Antam Gold Price Chart Today December 2, 2025: Up or Down?

Jakarta, Pintu News – The Antam gold price on December 2, 2025 shows interesting movements amid global market dynamics and shifts in the rupiah exchange rate. Based on the latest data from HargaEmas.com, daily price movements, weekly charts, and the trend of the last two weeks provide a clear picture of the current direction of gold prices, both in the international spot market and Antam prices in Indonesia.

Spot gold prices fell slightly today

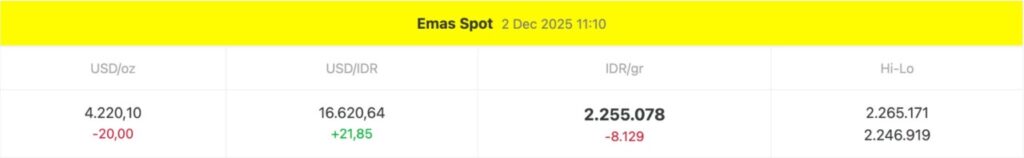

The international spot gold price on December 2, 2025 at 11:10 am WIB was at US$ 4,220.10 per ounce, down US$ 20.00 compared to the previous session. Based on HargaEmas.com data, this weakening occurred as the US dollar strengthened and market sentiment tended to lean towards risky assets.

In rupiah terms, the spot gold price stands at IDR 2,255,078 per gram, down by around IDR 8,129. Although the dollar price strengthened to IDR 16,620.64 per US$, the pressure on the gold market shows an alignment with global macro conditions and international bond yield movements.

Also Read: 3 Stock Sectors Predicted to be Bought by Investors When the Technology Sector Weakens

Spot Gold Rupiah Chart: Stable at Start of Day, Surges in the Afternoon

Based on a graph from HargaEmas.com, the movement of spot gold prices in rupiah on December 2, 2025 tends to be stable in the range of IDR 2.27 million until near noon. The new increase was significant after 12:00 WIB, following exchange rate adjustments and Asian market movements.

The chart shows that gold volatility increases ahead of the European and American trading sessions, a pattern often seen in global commodities. This intraday pattern helps market participants understand the moments that are usually the inflection points of the daily gold price.

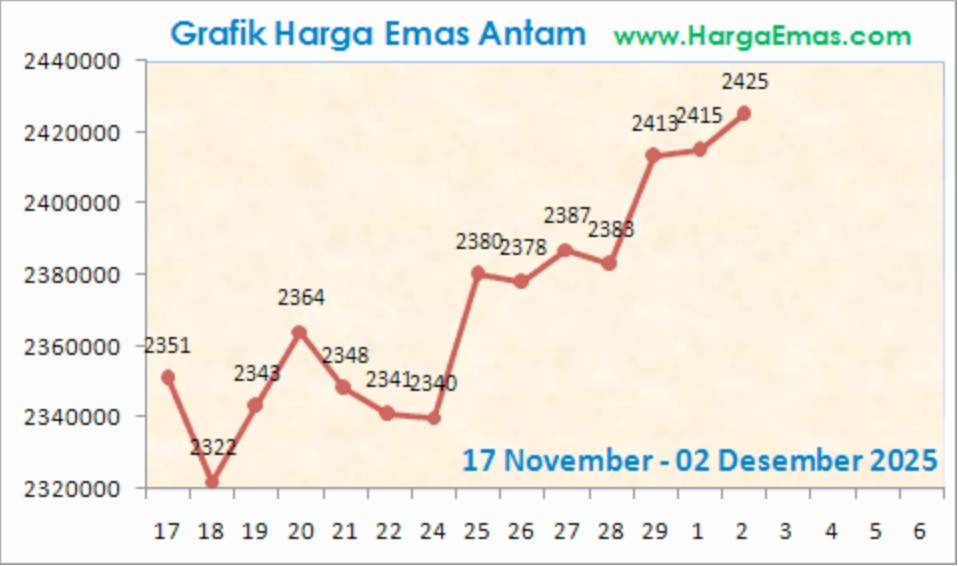

Antam Gold Price Chart November 17 – December 2, 2025: Consistent Uptrend

The movement of Antam gold prices in the period November 17 to December 2, 2025 shows a strong upward trend. Based on the HargaEmas.com chart, the price of Antam gold bars moved from around IDR 2,351,000 in mid-November and reached IDR 2,425,000 in early December.

The increase was driven by:

- Global market volatility

- Increase in domestic demand towards year-end

- Strengthening trend of safe haven commodities

Garik showed a zig-zag pattern, but overall formed a consistent bullish trajectory in the last two weeks.

What Does It Mean for Consumers and Investors?

Today’s data and charts show that Antam gold prices are still in a medium-term uptrend, despite the daily correction in spot gold prices. For domestic market players, the relatively stable movement of the rupiah makes changes in gold prices less sharp than the international market.

Overall, gold remains an important indicator to deal with global economic uncertainty, especially amidst central bank policy changes and US dollar exchange rate movements.

FAQ

Why did spot gold prices fall today?

Price weakness occurred due to the strengthening of the US dollar and movements in global bond yields that made investors temporarily switch from safe haven assets.

Why has the price of Antam gold increased in the last two weeks?

The increase was influenced by the global bullish trend, domestic demand, as well as the strengthening of safe haven commodity prices amid market turmoil.

Does the rupiah movement affect Antam’s gold price?

Yes, the rupiah exchange rate plays a big role. A rising US dollar usually increases the price of gold in rupiah even if the world spot price weakens.

Is it a good time to buy or sell gold?

The decision remains dependent on personal goals, needs, and time horizon. The chart shows a medium-term uptrend, but daily volatility remains a concern.

What is the general trend of gold prices in December?

Historically, gold often experiences increased demand at the end of the year, but remains sensitive to global monetary policy and the direction of the US dollar.

Reference

- HargaEmas.com. World Gold Spot & Antam Gold Price. Accessed on December 2, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.