Antam Gold Price Chart Today December 5, 2025: Up or Down?

Jakarta, Pintu News – Gold prices are again being discussed after daily chart data shows a stable movement but still attracts the attention of market participants. According to data from HargaEmas.com and GoldPrice.org, this trend is also in the spotlight because it occurs amidst the strengthening of the US dollar and the dynamics of the rupiah exchange rate.

This information is also monitored by traditional investors and cryptocurrency enthusiasts who use gold as an important metric indicator in reading global market sentiment.

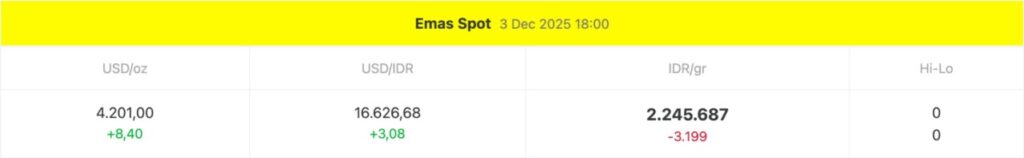

1. Global Spot Prices Strengthen Based on Market Data

According to GoldPrice.org spot price data, gold was at $4,201 per oz or around Rp69,981,443 using a conversion of Rp16,643 per US dollar. This data shows an increase of 8.40 points which according to market reports is considered a moderate strengthening that has received global attention. This movement is back in the conversation because it is considered stable even though risk-on markets such as crypto and stocks are receiving attention.

Based on GoldPrice.org’s intraday chart, gold prices moved in the range of IDR 2,238,500 to IDR 2,256,000 per gram throughout the day. The data shows relatively little volatility, attracting the attention of analysts who think the gold market is in a consolidation phase. This phenomenon is often discussed in the cryptocurrency community as gold is often used as a comparison to the movement of Bitcoin (BTC).

Also Read: Ripple CEO’s Shocking Prediction: Bitcoin Will Break $180,000!

2. USD/IDR Rate Strengthens According to Forex Data

According to USD/IDR data listed in the December 3, 2025 report, the exchange rate stood at 16,626.68 per dollar. Based on foreign exchange market information, this strengthening of the dollar has a direct impact on the value of gold in rupiah. This situation has again become a topic of discussion in various financial forums because the relationship between the dollar exchange rate, gold, and crypto assets such as Ethereum (ETH) is considered to be getting closer.

Market data shows that any small increase in the US dollar can affect domestic gold prices. According to the weekly economic report, this sentiment comes as a result of global monetary policies that analysts pay attention to. This relationship is an important metric that cryptocurrency investors often compare to understand macroeconomic direction.

