Bitcoin Holds Steady at $91,000 as Markets Anticipate Fed Rate Cut

Jakarta, Pintu News – The price of Bitcoin (BTC) has broken through the $91,000 level again after several weeks of decline. The rise comes as expectations rise that the Fed will cut interest rates in December.

In particular, J.P. Morgan predicted that the cut could happen in the upcoming FOMC meeting. Then, how will Bitcoin price move today?

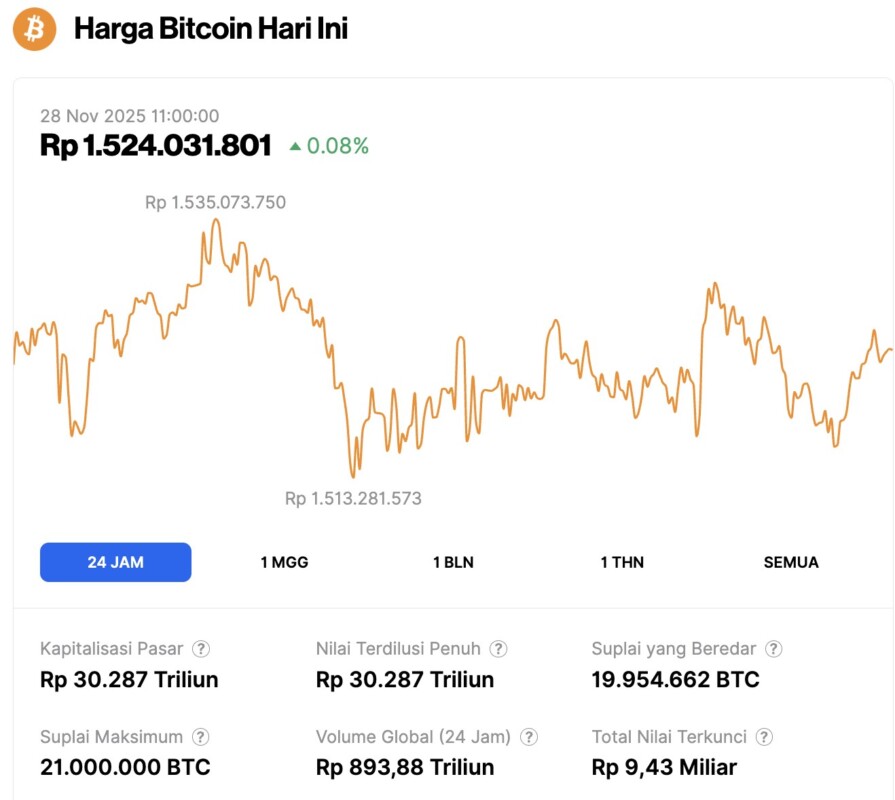

Bitcoin Price Up 0.08% in 24 Hours

As of November 28, 2025, Bitcoin was trading at $91,209, or approximately IDR 1,524,031,801, marking a modest 0.08% increase over the past 24 hours. During the same period, BTC’s price ranged between IDR 1,513,281,573 at its lowest and IDR 1,535,073,750 at its peak.

At the time of writing, Bitcoin’s market capitalization is estimated at IDR 30,287 trillion, while 24-hour trading volume has declined by 29%, down to IDR 893.88 trillion.

Read also: 3 Potential Altcoins Targeted by Crypto Whale amid Black Friday 2025 Discounts!

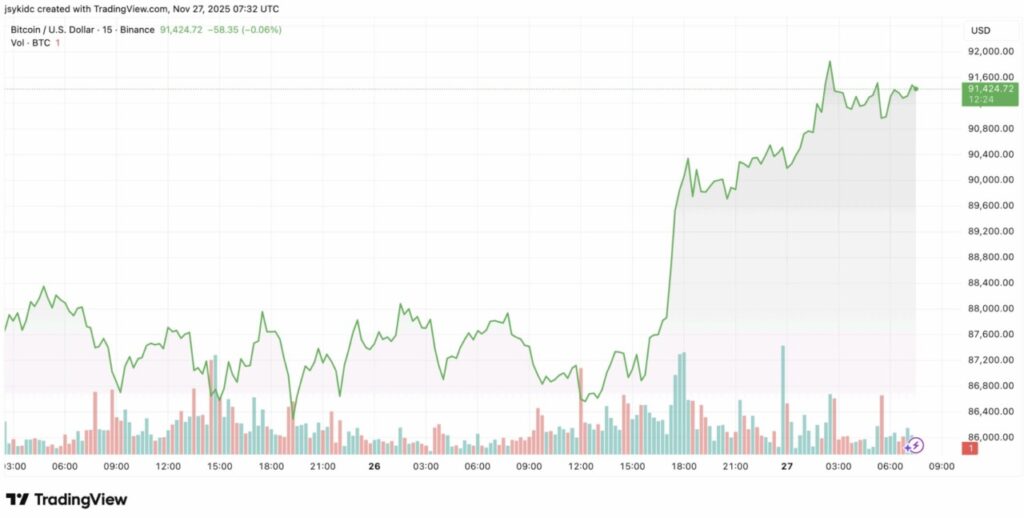

Bitcoin price recovers on hopes of Fed rate cut in December

The price of Bitcoin (BTC) has started to show recovery after experiencing a sharp decline. On November 27, the value of BTC had risen by 4.35%, although it still recorded a decline of nearly 20% in the past month.

