5 Facts about Bitcoin Price Drop to US$ 85,000 – Implications for Crypto Market!

Jakarta, Pintu News – The cryptocurrency market is on edge as the price of Bitcoin (BTC) corrected sharply to around US$85,000 – a drop that provoked many questions about how low the price could go and the impact it could have on the crypto market at large. Here are five key points discussed in the analysis based on the latest data and market sentiment.

1. A drop to US$85,000 signals major selling pressure

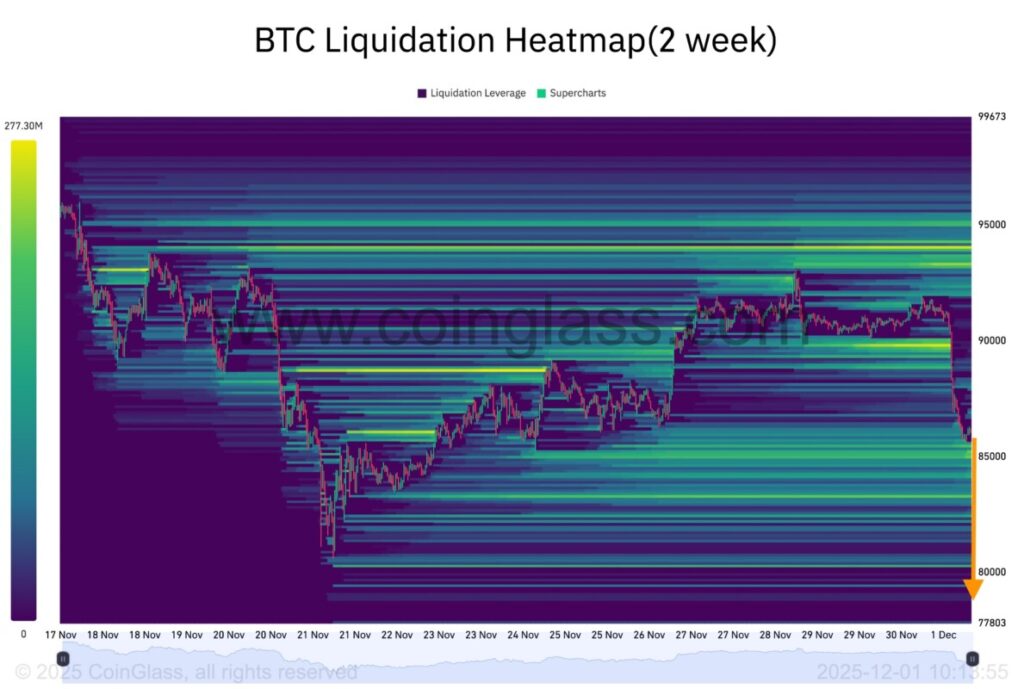

According to Cointelegraph, BTC’s price drop to around US$85,000 was recorded as a significant correction in the short term. The massive sell-off indicates that many longs were liquidated, adding pressure to the market. This suggests that the market is facing liquidity risk and negative sentiment simultaneously.

This kind of decline doesn’t just affect BTC – it tends to affect the entire crypto market, including altcoins – as investors will tend to withdraw funds from riskier assets. This could put the overall crypto market capitalization under pressure.

Also Read: 3 Stock Sectors Predicted to be Bought by Investors When the Technology Sector Weakens

2. Potential technical support tested – market enters vulnerable zone

With BTC around US$85,000, a number of technical support levels are crucial; if these fail to hold, the price could potentially fall further. The technical analysis in the article mentions that volatility is still very high, so movements could be quick up or down depending on market demands.

It is important for market participants to monitor trading volumes and market liquidity – as in low liquidity conditions, large buy or sell orders can cause extreme price movements. Hence, caution is required in the short term.

3. Implications for altcoins and non-Bitcoin crypto assets – risk flyer

BTC’s drastic drop is usually followed by a correction in altcoins, especially assets with small market capitalizations or projects with low liquidity. Cointelegraph warns that when the “top crypto” weakens, many altcoins could be hit by a domino effect, especially if investors choose to reduce risk and withdraw funds.

This is a challenging moment for altcoins and unestablished crypto projects – because despite their potential, market liquidity and volatility can significantly depress prices.

4. Chance of rebound if catalysts emerge – room for recovery remains

Despite the significant drop, analysts also highlighted that if there are positive catalysts – such as monetary policy, global liquidity, or institutional adoption – the crypto market has a chance to rebound. In that context, BTC could gain fresh support, and altcoins with strong fundamentals could become attractive options.

However, such a rebound is said to be highly dependent on external conditions: interest rate policy, the macroeconomic situation, as well as global capital flows into risky assets are key determinants.

5. The importance of risk management strategies and market vigilance

The drop to US$85,000 confirms that the crypto market remains highly volatile and sensitive to changes in sentiment. For investors and traders, it’s a reminder that large positions or high leverage carry great risk.

It is recommended that cryptocurrency holders consider liquidity, diversification, and investment horizon – and not rely exclusively on price predictions – as many external variables can affect the market quickly.

FAQ

Why did the price of Bitcoin drop to US$85,000?

As massive sell-offs and liquidation of long positions exacerbated the market pressure – plus the global negative sentiment towards risky assets.

Do altcoins automatically go down if BTC goes down?

Many altcoins tend to go down as corrections often spread across the crypto market, especially assets with small capitalization or low liquidity.

Can the price rebound from this point?

Yes – if positive catalysts such as global liquidity, institutional adoption, or macroeconomic stability emerge, crypto markets could receive renewed support.

What are the main risks now for crypto investors?

Risks include high volatility, low liquidity, global macroeconomic pressures, and the domino effect of corrections from BTC to altcoins.

What strategies are suggested in this situation?

Prudent risk management: avoid high leverage, consider asset diversification, and stay alert to liquidity indicators and global conditions before taking large positions.

Reference

- Cointelegraph. Bitcoin price slides $85K – How low can BTC go in December? Accessed December 2, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.