,378,000 the day before. This indicates strengthening buying sentiment towards the close of the month.

Conclusion

Antam’s gold price movement today, November 27, 2025, shows stability with a tendency to strengthen at the end of the day. Although international spot prices experienced a slight weakening, the price in Rupiah remained competitive driven by a relatively stable exchange rate.

For investors who are considering buying gold bullion as a hedging instrument against inflation or market uncertainty, the current price is still attractive, especially with the consistent upward trend during November.

Also Read: Hedera (HBAR) Needs Nearly 40% Hike to Recover November Losses

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ Antam Gold Price Today

1. What is the price of Antam gold today (November 27, 2025)?

IDR 2,387,000 per gram.

2. Did the Antam gold price go up or down today?

Up, from IDR 2,378,000 yesterday to IDR 2,387,000 today.

3. How did the gold price trend during the month of November 2025?

It tends to rise, from a level of around IDR2,260,000 at the beginning of the month to above IDR2,380,000 at the end of the month.

4. What causes gold prices to fluctuate?

Global factors such as the world gold price (USD/oz), USD/IDR exchange rate, interest rates, inflation, and geopolitical tensions.

5. Is now a good time to buy gold?

Judging by the strengthening price trend towards the end of the year and the volatility of global financial markets, gold remains an attractive investment instrument for the long term.

Reference:

- HargaEmas.com. Accessed on November 27, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.