Who is Benjamin Graham?

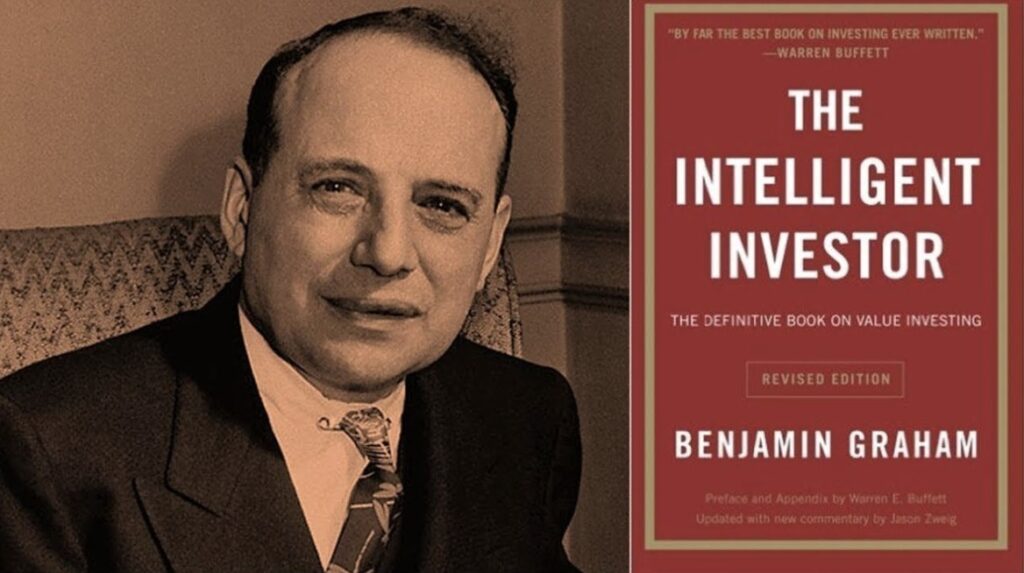

Jakarta, Pintu News – In the modern investment world, Benjamin Graham is often cited as the man who laid the foundation for the way legendary investors like Warren Buffett think.

He is not only a renowned financial analyst or book author, but also known as the “father of value investing” – an investment approach that focuses on the intrinsic value and safety of capital.

History of Benjamin Graham

Benjamin Graham – born Benjamin Grossbaum in 1894 in London – grew up in the United States after his family moved when he was young. Although his family experienced financial hardship during his childhood, it encouraged Graham to explore the world of finance, corporate analysis, and investing with a very cautious and systematic approach.

Read also: Google Stock Hits Record High, Nvidia Applauds Its Success!

He pursued a career on Wall Street at a brokerage firm, and became known for two monumental books: Security Analysis (1934, with David Dodd) and The Intelligent Investor (1949). These books laid the foundation for an investment approach based on intrinsic value and fundamental analysis – later known as “value investing.”

Warren Buffett’s Guru

Benjamin Graham is often referred to as the “father of value investing,” and one of his most famous students is Warren Buffett. Buffett himself admits to being heavily influenced by Graham’s teachings, and calls The Intelligent Investor one of the best works in the field of investing.

Their relationship was more than just teacher-student. Graham not only taught stock analysis techniques, but also provided the framework – disciplined, rational, and intrinsic value-focused – that later became the cornerstone of Buffett’s investment philosophy.

Graham’s legacy lives on through Buffett and many other investors; many modern investors still adopt his principles.

Benjamin Graham Net Worth

The specifics of Graham’s “net worth” are not widely discussed in modern literature – in contrast to contemporary figures who have public wealth estimates. The main focus that is remembered of Graham is not his own wealth, but rather his contribution to investment theory and practice.

But his legacy is far greater than material numbers. Through his books and teachings, Graham helped create an investment framework that has helped many people generate and maintain wealth sustainably. In other words: the value of his intellectual legacy arguably goes far beyond personal wealth.