This price increase was driven by market participants’ expectations of a possible interest rate cut by the Fed in December, following a change in sentiment among policymakers.

J.P. Morgan expects a 25 basis point rate cut in December. Previously, the banking firm expected the Fed to keep rates on hold until January, but now it seems to have changed its view.

This prediction refers to the statement of New York Fed President and FOMC Vice Chairman, John Williams.

“While the outcome of the next FOMC meeting remains uncertain, we now believe that recent statements from Fed officials point to a possible decision to cut rates in the next two weeks,” said J.P. Morgan economist Michael Feroli.

Meanwhile, Goldman Sachs added that the pending September jobs report also strengthened the case for further rate cuts. Many investors were already expecting additional cuts even before this latest prediction emerged.

Will the Fed Cut Interest Rates as Support Strengthens?

More and more Federal Reserve officials are now voicing support for an interest rate cut. On Monday, Fed Governor Chris Waller confirmed that he would vote in favor of a rate cut in December.

Waller stated that private employment data showed the labor market weakening faster than expected.

Read also: Gold Price Shows Weak Signals, Bitcoin and Ethereum Gain!

However, this view is opposed by Boston Fed President Susan Collins, who believes that inflation is still the main concern compared to the weakening labor market. Central bank officials are still discussing the direction of this policy.

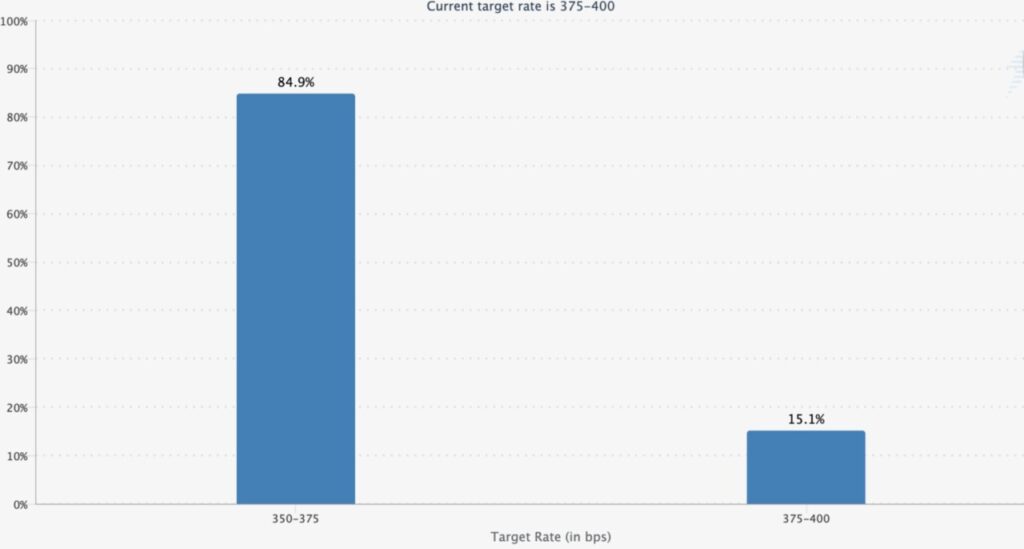

On the other hand, the futures market seems confident that the Fed will cut interest rates. Based on CME FedWatch data, market participants now estimate an 84.9% probability that a rate cut will be made in December.

In addition, former White House economist Kevin Hassett has been mentioned as a strong candidate for the next Fed Chair. President Donald Trump’s advisors stated that Hassett is the top choice in the selection process that is now almost complete.

Hassett is known as a proponent of aggressive interest rate cuts. It is no surprise that he is the President’s top choice, given that he has consistently pushed for such policies.

FAQ

What caused the recent rise in Bitcoin price?

The recent rise in the price of Bitcoin (BTC) is due to market expectations of an interest rate cut by the Federal Reserve (Fed) in December, which was triggered by a prediction from JP Morgan.

Who is in favor of a Fed rate cut in December?

Federal Reserve Governor Chris Waller has confirmed his support for an interest rate cut in December, based on data showing weakness in the labor market.

What are the chances of a Fed rate cut in December according to CME FedWatch data?

According to CME FedWatch data, the odds for a rate cut by the Fed in December are 84.9%.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Price Reclaims $91k as JP Morgan Predicts December Fed Rate Cut. Accessed on November 28, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.