Bitwise Set to Launch Avalanche ETF — Here’s What You Need to Know

Jakarta, Pintu News – Bitwise Asset Management will soon launch its latest product, the Avalanche Exchange Traded Fund (ETF) (AVAX), which has caught the attention of the crypto market.

With the recent announcement of the filing of amendments to the S-1 form with the U.S. Securities and Exchange Commission (SEC), the price of AVAX surged by 7%. This ETF is expected to give investors wider access to invest directly in Avalanche (AVAX) in a safer and more stable manner.

Details of Avalanche ETF by Bitwise

Bitwise has just announced plans to launch an Avalanche-based ETF that will trade under the ticker code “BAVA” on the NYSE Arca exchange, pending the green light from regulators.

Read also: Altcoin Season Not Coming? Crypto Analyst Reveals the Real Reason!

The ETF will charge a management fee of 0.34%, but as a strategy to attract early investors, Bitwise is offering a complete fee waiver for the first month or until the fund reaches $500 million – an approach they have previously used successfully for other altcoin ETFs.

Designed to provide direct exposure to the price movements of AVAX, this ETF tracks the CME CF Avalanche-Dollar Reference Rate index. Not only that, the ETF also brings added value through staking options as a secondary feature, providing passive income potential for its holders.

This move marks Bitwise’s commitment to continue delivering innovative crypto products in line with the dynamics of the digital asset market.

Institutional Engagement and Asset Retention

To ensure asset safety, Bitwise has teamed up with Coinbase Custody Trust Company as Avalanche’s asset custodian, while BNY Mellon will manage the fund’s cash operations. This partnership demonstrates Bitwise’s commitment to providing safe and reliable services in the management of this ETF.

As a sign of trust and commitment, Bitwise Investment Managers will purchase the first $2.5 million basket of shares at a price per share of $25, which includes 100,000 shares. This move is similar to the approach Bitwise took at the launch of the XRP and Dogecoin ETFs which also received great attention from retail and institutional investors.

Read also: Pi Network Rises 3% Today — Is the Rally Real or a Trap?

Market and Price Reaction of AVAX

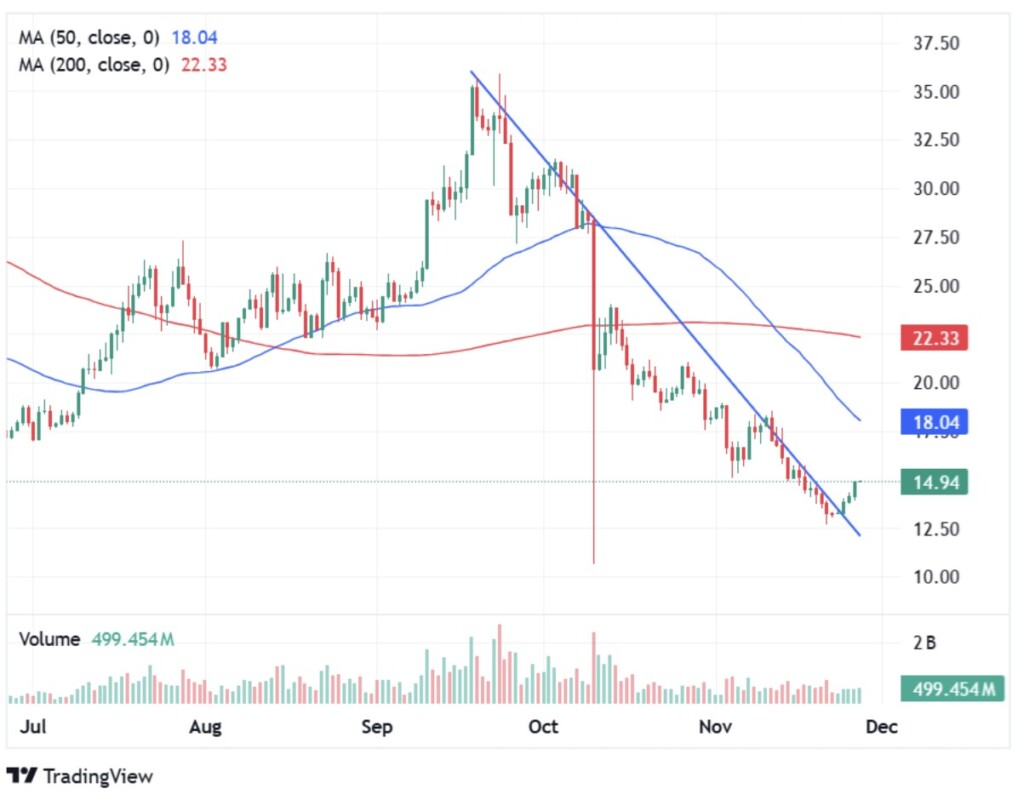

Following the latest announcement from Bitwise, the price of AVAX has surged by almost 7%, with a trading value close to $15 and a market capitalization of around $6.41 billion. Nonetheless, AVAX is still trading below its 50-day moving average of $18, which it needs to reclaim to confirm a stronger bullish trend.

The derivatives market showed mixed sentiments, with the total open interest of AVAX futures falling by almost 0.50% to $612 million on November 27. However, AVAX futures open interest on Binance and OKX exchanges saw a surge of 6%.

Overall, Bitwise’s launch of the Avalanche ETF marks an important step in the evolution of the crypto market, providing easier and safer access for investors to engage in the Avalanche market.

With its proven structure and strategy, the ETF is expected to be well received by the market and drive wider adoption of AVAX as an investment asset.

FAQ

What is the Avalanche ETF launched by Bitwise?

The Avalanche ETF is an investment product offered by Bitwise Asset Management, which gives investors direct exposure to Avalanche (AVAX) through the CME CF Avalanche-Dollar Reference Rate index. The ETF will trade under the ticker symbol “BAVA” on NYSE Arca.

How much is the management fee for Avalanche ETF by Bitwise?

The Avalanche ETF offered by Bitwise has a management fee of 0.34%. However, Bitwise waives the fee completely for the first month or until the fund reaches $500 million under management.

Who is responsible for holding Avalanche’s assets in this ETF?

Coinbase Custody Trust Company acts as the custodian of Avalanche assets, while BNY Mellon manages cash operations for the Avalanche ETF by Bitwise.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitwise Prepares to Launch its Avalanche ETF, Reveals Ticker & Fees. Accessed on November 28, 2025

- Coinpedia. Bitwise Files Updated Avalanche ETF Management Fee and Ticker Announced. Accessed on November 28, 2025

- CoinSpeaker. Bitwise is One Step Closer to Launching Avalanche ETF. Accessed on November 28, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.