Benjamin Graham’s Investment Principles

Benjamin Graham’s key investment principles are:

Principle #1: Always Invest with a Margin of Safety

Graham’s main principle is to buy stocks at prices far below their intrinsic value. The goal is simple: buy $1 worth of assets for just 50 cents. This provides a great profit opportunity while reducing the risk of loss.

Graham often picks stocks of companies whose current assets (minus debt) are even higher than their total market capitalization – known as the “net-net” strategy. That is, he effectively buys businesses for “free.”

Read also: What is Bluechip Stock and How to Buy It?

The advantages of this approach are:

- Provides protection if the business fails

- Provides the potential for high returns when the market realizes true value

Although many of Graham’s disciples developed their own styles, almost all of them stick to this important concept: margin of safety is the foundation of smart, defensive investing.

Principle #2: Expect Volatility and Profit from it

In the world of stocks, volatility is normal. Instead of panicking when the market goes down, smart investors see it as an opportunity to buy good stocks at low prices.

Benjamin Graham illustrated this with the fictitious character “Mr. Market”, an imaginary business partner who daily offers prices for buying or selling stocks. Sometimes he is very optimistic and offers high prices, sometimes pessimistic and offers low prices.

The main lesson:

Don’t let Mr. Market’s emotions influence your decision. Assess a company’s fair price based on rational analysis, not market moods.

Graham’s two strategies for dealing with volatility:

- Dollar-Cost Averaging (DCA)

Regular investment of a fixed amount, regardless of the market price. It reduces the risk of buying at peak prices, is suitable for passive investors, and does not require a specific time to determine when to buy. - Diversification between Stocks and Bonds

Graham suggests splitting a portfolio between 25% to 75% stocks and bonds, depending on market conditions. This strategy preserves capital during market downturns, while still providing growth through bond income.

It also prevents boredom, which can lead to risky speculation.

Principle #3: Know Your Investment Type

Benjamin Graham emphasized that everyone should understand their own character and investment approach, so as not to be trapped by false expectations or inappropriate strategies.

Active vs. Passive Investors

Graham divides investors into two main types:

- Enterprising Investor (Active)

Willing to put in the time and energy to do in-depth research for higher returns. For Graham, “results = work”, not simply “risk = reward”. The more effort and analysis put in, the greater the potential returns. - Defensive (Passive) Investor

Don’t have time for in-depth analysis? Graham suggests a simple approach like investing in a market index (e.g. Dow Jones or S&P 500 stocks).

The goal is to get overall market returns without the hassle of picking stocks individually, and avoid the risk of underperforming the market.

Many people think that a little extra effort can beat the market, but in reality, according to Graham, most who try actually get worse results.

Popular Benjamin Graham Quotes / Words

Benjamin Graham is known for many famous quotes that reflect his investment philosophy. Some of them are:

- “The intelligent investor is a realist who sells to optimists and buys from pessimists.”

- “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

- “An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.”

- “The investor’s chief problem, and even his worst enemy, is likely to be himself.”

These quotes show that for Graham, success in the capital markets is not about chance or speculation – but about discipline, rationality, and understanding that markets often act irrationally.

FAQ

Why is Benjamin Graham called the “father of value investing”?

Because he defined and popularized an investment approach based on a company’s intrinsic value, buying when stocks are undervalued, and emphasizing margin of safety – an approach that distinguishes between long-term investment and short-term speculation.

Is Graham’s investment method still relevant in this modern era?

Yes – principles such as fundamental analysis, margin of safety, and long-term investing remain relevant, especially for individual investors who want to avoid market volatility and speculation. Many modern and institutional investors continue to use Graham’s philosophy.

What is Benjamin Graham’s most important message for beginner investors?

The most important message is: don’t follow the emotions of the market. Investments should be based on a thorough analysis of the real value of the company, not based on hype or trends. Be patient, focus on the long term, and prioritize capital security with a margin of safety.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Investopedia. Benjamin Graham’s Timeless Investment Principles. Accessed on November 27, 2025

- Julia Kagan. Benjamin Graham: The Father of Value Investing and His Legacy. Accessed on November 27, 2025

- Scott Levine. Who Is Benjamin Graham? Accessed on November 27, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.