Dogecoin Sees a Sharp Drop — Is a Rebound to $0.30 Still Realistic?

Jakarta, Pintu News – Dogecoin (DOGE) price is attracting attention again as signals on various key indicators strengthen. The change in structure creates a clearer reaction around the December support level. Buyers are expected to respond faster at important levels, while sellers are starting to lose control in the area of the recent price lows.

DOGE’s price movement is showing improvement in the short-term cycle. Analysts note a stronger response at key inflection areas. Currently, the Dogecoin price is approaching the zone that usually determines the direction of movement in the short term.

So, how is the Dogecoin price moving today?

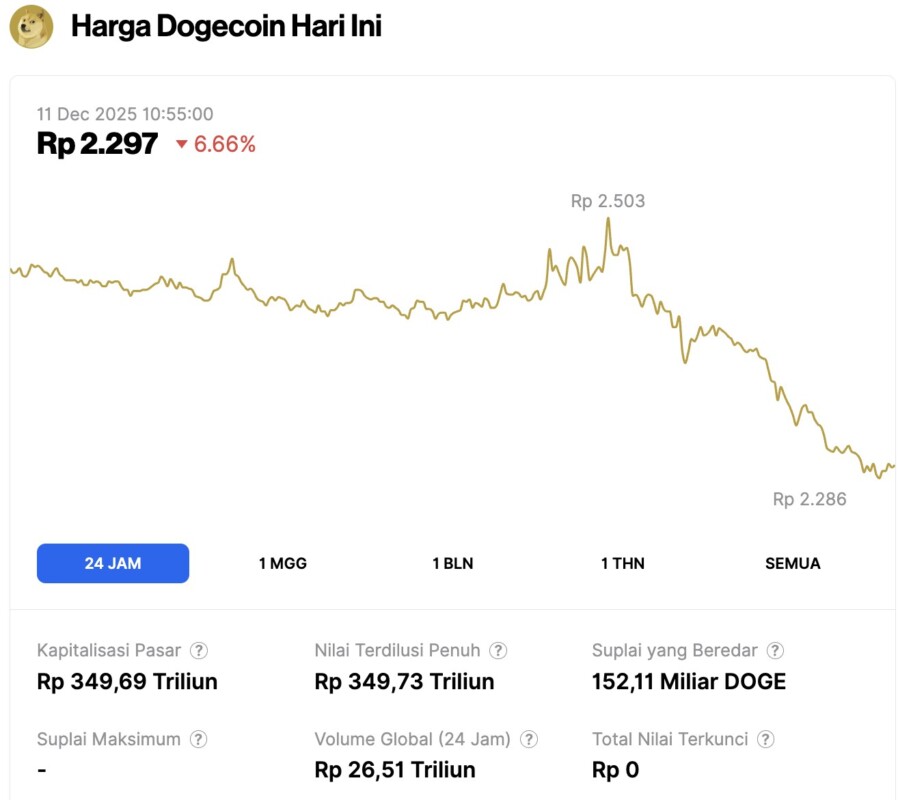

Dogecoin Price Drops 6.66% in 24 Hours

On December 11, 2025, Dogecoin saw a 6.66% drop over the past 24 hours, trading at $0.1381 — roughly IDR 2,297. During that time, the price of DOGE fluctuated between IDR 2,503 and IDR 2,286.

At the time of writing, Dogecoin’s market capitalization is approximately IDR 349.69 trillion, with a 24-hour trading volume of around IDR 26.51 trillion.

Read also: Dogecoin Could Soar 114% — But It All Depends on This Key Support Level

MACD Crossover Highlights Dogecoin Price Setup

Tardigrade traders confirmed the formation of a bullish crossover signal on the weekly MACD indicator on the price chart. Currently, the market valuation of DOGE stands at $0.143, with the MACD line starting to move up over the signal line.

The green histogram bars appear to be increasing consistently, with each bar larger than the previous. This is a strong indication of aggressive buying intentions from the start. Inoversold conditions, the pressure from sellers starts to weaken.

DOGE price is showing higher candlestick bodies in the last few sessions. Every time the price is tested downwards, thelower wick is getting smaller. The panic supply disappears, and the market structure starts to stabilize. Buyers began to actively respond in the demand zone.

The slope of the trend line has also increased with a neater spacing, reflecting the dominance of the buying force. As such, the Dogecoin price is entering a more constructive phase, supported by strong initial technical signals.

