3 Altcoins Gaining Whale Attention Ahead of the December 2025 FOMC Meeting

Jakarta, Pintu News – The FOMC meeting on December 9-10 is in the spotlight as market participants expect a possible 25 basis points rate cut. This move could potentially provide a short-term liquidity injection into risky assets.

However, the crypto market still moved cautiously, recording a decline of around 1.1% ahead of the announcement. Even so, some large investors (crypto whales) started taking positions early.

Some tokens are showing increased accumulation by whales, and some are even showing recovery patterns or potential breakouts on their price charts. This article will discuss three such tokens.

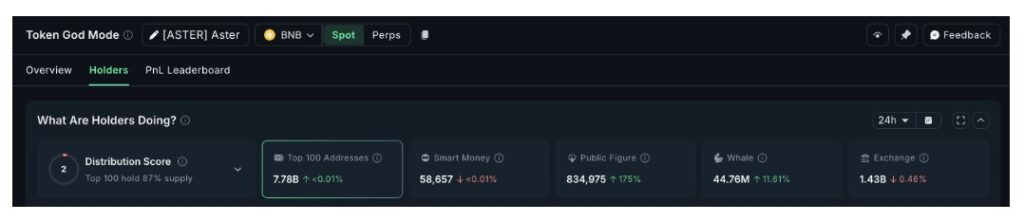

Aster (ASTER)

Aster (ASTER) showed one of the strongest accumulation signals from crypto whales in 24 hours (9/12).

Read also: Dogecoin Could Soar 114% — But It All Depends on This Key Support Level

Despite the token’s price dropping 4% today and more than 10% in the past month, the whales have increased their holdings by 11.61%, bringing the total to 44.76 million ASTER, with an average price close to $0.93. This means they have bought around 4.67 million tokens, worth almost $4.34 million at current prices.

Accumulation on weakness is often a sign that whales are anticipating a change in market conditions, especially after the FOMC meeting results are announced.

The ASTER price chart also supports this analysis.

Between November 3 and December 7, Aster prices formed higher lows, while the RSI (Relative Strength Index) – a momentum indicator – printed lower lows. This pattern is known as a hidden bullish divergence, which usually indicates a continuation of the uptrend and a weakening of selling pressure.

A similar pattern also emerged between November 3 and November 29, during which time Aster rallied around 22%. The whales seemed to speculate earlier that a similar reaction could occur if market sentiment returned to favor risky assets post the interest rate decision.

In addition, ASTER’s price is currently moving in a narrowed triangle pattern, which usually reflects indecision between buyers and sellers before a big move. The first resistance level to break is $1.01. If successful, the price could potentially head towards $1.08, and could even jump higher to around $1.40.

However, this technical structure will fail if the price drops below $0.89 – which could open the way to $0.84 and invalidate the potential uptrend continuation that the whales are observing.

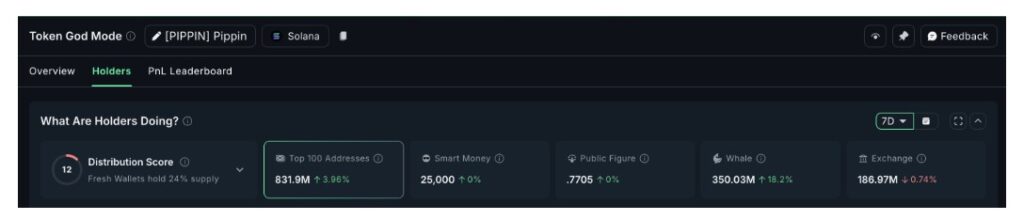

Pippin (PIPPIN)

Pippin became the second token to show significant accumulation from large investors (crypto whales) ahead of the FOMC meeting in December.

In the past seven days, the whales have increased their holdings by 18.2%, bringing the total to 350.03 million PIPPIN. This means they bought about 53.9 million PIPPIN tokens, worth about $9.75 million at current prices.

