Arthur Hayes Warns of Tether Risk If Bitcoin & Gold Drop 30% – Is USDT Safe?

Jakarta, Pintu News – BitMEX founder Arthur Hayes has just issued a strong warning about the potential risks facing Tether (USDT). According to him, Tether’s asset rotation to Bitcoin and gold could backfire if the market corrects deeply.

Is USDT at risk of collapse? Or is it just fear mongering? Here’s the summary.

1. Hayes: 30% Drop Could Make Tether “Bankrupt” in Accounting

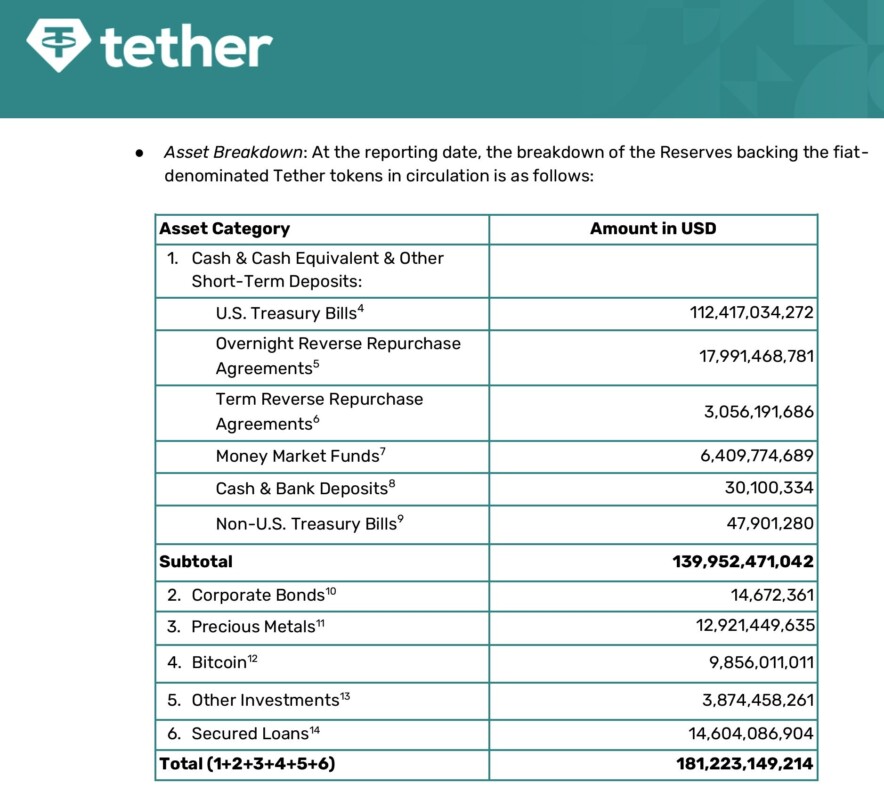

Hayes highlighted data from Tether’s Q3 2025 report that showed:

- Gold holdings: $12.9 billion

- Bitcoin holdings: $9.9 billion

According to him, this decision is an “interest rate trade” – an anticipation of a rate cut by the Fed, which could lower Treasury yields and raise BTC and gold prices.

However, if these two assets drop by 30%, Hayes claims Tether could lose all of its capital, despite remaining operationally liquid.

“Tether is betting solvency on volatile assets, not stable government debt.”

2. Community: Tether Remains Highly Liquid and Redemption Ready

UQUID Card’s CEO, Tran Hung, refutes Hayes’ scenario:

- US Treasury bills: $112.4 billion

- Repo agreements: $21 billion

- Total cash & cash equivalents: More than 70% of total assets ($181.2 billion)

Tether also passed a “stress test” during the FTX 2022 crisis, redeeming $25 billion in 20 days without any problems.

“During 2022, USDT proved that it can be redeemed in large amounts without faltering.”

Also Read: 7 Proper Ways to Save Money to Make Your Finances Safer

3. Tether’s leverage is high, but profits are also fantastic

According to Cory Klippsten (CEO of Swan Bitcoin), Tether’s structure is aggressive:

- Leverage: 26x

- Equity cushion: Only 3.7%

- Risky asset portfolio: Around 25%

While a 4% drop could wipe out equities, a 16% drop in risk assets could also have a big impact.

But Tether makes more than $15 billion in profit per year, and its owners just declared a $12 billion dividend – meaning they have the capacity to inject funds if needed.

Also Read: When will the Gold Price Drop Drastically? This is the Full Explanation

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Can Tether go bankrupt if Bitcoin and gold plummet?

In terms of accounting (equity), yes. But in terms of liquidity, Tether can still redeem USDT because the majority of its assets are still in the form of cash and short-term government securities.

Is Tether too aggressive?

Some analysts consider its leverage structure to be high. But Tether has high profitability and strong liquid assets.

Is USDT still safe to use?

Currently, yes. There is no evidence of default yet. But it’s important to monitor Tether’s asset allocation regularly.

What does S&P Global’s ‘5’ rating mean?

That’s the lowest rating in the S&P system for stablecoins, indicating high risk even though there have been no breaches.

Reference:

- Oluwapelumi Adejumo / BeInCrypto. Arthur Hayes Warns Tether ‘Macro Hedge’ Risks Equity Wipeout. Accessed December 1, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.