Structure Supports DOGE’s Higher Price Target

The current price of DOGE continues to press the upper limit of the regression channel with increasingly stronger intentions. Every time the price returned to the $0.135 level, the buyers were quick to take positions and defend the area.

The lower candlestick shadows (wicks) that appeared in some sessions indicated a failed downside attempt. The candlestick bodies also began to approach each other within the channel, signaling price consolidation.

The downward pressure started to weaken as the price movement narrowed towards the end of December. The next direction of movement is determined by the pivot at $0.150. If the price manages to break $0.155, then the opportunity opens towards $0.181.

Continued growth above that range opens the way towards $0.210. After that, there is a relatively clear space to head towards $0.270. The $0.210 level becomes the next obstacle before the big target at $0.30 can be reached. In each market reaction cycle, buyers show greater activity, while sellers are no longer able to push the price to lower levels.

Read also: Ethereum Price Dips Back to $3,100 — Is a Bullish Crossover on the Horizon?

As such, the DOGE price outlook going forward is likely to point towards a measured attempt to reach higher levels, including the $0.30 zone.

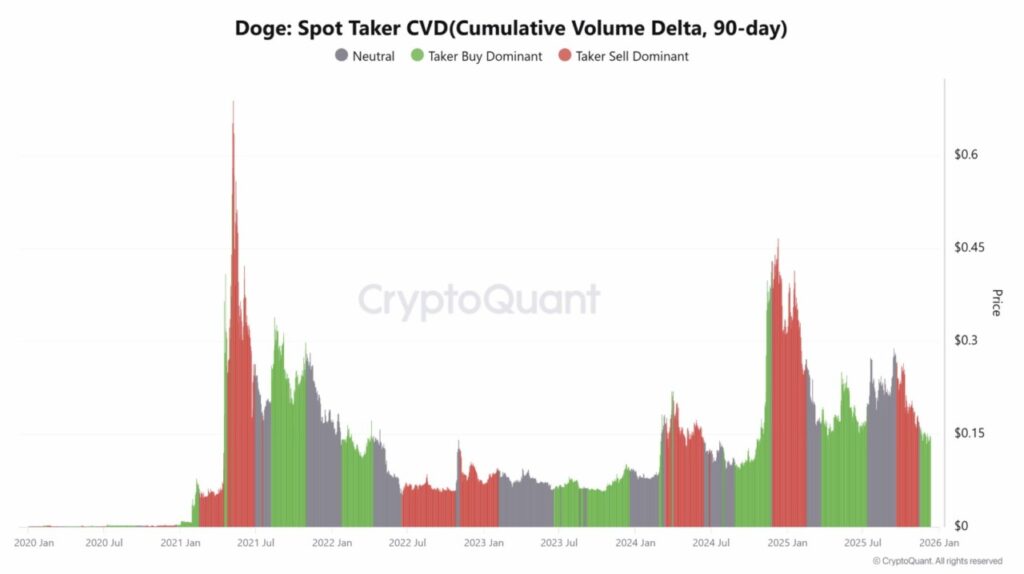

Strong Buyer Control Seen in CVD Spot Takers

The Spot Taker CVD indicator shows a slow rise on the buying side. The slope of the chart is stable without sharp spikes, which indicates the seriousness of the active buyers. The price of DOGE rises every time CVD strengthens.

The buyers consistently maintained the same demand area in each retest. The sell orders did not manage to print a new low. The price bounce corresponds to a green candlestick tightening pattern on the lower time frame. The strength of this CVD aligns with the weekly bullish crossover signal on the MACD.

The congruence between the two creates confidence in the larger market structure. The flow of movement driven by spot transactions helps direct DOGE prices more clearly, especially in the early phases of trend reversals.

The intraday cycle shows the dominance of activity from the buyers’ side. This opens up opportunities for development towards the higher resistance zone.

Overall, the Dogecoin price is now entering a more decisive phase with the support of increasingly strong technical signals. Buyers are guarding key areas and halting previous downside attempts. The MACD crossover is an additional supporting factor in this trend switch.

As such, DOGE has a clear path to higher levels, with a medium-term target of around $0.30.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Dogecoin Price Eyes $0.30 as Bullish Crossover Pattern Signals a Trend Shift. Accessed on December 11, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.