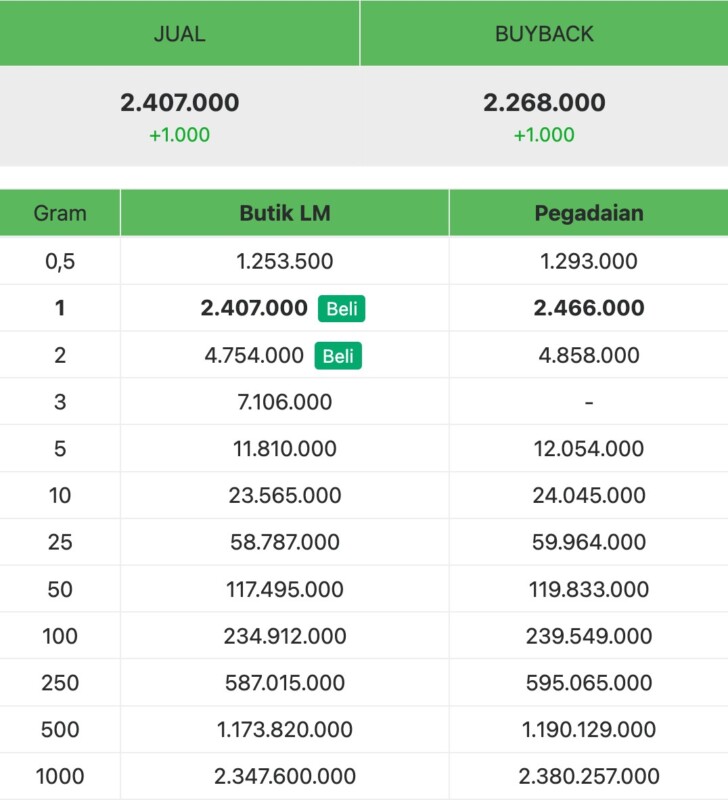

3. Antam Gold Price Has Increased According to the PriceEmas.com Report

Based on HargaEmas.com data, the selling price of Antam gold for 1 gram is at the level of IDR 2,407,000. This information mentions an increase of IDR 1,000 from the previous day, making it again a topic of discussion in the precious metals market. Some analysts say this small increase is common when global spot prices move up.

The same data also shows that the buyback price is in the range of IDR2,268,000. The difference in selling and buyback prices is an important indicator of liquidity according to gold market analyst reports. This price structure is monitored because it is often used as a reference when reading the direction of retail demand.

4. Gold Daily Chart Shows Stable Trend According to GoldPrice.org

The daily chart on December 4, 2025 shows a relatively stable movement. Based on the chart, the price is in a marginally strengthening zone and is the talk of the analyst community as it is considered to reflect healthy market conditions. This stability has brought gold back into the spotlight as a benchmark asset against resilient altcoins such as Ripple (XRP) or Solana (SOL).

According to commodity analysts, low volatility indicates that the market is not facing major external pressures. This data also impacts the expectations of cryptocurrency market participants who monitor the relationship between precious metals and digital assets. This creates a market dynamic that is often the subject of discussion in the financial media.

5. Gold Price Movement and Its Relevance to the Crypto Market

According to the observations of macro analysts, gold is often used as a global market risk indicator. The steady movement of gold prices based on spot data and daily charts is a reference for the cryptocurrency community to read risk trends. This connection is back in the spotlight as it is widely discussed along with the performance of altcoin gainers and the Pi Network project.

Market data shows that when gold stabilizes, some crypto assets tend to experience similar patterns in their volatility. According to digital asset analyst reports, this relationship is not a prediction, but simply an interpretation of macro dynamics. This phenomenon is often attributed to the behavior of whales that monitor hedged assets as a reference.

6. Impact of Antam’s Price Structure on Domestic Demand Direction

According to the HargaEmas.com report, Antam’s gold price structure by weight shows a discount per gram for larger denominations. This data often receives attention from institutional investors as it reflects market efficiency and demand. This type of data is also often evaluated in economic analysis.

The price for 100 grams, for example, was recorded at IDR 234,912,000, which according to precious metals analysts reflects a consistent trend in large-scale demand. This development is again a subject of discussion as it is considered representative of the health of the domestic market. The price structure is also often used as a reference in comparing physical gold and digital assets.

7. Market Implications: Gold Remains in the Spotlight Despite Crypto’s Attention

According to market reports, gold remains the asset to watch despite cryptocurrencies attracting huge attention. The steady price movement of gold based on spot data makes it one of the benchmark assets in macro analysis. It is being discussed again due to its relevance in diversification strategies for professional investors.

For global markets, gold data is used as one of the important components in reading inflationary pressures. According to macro analysts, the stability of gold reflects the market’s expectations of short-term risks. This situation is often compared to top crypto volatility as they complement each other in reading market conditions.

FAQ

What caused Antam’s gold price to be in the spotlight today?

Antam’s gold price is in the spotlight as data from HargaEmas.com shows a steady rise as global spot prices strengthen.

Why is the gold price chart stable throughout the day?

GoldPrice.org’s daily chart shows low volatility reflecting the lack of external pressure on the commodity market.

How does gold relate to the cryptocurrency market?

According to macro analysis, gold is a risk indicator that the cryptocurrency community often monitors to read global market sentiment.

What is the impact of USD/IDR strengthening on domestic gold prices?

According to exchange rate data, the strengthening of the dollar has increased the price of gold in rupiah, affecting the selling and buyback prices.

What factors affect daily gold volatility?

According to the intraday chart report, dollar movements and global market sentiment are the main factors shaping gold’s daily volatility.

Reference

- HargaEmas.com. Gold Price Chart Today. Accessed December 5, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.