5 Important Signals of BTC Volume Decline that the Market is Talking About!

Jakarta, Pintu News – The cryptocurrency market is back in the news after data showed a large drop in Bitcoin (BTC) trading activity during November. According to market analyst Darkfost, the slump in spot trading volumes on a number of major exchanges signals broader market pressures that could have long-term repercussions.

This situation took place amidst a consistent price correction, catching the attention of market watchers who monitor important metrics related to the movement of the top crypto asset.

21% Drop in Major Exchanges in the Spotlight

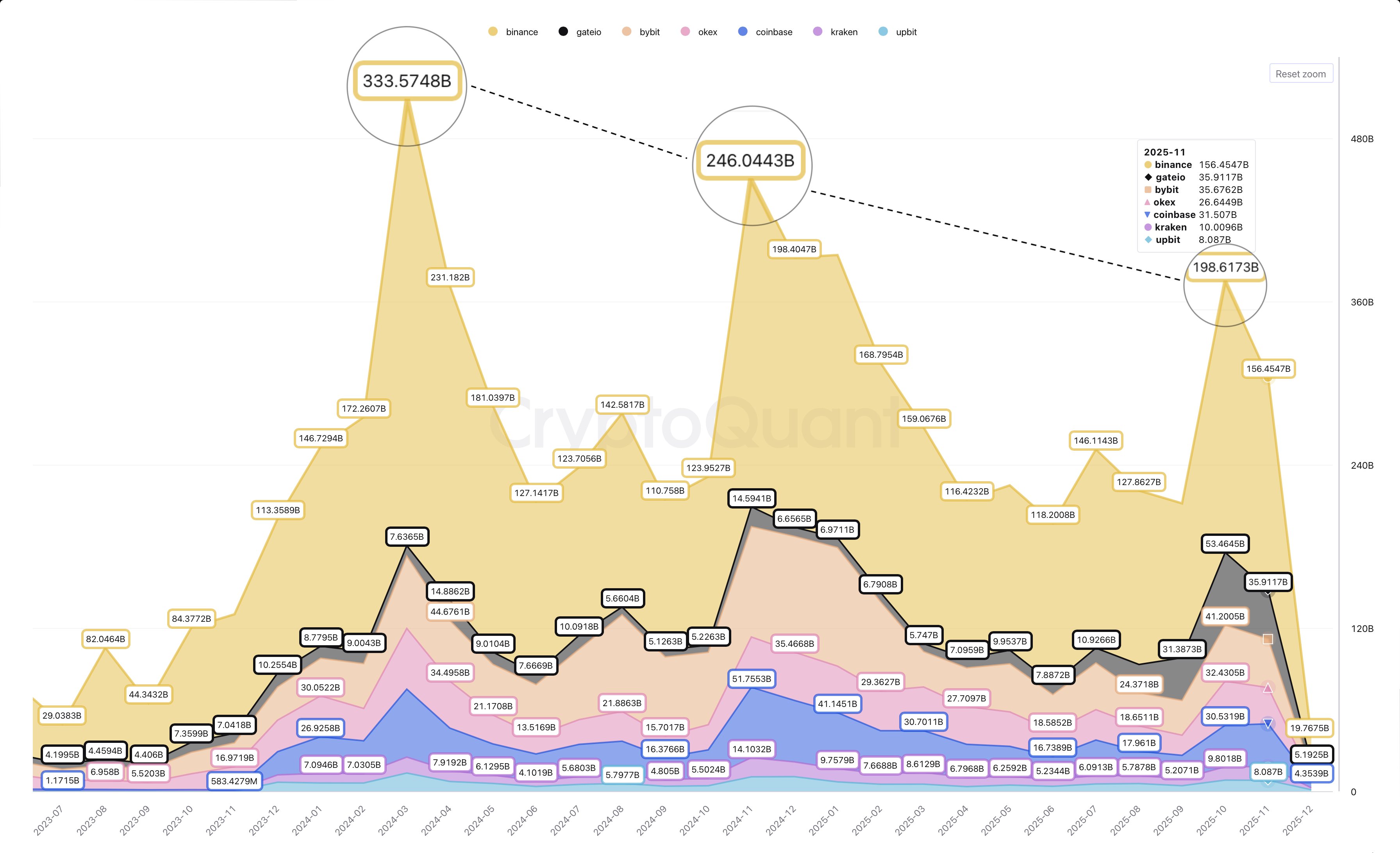

According to data cited by Darkfost, Bitcoin spot trading volume on Binance – which accounts for more than half of global spot trading activity – fell from $198 billion (≈ Rp3.29 quadrillion) in October to $156 billion (≈ Rp2.59 quadrillion) in November, a decline of around 21%.

