4 Crucial Charts That Will Determine Bitcoin’s Price Outlook by the End of 2025

Jakarta, Pintu News – The crypto market is entering the end of the year with growing pressure, and Bitcoin (BTC) is making its way towards Christmas 2025 in a fragile but signaled state. BTC’s price hovering around $93,000 (Rp1.55 billion) reflects a market that is in the final phase of a correction but has yet to find a clear bullish trigger.

Four key charts reveal deep dynamics: huge losses of short-term holders, new whale capitulations, the dominance of macro conditions especially real interest rates, and the re-emergence of aggressive buyers in the spot market. This combination of factors forms a complex picture of Bitcoin’s direction in the coming weeks.

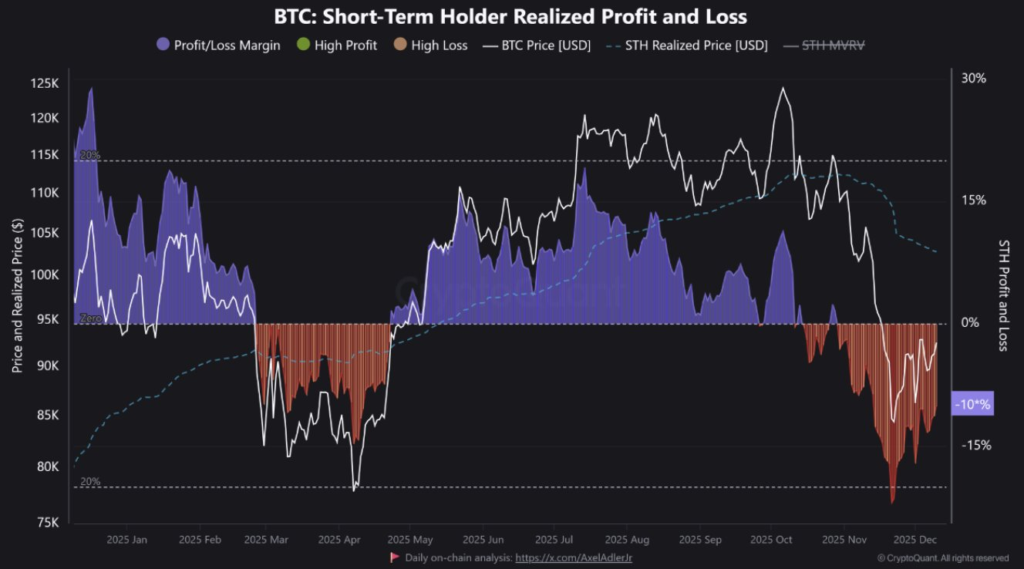

BTC Short-term Holders Still Trapped in Losses

The first data shows that Bitcoin’s short-term holders (STHs) are in the most painful phase of the year. This group bought BTC in the last few months and is now carrying an average loss of around 10%.

The realized price chart shows that the market prices are still below their average buying price, signaling continued selling pressure. In this situation, any small gains are likely to be capitalized on to exit at breakeven.

While this may seem negative, this phase of deep losses usually comes at the end of a correction. The lack of long-term selling pressure means that most of the vulnerable market participants have been eliminated.

Historically, a new bullish signal is formed when the price manages to break back above STH’s realized price. Until that moment happens, BTC is likely to remain trading in a sideways pattern with the risk of additional corrections.

New Whales Begin to Surrender, Signaling Capitulation at the End of the Cycle

The second chart shows the behavior of the whales, especially the new whales who bought a lot of BTC at high levels. In recent days, this group has recorded daily losses of up to $386 million, one of the biggest capitulation points this year. This massive selling signals strong emotional and financial pressure on large market participants who are late entrants.

Also read: Many Bitcoin Whales Rise from the Grave in 2025: A Bull Run or a New Crisis?

In contrast, old whales remain more stable and do not show similar capitulation patterns. The transition of ownership from new whales to stronger holders is usually an important foundation towards the recovery phase. While this capitulation may cause a short-term downturn, in the medium term it consolidates the market structure. Once major selling pressure subsides, crypto markets tend to be more resilient to subsequent shocks.