In addition, the top 100 addresses (which include mega whales) also added to their positions, with holdings rising by 3.96%. When both whales and other large holders accumulate during a slowing market phase, it often reflects a belief that a new move is about to form.

PIPPIN’s price action supports this view. Pippin’s price rose 3.06% in the last 24 hours, after a week of relative calm. However, on a monthly basis, the token still recorded a gain of over 400%. The current price structure resembles a bull flag pattern – an uptrend continuation pattern that forms when a strong rally pauses.

Accumulation by whales amid this consolidation phase suggests that they are anticipating a potential spike in volatility after the FOMC decision.

To confirm a breakout from this pattern, Pippin needs to break the $0.21 and $0.26 levels. The main breakout can only be considered valid if the price is able to cross $0.34, which has been a strong resistance zone since Pippin peaked.

Currently, the price of PIPPIN has broken the upper trendline of the flag pattern, but it needs a clean daily candle close above $0.21 to confirm the move.

If the price of PIPPIN drops below $0.14, the pattern structure starts to weaken. A further drop below $0.10 could invalidate the bull flag pattern completely and open the risk to deeper support around $0.08. But so far, the whales seem to see this consolidation phase as an opportunity, not a sign of trend exhaustion.

Read also: Altcoin Season Begins? Analysts Predict ETH/BTC Chart to Resemble 2017 Bull Run

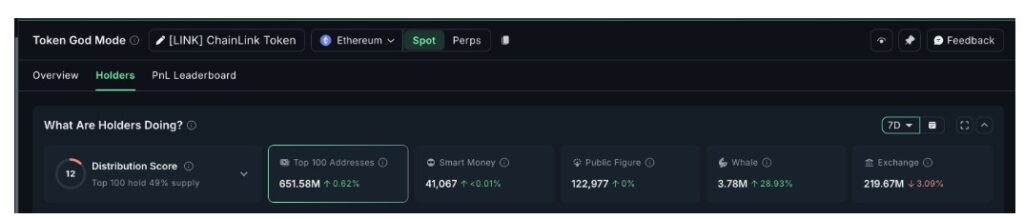

Chainlink (LINK)

Chainlink (LINK) became the third token to show steady accumulation interest from large investors (crypto whales) ahead of the December FOMC meeting and potential interest rate cuts.

In the last seven days, the whales have increased their holdings by 28.93%, totaling 3.78 million LINKs. At current prices, these additional positions are worth around $11.5 million.

Top-100 addresses also added 0.62% to their holdings, while the balance on the exchange fell by 3.09% – a general sign of increased demand from both large and retail investors.

The whales’ conviction is in line with the pattern shown by LINK’s 12-hour chart.

LINK’s price rose 12.5% in the past week, indicating a short-term uptrend. Between December 7 and 9, the price formed a higher low, while the RSI indicator printed a lower low – a hidden bullish divergence pattern. This pattern usually indicates a continuation of the uptrend, as it shows that selling pressure is starting to weaken even though the price remains at higher levels.

For this pattern to be confirmed, LINK needs to break the $13.72 level with a convincing 12-hour candle close. A stronger resistance is at $14.19, which was previously a rejection point for LINK’s price.

If this level is successfully broken, the price has the potential to continue rising to $14.95, and if the momentum continues, the next target is $16.25 as the next big resistance zone.

However, if the market turns more cautious after the FOMC results are announced (risk-off), the first support level to watch is $12.97, which is also the 0.618 Fibonacci zone. If this level is broken downwards, the price could drop towards $11.75, which has been a strong support level since December 1.

Currently, the whales are accumulating heavily amid the emergence of a hidden bullish divergence on the LINK chart. This creates a scenario where even a slight injection of liquidity from the FOMC outcome could extend the ongoing uptrend.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Crypto Whales FOMC Buying Accumulation Analysis. Accessed on December 10, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.