5 Crypto Market Watch Facts: Solana (SOL) Drops 5% in 24 Hours

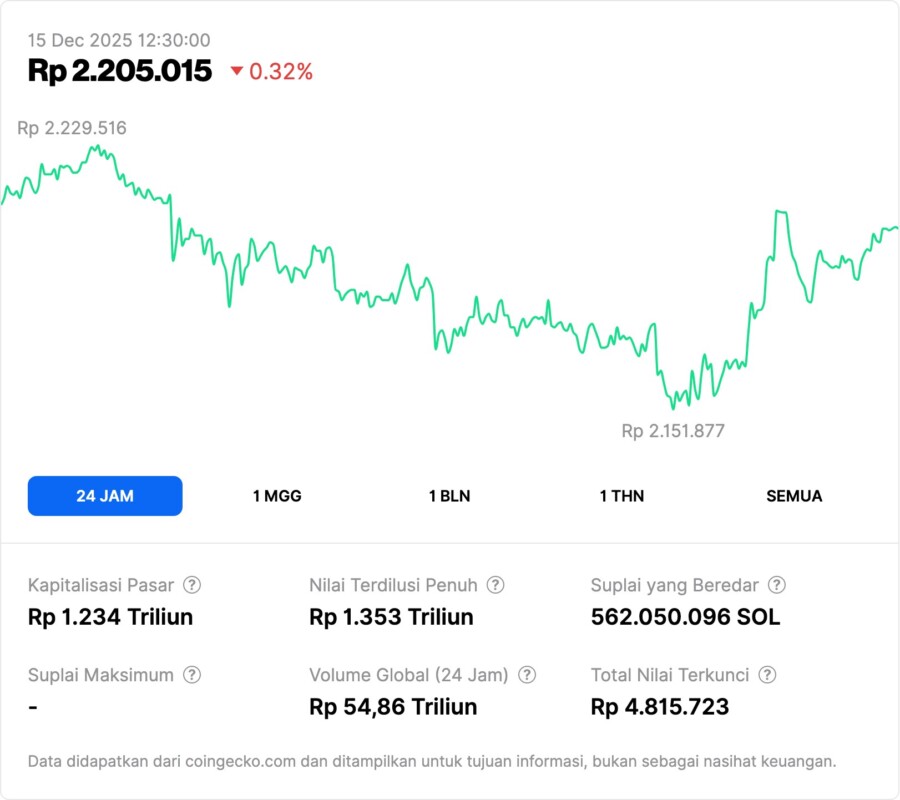

Jakarta, Pintu News – Solana (SOL), one of the top cryptocurrencies by market capitalization, is the talk of the town after the token’s price jumped down by about 5% in the last 24 hours based on data reported by Watcher Guru which monitors global crypto market participants.

This price movement caught the attention of analysts as it reflects the selling pressure that occurred across the crypto market in the same period. The information summarized includes CoinGecko data and market analysis which are important indicators of changes in current market conditions.