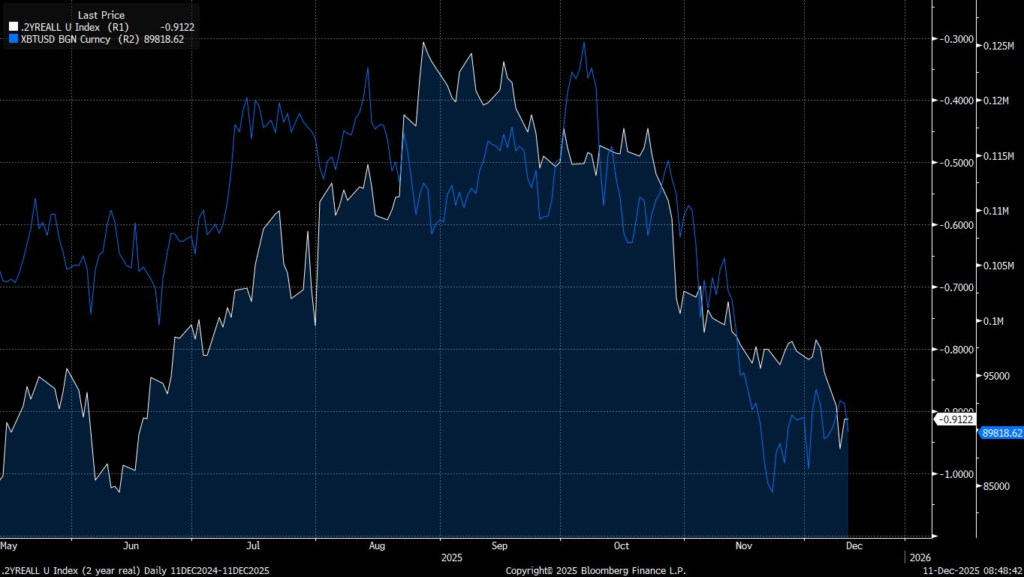

US Real Interest Rates Still Controlling Bitcoin’s Direction

The third chart relates Bitcoin’s movement to the real interest rate on two-year US Treasury bonds, one of the most important macro indicators this year. Throughout 2025, BTC moved almost in line with changes in real interest rates. When real interest rates fell, Bitcoin rose as liquidity increased. But in recent months, real interest rates have risen again, putting the cryptocurrency’s price expansion on hold.

Interest rate cuts by the Federal Reserve are fundamentally insufficient if inflation is also falling faster, as that actually raises real interest rates. As long as real conditions remain tight, risk-taking in the crypto market will be limited. To trigger a new bullish phase, Bitcoin needs a looser macro environment, something that has not been seen towards the end of 2025.

Spot Buyers Begin to Return, Early Signal of Potential Rebound

The fourth chart monitors the Spot Taker CVD, an indicator that shows the dominance of aggressive buying in the spot market. After weeks of seller dominance, the indicator is now starting to show buyer dominance. The color change from red to green is an early signal that new demand is starting to enter the crypto market. Typically, this is the initial foundation for the formation of a price floor.

Read also: Gemini’s New Breakthrough: RLUSD and XRP Ledger Integration for Fast and Cheap Transactions

Nevertheless, one or two days of positive signals are not enough to confirm a new trend. It takes a consistent period to ensure that buyers are able to absorb the selling pressure from short-term holders and whales who give up. If this trend of aggressive buyers persists, Bitcoin could enter a stabilizing phase before attempting a recovery.

Conclusion

The four main charts show the Bitcoin market is in the final phase of a correction with recovery prospects still dependent on three factors: the price must re-break the short-term holder’s realized price, US real interest rates must soften, and the dominance of spot buyers must continue.

As long as these three conditions are not met, Bitcoin (BTC) is likely to move in the $88,000-$93,000 range, with a potential flash drop to $85,000 if macro pressures continue. For long-term investors, this period could be a planning phase, not a time to take aggressive risks.

FAQ

What is the price realized by short-term holders of Bitcoin?

The price realized by short-term holders (STH) is the average cost basis of the coins they purchased in the last few months.

Who is the new pope and the old pope in the context of Bitcoin?

New whales are large holders who have recently accumulated Bitcoin, while old whales are those who have held Bitcoin over a longer period of time.

How does the real interest rate affect the price of Bitcoin?

Real interest rates, which measure interest rates after inflation, have a major influence on the price of Bitcoin. High real interest rates can limit risk appetite and hold back Bitcoin’s price increase.

What is Spot Taker CVD and how does it affect the Bitcoin market?

Spot Taker CVD measures the net volume of market orders that cross the spread on exchanges. An increase in spot taker buyer activity indicates strong demand in the spot market, which could support Bitcoin price recovery.

What is needed for a bullish turn in Bitcoin price?

For a clear bullish turn in Bitcoin price, three signals are required: the price must hold above the price realized by short-term holders, real interest rates must fall, and Taker buying dominance must persist to confirm strong spot demand.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Four Charts Bitcoin Price Prediction Christmas 2025. Accessed on December 14, 2025

- Featured Image: Coindesk

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.