Pi Network Price Prediction and Outlook December 2025: Pi Coin will Rise or Fall?

Jakarta, Pintu News – Pi Network showed considerable resilience amid the crypto market correction in November, with mixed signals for December.

While Bitcoin (BTC) fell nearly 19% last month, Pi only saw a 2.6% decline, reinforcing its position as a defensive asset amid sluggish market conditions. Although seemingly stable, hidden tensions have the potential to change market dynamics in the early weeks of the last month of the year.

Pi Coin Affirms Negative Correlation with Bitcoin

Since its launch, Pi Network’s Pi Coin has shown unusual price dynamics. Throughout 2025, only February and May closed with gains, and now November is trying to join that short list.

Read also: Pi Network Price Plunges 8% Today: Will Pi Coin Trigger Altseason?

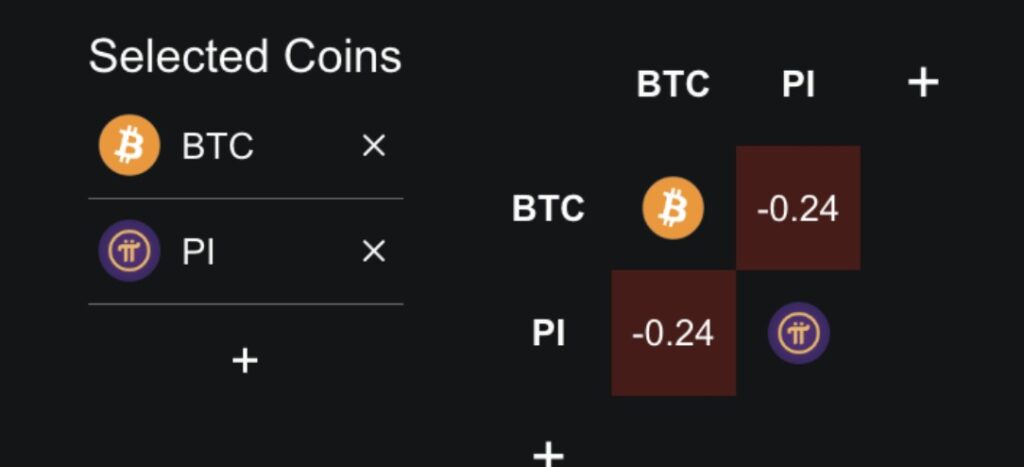

Most interestingly, Pi’s monthly correlation with Bitcoin is negative, currently standing at -0.24. This decorrelation gives Pi a structural advantage when major markets are weak.

In the past seven days, Pi has still recorded a gain of 2.7%, making it one of the most stable altcoins amid difficult market conditions. This resilience is partly explained by the opportunistic buying flows that came in when there was a massive liquidation in Bitcoin. However, this stability is no guarantee of a continuation of the uptrend.

Technically, chart analysts are beginning to identify signals that cast doubt on the strength of current price support. Pi is trading in a falling wedge pattern, which is generally interpreted as a bullish reversal pattern.

The price is currently testing the upper limit of the pattern at around $0.28. If it is able to break this level cleanly, there is potential for price expansion towards $0.36, even $0.46 if trading volumes increase. However, there are two technical indicators that are holding back this optimism.

Technical Divergence Indicates Weakness

On the 3-day time frame, the RSI indicator shows a hidden bearish divergence: while the price is forming lower highs, the RSI is printing higher highs, indicating that selling pressure is still dominant even though the price appears to be stabilizing.

Read also: Pi Network Beats Bitcoin and Ethereum in November 2025, Here’s the Key Catalysts

On the other hand, the CMF (Chaikin Money Flow) indicator is still in the negative zone and is testing its uptrend line – a worrying configuration, as in early October a similar pattern preceded a 42% drop in prices.

These signals suggest that Pi’s price resilience is more due to the absence of selling pressure, rather than any real accumulation from investors.

Three key areas will be of major concern this month:

- Upside (bullish): If the price manages to break $0.28, then there is an opportunity to rise to $0.36 and subsequently $0.46 – provided that the volume and CMF are positively supportive.

- Downside (bearish): If the price falls below the $0.20 psychological threshold, then the $0.18 and $0.15 levels are at risk of being tested, especially if Bitcoin’s recovery reverses Pi’s negative correlation and absorbs market liquidity.

As such, Pi’s price movement in December depends heavily on the behavior of the CMF indicator and the ability of the falling wedge pattern to push the price through $0.28.

Overall, Bitcoin’s long-term weakness could paradoxically benefit Pi as it attracts defensive capital, but without technical confirmation, a bearish trend remains the most likely scenario.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Investx. Pi Coin price forecast and outlook for December 2025. Accessed on December 1, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.