This trend reflects a broader malaise in the cryptocurrency market, as a number of major exchanges also recorded declines. According to the same report, Bybit saw a 13.5% decline, Gate.io fell 33%, and OKX lost 18% during the period.

The drop in volume is directly related to Bitcoin’s 17.5% price weakness in the same month, according to Darkfost’s analysis. This data suggests that the selling pressure in the spot market continues to suppress volatility and trading interest.

This suggests that while Bitcoin remains the top crypto asset, interest in spot trading has fallen sharply and is being watched by institutional and retail market participants.

Also Read: 5 Important Facts from Bitcoin’s (BTC) Latest Prediction: US$125,000 Target?

Risk of Further Correction if Trend Continues into December

Darkfost explained that Bitcoin’s current price action, while significant, is not yet on par with the extreme corrections that have appeared in previous cycles. However, the analyst emphasized that if the trend of weakening volumes and prices continues into December, the market could potentially face continued selling pressure. In this context, the market could experience a decrease in liquidity, leading to a weakening of the price response.

Furthermore, Darkfost believes that declining investor confidence is a factor to watch. Increasingly quiet trading activity can lead to a bearish circle, where low volume makes it harder to establish a positive price trend. This situation suggests that crypto market participants need to monitor trading indicators as an important metric in spotting potential changes in market direction.

Continuously Declining Spot Volume Cycle

Based on data recorded by Darkfost, Bitcoin’s peak spot trading volume has been steadily declining in the past few monthly cycles. In March 2024, Binance recorded a trading peak of $333.57 billion (≈ €5.54 quadrillion), which then dropped to $246.04 billion (≈ €4.09 quadrillion) in November 2024, and fell back to $198.6 billion (≈ €3.30 quadrillion) in October 2025. This gradual decline signals a structural shrinkage of interest in spot trading.

In addition, the ratio of spot to futures trading volume now stands at 0.23, meaning that more than 75% of Bitcoin trading activity is dominated by the futures market. This suggests that while the market remains active, investor interest is mostly directed towards leverage and short-term speculation. According to Darkfost, the data shows that the spot market is losing traction in the current cryptocurrency ecosystem.

Bitcoin Price Impact and Potential Additional Pressure

With Bitcoin price hovering around $89,300 (≈ Rp1.48 billion) and showing a 0.21% decline in the last 24 hours, market pressure is expected to persist. Darkfost thinks that short-term price movements are likely to be heavily influenced by the stability of spot trading volumes. Consistent volume declines can be an important indicator in predicting market direction as low volumes are often associated with weakening price trends.

The crypto market as a whole is still being monitored in the context of macro uncertainty and volatile investor interest. This suggests that market participants should pay close attention to volume dynamics, both to avoid excessive risk and to understand potential trend reversals. In this regard, the data presented by Darkfost sheds light on the structural pressures that could affect the market in the coming months.

Also Read: 10 Ways to Learn Crypto from Zero: Basic Guide to Start Investing Safely

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What was the main cause of the decline in Bitcoin trading volume in November?

The decline was mainly triggered by a 17.5% drop in Bitcoin price and reduced interest in spot trading on major exchanges such as Binance, Bybit, Gate.io, and OKX.

Why is a drop in spot volume considered important to analysts?

Spot volume is used as an indicator of market liquidity; a significant drop could signal weak investor confidence and the potential for further price pressure.

How do spot and futures trading volumes compare today?

According to Darkfost data, the spot to futures volume ratio stands at 0.23, meaning that more than 75% of Bitcoin trading now takes place in the futures market.

What are the risks if the downward trend continues into December?

Risks include continued selling pressure, reduced liquidity, and the potential for a bearish loop that aggravates the formation of a positive price trend.

Why is the trading volume cycle a concern?

The data shows repeated declines in volume peaks, which could illustrate the diminishing structural interest in BTC spot trading over the long term.

Reference

- NewsBTC. Bitcoin Market Records 21% Crash in November Trading Volume, What This Means for Price. Accessed on December 8, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.