1. SOL Price Drop 5% in 24 Hours

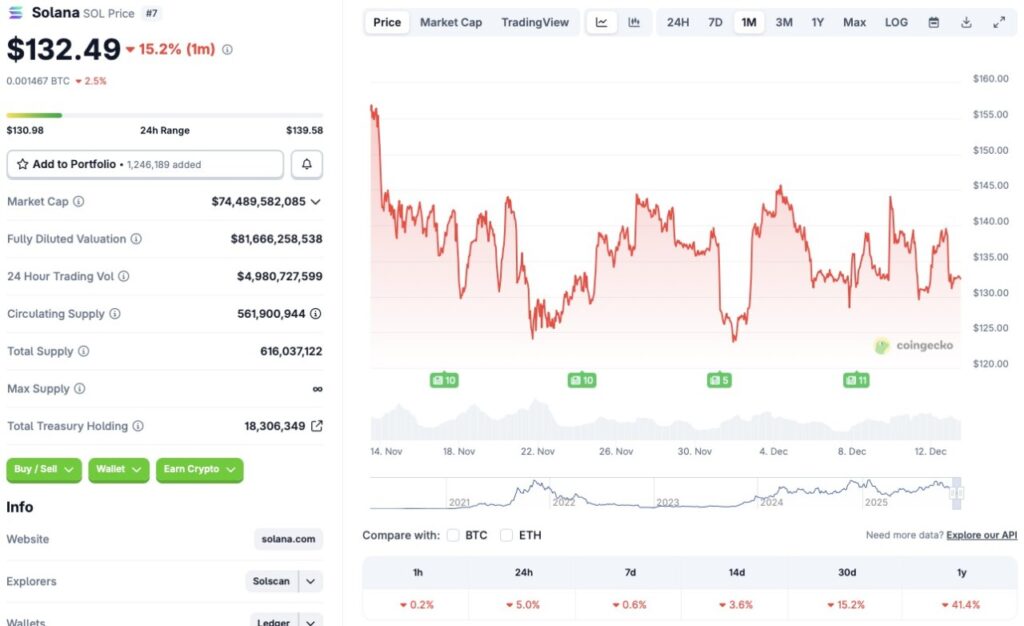

Based on published price data, Solana (SOL) is monitored to have recorded a decline of around 5% in the last 24 hours, making the token one of the negative gainers among major widely traded altcoins. This movement also shows SOL is down about 0.6% in a week and over 15% in a month, data monitored by CoinGecko and market analysts.

This drop comes amid the broader cryptocurrency market showing bearish sentiment, with a number of major crypto assets experiencing selling pressure. These daily price movements suggest that SOL is following general market trends rather than the network’s fundamental performance independently.

Also Read: Charles Hoskinson Shares Cardano 2026 Big Plan: It’s the Future of ADA!

2. Downward Trend Over Multiple Periods

According to historical data also monitored by market analysts, Solana has previously shown periodic declines in recent months, including weekly and monthly corrections that reflect broader market pressures in the crypto space. In addition to the 5% drop in 24 hours, SOL also fell on longer timeframes due to bearish market conditions.

Analysts note that during this period of decline, the SOL has lost a significant percentage of its previous yearly peak, signaling a prolonged corrective trend within the crypto market in general. This has been discussed by market participants as a reflection of broader macro market conditions.

3. Effect of Global Market Pressure on Solana

Other market reports suggest that selling pressure in SOL is often linked to risk-off sentiment in the broader crypto market, including profit-taking and decreased investor risk appetite. Derivatives data such as declining Open Interest also reflects investors reducing exposure to SOL in the futures market.

In addition, Bitcoin (BTC) price corrections and changes in global macroeconomic sentiment also contribute to Solana’s price movements as crypto assets are usually correlated with Bitcoin market movements. These conditions are widely monitored by analysts as important indicators of SOL price dynamics.

4. ETF Activity and Institutional Fund Flows

Although SOL prices were observed to be weakening, other data showed that the ETF-based Solana product recorded significant institutional fund inflows in recent days, suggesting lingering interest from large investors despite the price drop. Data from KuCoin reported that Solana ETFs recorded around $674 million in net inflows in the last seven days.

This phenomenon signals that despite the pressure on Solana’s market price, there remains strong institutional interest in the asset, a metric that analysts monitor when assessing long-term sentiment in the crypto ecosystem.

5. Investor Sentiment and Market Liquidation

The market liquidation data also shows that the price drop on SOL coincided with broader selling pressure in the cryptocurrency market, causing large liquidations on several assets including Solana and other altcoins such as BNB and Cardano in the broader period. This is one of the reasons why SOL is monitored as part of the overall market dynamics.

Risk-off sentiment in crypto markets often triggers concurrent price declines across many assets, as seen in the decline in total crypto market capitalization and the contraction of liquidity in derivatives markets. These conditions are monitored by market participants as indicators of potential further pressure or price stabilization in the short term.

FAQ

What does a 5% drop in 24 hours mean for Solana (SOL)?

The 5% drop in 24 hours refers to the magnitude of the SOL price drop in the last daily period based on market data monitored by CoinGecko and Watcher Guru.

Why did SOL fall despite ETF inflows?

ETF inflows indicate institutional interest, but prices could fall due to broader market selling pressure and risk-off sentiment in the overall crypto market.

How do global market pressures affect SOL prices?

Global market pressures, including Bitcoin (BTC) declines and profit-taking, can create bearish sentiment that impacts the prices of other assets such as Solana.

What are the key risks that investors monitor for SOL?

Key risks include short-term price volatility, widespread market selling pressure, as well as decreased risk appetite reflected in the derivatives market.

Reference

- Watcher Guru. Solana Falls 5% in 24 Hours: You Shouldn’t Miss This Dip. Accessed December 14, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.