5 Factors for Bitcoin (BTC) to Return to a Bullish Trend Ahead of the Start of 2026!

Jakarta, Pintu News – Bitcoin (BTC) slipped back below $90,000 in early Asian trading, according to a report by BeInCrypto. This weakness comes despite the Federal Reserve cutting interest rates for the third time this year, a policy that is usually a positive catalyst for risk assets.

Bitcoin’s price movement in the opposite direction confirms that macroeconomic support is no longer enough to restore the bullish trend without other fundamental factors.

1. Volatility Pressure and Monthly Performance According to BeInCrypto Data

BeInCrypto Markets reported that December was a month of volatility for Bitcoin, continuing two consecutive months of decline. November even recorded the biggest loss of the year for the largest cryptocurrency. This data highlights the ongoing market pressure on BTC.

Bitcoin price is now hovering around $89,885, down 2.7 percent in the last 24 hours, according to the report. Despite macro catalysts such as interest rate cuts, the price response shows weak buying momentum. This confirms that domestic crypto market sentiment plays a bigger role than external factors.

Also Read: 5 Strong Signals from Dogecoin: Price Resilience, New Adoptions, to $1 Potential!

2. The Role of Liquidity as a Bullish Trend Determinant According to Analysts

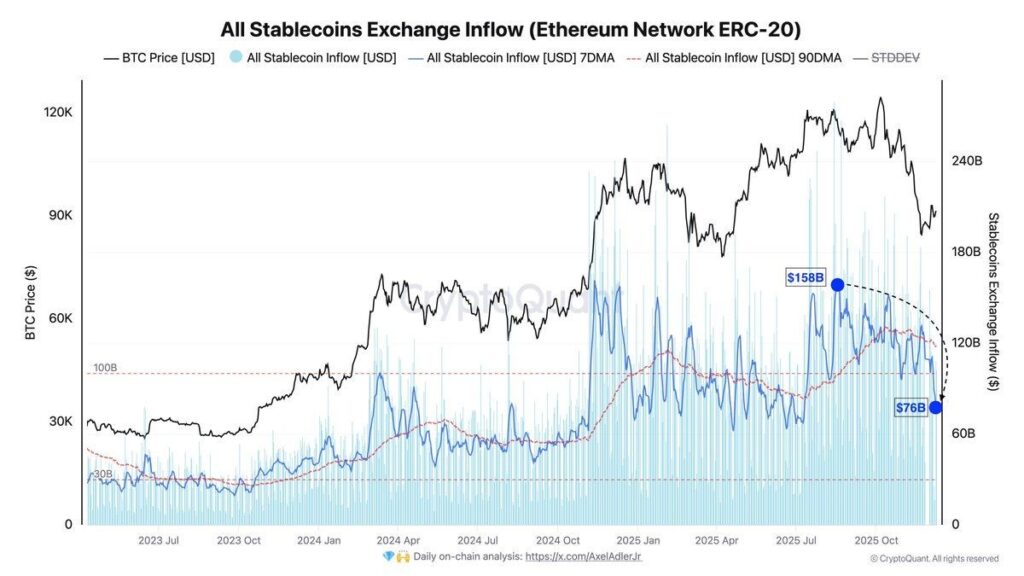

According to Darkfost analysts quoted by BeInCrypto, the amount of stablecoins coming onto exchanges has decreased dramatically. From a peak of $158 billion in August, the figure has dropped to around $76 billion, representing a decline of almost 50 percent. This trend indicates a weakening of liquidity, which is usually the main fuel for Bitcoin’s bullish movement.

The 90-day average also fell from $130 billion to $118 billion, according to the analyst’s observations. Darkfost asserts that the recovery of the bullish trend requires an influx of fresh liquidity into the crypto market. Without fresh cash flow, the upward movement will be difficult to sustain and is likely to be capped by selling pressure.

3. Market Sentiment and Investor Behavior Still a Major Challenge

BeInCrypto highlighted that in addition to liquidity, market sentiment needs to undergo significant improvement. High levels of fear and low investor engagement are said to continue to hinder capital rotation into Bitcoin. This suggests that the market is still in a defensive phase.

A change in sentiment is needed for capital to start flowing back into risky assets like Bitcoin. This means increased investor confidence in BTC’s medium- and long-term prospects. However, a recovery in sentiment usually requires a strong trigger, such as positive economic data or an apparent technical recovery in the market.

4. Combination of Internal and External Factors Needed for a Sustainable Rebound

According to the analysis quoted by BeInCrypto, the Fed rate cut is not enough to have a positive impact because the internal pressure of the crypto market is more dominant. Decreased liquidity and low participation are still the main obstacles to the recovery trend. This shows the need for synergy between macro and micro factors to restore the bullish trend.

In this context, the report emphasizes that Bitcoin needs stronger triggers than just monetary policy. Factors such as increased on-chain activity, growth in the derivatives market, or a surge in institutional capital flows could be additional catalysts. Without such support, a major recovery is likely to be delayed.

5. Market Indicators to Watch to Gauge Potential Trend Reversals

BeInCrypto mentions that the most noteworthy indicators right now are liquidity flows and sentiment metrics. A decline in stablecoin flows illustrates the weak purchasing power available within the ecosystem. Until those metrics improve, the pressure on Bitcoin is likely to continue.

In addition, the dynamics of investor behavior-including trading volume, futures open interest, and ownership distribution-will be additional signals in assessing the strength or weakness of a trend. These indicators provide a snapshot of market conditions that are often not apparent from price movements alone.

Also Read: 5 Highlights of TRUMP Meme Coin’s $1 Million Game Campaign: New Strategy to Boost Token Value?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What caused the latest drop in Bitcoin price?

According to BeInCrypto, the decline was due to weakened liquidity and negative market sentiment despite interest rate cuts by the Federal Reserve.

What is the current Bitcoin price based on the report?

BeInCrypto reported that Bitcoin is trading around $89,885 with a 2.7 percent drop in the last 24 hours.

Why is liquidity important for Bitcoin’s trend recovery?

The report explains that liquidity-as seen in the flow of stablecoins to exchanges-is an indicator of the market’s ability to support a sustained upward movement.

How does market sentiment affect Bitcoin’s movement?

Negative sentiment discourages investors from participating, resulting in lower demand for Bitcoin. Conversely, positive sentiment can attract new capital flows.

What factors are needed to restart Bitcoin’s bullish trend?

According to the cited analysis, Bitcoin needs increased liquidity and improved market sentiment for the bullish trend to re-establish itself sustainably.

Reference

- BeInCrypto. Bitcoin Bullish Trend Recovery in December 2025. Accessed on December 12, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.